On Wednesday, the December quarter wages data showed pay rises remain moderate despite the surging cost of living. The Australian share market pulled back from earlier losses on this data.

Find out how the day played out on our live blog.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapsot at 5:15pm AEDT

By Emilia Terzon

- ASX 200 (CLOSE) -0.4% to 7,314 points

- All Ords (CLOSE): -0.4% to 7,517 points

- Australian dollar: -0.4% to 68.28 US cents

- Dow Jones (CLOSE): -2.1% to 33,130 points

- S&P 500 (CLOSE): -2% to 3,997 points

- Nasdaq (CLOSE): -2.5% to 11,492 points

- Nikkei: -1.3% to 27,104 points

- EuroStoxx 600 (CLOSE): -0.2% to 464 points

- Brent crude: -1.5% to $US82.82/barrel

- Spot gold: +2% at $US1,8455/ounce

- Iron ore: +1.3% at $US130/tonne

- Bitcoin: -1.5% at $US24,444

ASX ends down but not as bad as it opened

By Emilia Terzon

We've ended today with results by miner Rio Tinto.

Profit after tax was down 41 per cent to $US12.4 billion. Net cash was down 36 per cent.

Shareholders will receive a $US2.25 final dividend, which took the full-year total to $US4.92.

One of the biggest reasons profits was down was the fall in the price of iron ore on the market, although it's also dealing with inflationary pressures.

It ended down half a per cent, which was pretty broadly in line with the wider ASX 200 which lost 0.4 per cent to 7,314 points.

Domino's was the biggest drag overall. It's off 23%!

See you all tomorrow.

So is there a wage price spiral? Many say no

By Emilia Terzon

Today's jobs data showing the rise of wages is slowing has many economists today concluding that there's no wage-price spiral.

That's when wages keep rising at a rate with the overall inflation rate. It's what the RBA is worried about.

Here's economist Carlos Cacho chatting about this with ABC business reporter Alicia Barry today:

CBA is also concluding there's no spiral.

They believe it so much they've underlined it in their note today!

The WPI today was consistent with our internal data – Australia is not facing a wage‑price spiral.

Our call for the RBA is unchanged – based on the RBA’s recent rhetoric we expect two further 25bp rate hikes over the next two months that would take the cash rate to 3.85%.

Bis Oxford Economics' Sean Langcake also thinks today's data is "below expectation" and shows that wages growth isn't as "bad as the RBA have feared so far".

However, he thinks it won't fully allay the board's concerns about a wage price spiral. He's tipping 3 more rate hikes.

Market snapshot at 3pm AEDT

By Emilia Terzon

- ASX 200: -0.4% to 7,305 points

- All Ords: -0.5% to 7,509 points

- Australian dollar: -0.3% to 68.35 US cents

- Dow Jones (CLOSE): -2.1% to 33,130 points

- S&P 500 (CLOSE): -2% to 3,997 points

- Nasdaq (CLOSE): -2.5% to 11,492 points

- Nikkei: -1.2% to 27,126 points

- EuroStoxx 600 (CLOSE): -0.2% to 464 points

- Brent crude: -1.5% to $US82.82/barrel

- Spot gold: +2% at $US1,8455/ounce

- Iron ore: +1.3% at $US130/tonne

- Bitcoin: -1.5% at $US24,444

Some more on the wages data from the ABC

By Emilia Terzon

Here's a full wrap by my colleague Gareth Hutchens.

Some less discussed ABS data out today

By Emilia Terzon

So along with the jobs data, we also have an ABS release showing that more Australians are getting scammed.

There's been a lot of media coverage of this issue in recent times.

We've had stories about everything from Facebook Marketplace scams, text message phishing, and even the risks of cyberattacks on data leading to further scams.

Personally, the weirdest one I've heard about is a story I reported a few years ago about a woman who got scammed while trying to buy a dachshund puppy online.

The ABS data out today shows the problem is indeed getting worse.

Two thirds of people surveyed by its Personal Fraud Survey for 2021-22 reported they've had a scam offer or request. That was up from 55 per cent the previous year.

The most common scams were over the phone and text.

Text scams doubled in prevalence, showing you're not the only one getting increasingly annoyed by those texts from random numbers purporting to be your bank or energy retailer. (DO NOT CLICK ON THEM!)

The good news? People are wising up on the scammers.

"The survey shows that 2.7 per cent of Australians responded to a scam in 2021-22 down from 3.6 per cent in 2020-21," ABS head of crime and justice statistics, William Milne, says.

“About one third reported to a bank or financial institution, which remains the most common authority scams are reported to.

"However, we have recently seen a notable increase in reporting to the police, up from 8.2 per cent in 2020-21 to 14 per cent in 2021-22."

Where we are sitting at 12:30pm AEST

By Emilia Terzon

The ASX has recovered from its early morning dump.

The benchmark is now only down 0.2 per cent. And if you check out this swing it shows the jobs data that came out at 11:30am AEDT may have helped its fortunes.

There was a spike just as the data was released. It showed wage increases moderated in the last December quarter.

And why would jobs data influence the market?

It's all about rates my friend.

Moderating wage growth may influence the RBA to go easiers on rate hikes to tackle inflation.

Meanwhile, when it comes to specific sectors, things are lot greener than they were a few hours ago. We now have a few indexes in positive territory, including utilities.

Origin is the top performing stock with a gain of 12.7%. That's after the electricity and gas provider posted its results. (More on that earlier in the blog.)

Poor pizza chain Domino's is still down 20% on its results.

Reserve Bank of New Zealand pushes through 0.5 percentage point rate rise

By Michael Janda

The RBNZ has raised its cash rate from 4.25 to 4.75 per cent — remember, Australia's is currently 3.35 per cent.

But it could have been worse news for borrowers, with some economists having tipped another 0.75 of a percentage point rise.

For some context around the large rate rise, the RBNZ last met in November, while the RBA met in December and earlier in February.

The bad news for borrowers in New Zealand is that it still doesn't look like the RBNZ is done, even as our cousins across the ditch lurch towards recession.

Even the devastation of Cyclone Gabriel was not enough to stay the RBNZ's hand, as noted in its post-meeting press release.

"It is too early to accurately assess the monetary policy implications of these weather events, given that the scale of destruction and economic disruption are only now becoming evident. The timing, size, and the nature of funding the Government's fiscal response are also yet to be determined.

"The Committee's current assessment is that over coming weeks, prices for some goods are likely to spike and activity will be weaker than previously expected. Export revenues will be negatively impacted.

"Monetary policy is set with a medium-term focus, and the Committee will look through these short-term output variations and direct price effects. In time, the infrastructure and community rebuild will add to activity and inflationary pressures, especially given existing capacity constraints in the economy."

In fact, RBNZ board members currently expect to have to lift the cash rate to 5.5 per cent later this year, although Capital Economics analyst Marcel Thieliant doesn't believe they'll get quite that high.

"The Bank reiterated its view that a decline in output will be needed to rein in price pressures, but we think that the coming recession will be a little deeper than the Bank is anticipating.

"We therefore expect the Bank to stop at 5.25% and we think that rate cuts could happen as soon as the end of this year rather than the second half of next year as signalled by the Bank today."

Wages data exposes 'Reserve Bank bluster'

By Michael Janda

A scathing note from Betashares chief economist David Bassanese lambasting the Reserve Bank and some economists who have expressed concerns about runaway wages growth fuelling inflation.

"Despite all the bluster from the Reserve Bank concerning 'anecdotal reports' of accelerating wage gains, the nation's preeminent wage measure – the Wage Price Index (WPI) — revealed another relatively mild gain of 0.8% in the December quarter. Over the year, the WPI – covering both private and public sector workers – rose 3.3%. This result is lower than market expectations for a 1% quarterly gains, and 3.5% growth over the year," he wrote in a note on the WPI.

"Indeed, this is very much a 'goldilocks' report – not hot enough to justify an aggressive 0.5% RBA rate hike at the March policy meeting, nor cool enough to deny workers at least some moderate income growth to battle ongoing cost-of-living pressures.

"Indeed, with headline CPI inflation up 7.8% over the same 12-month period, it still implies a chunky 4.5% decline in real worker earnings over 2022. The good news for workers is that wage growth is picking up, the good news for the RBA is that the acceleration in wage growth remains reasonably modest and is not yet at a pace inconsistent with it's long-run 2 to 3% inflation target.

"To be sure, the marked acceleration in consumer prices over the past year can't be blamed on run-away wage growth. Households have faced a drastic cut in real wages. Instead, the lift in inflation has reflected a range of non-wage cost factors and the relative ease with which business has been able to pass on these costs without overly crimping their profit margins. This reflects strong underlying consumer demand but also areas of the economy where competition is arguably not as strong as it should be."

Despite the lower than expected number, Mr Bassanese still expects the Reserve Bank to raise interest rates two more times, in March and April, taking the cash rate target to a peak of 3.85 per cent.

Wages continue growing, but fall further behind inflation

By Michael Janda

The latest Wage Price Index (WPI) from the Australian Bureau of Statistics shows base pay packets rose 0.8 per cent in December quarter and 3.3 per cent annually.

"The increase in hourly wage rates for the December 2022 quarter was lower than the increase for the September quarter (0.8 per cent compared to 1.1 per cent)," noted Michelle Marquardt, the ABS head of prices statistics.

"It was, however, higher than any December quarter increase across the last decade. This follows on from the September and June 2022 quarters which were also higher than their comparable quarters back to 2012.

"In combination these quarterly increases have resulted in the highest annual growth in hourly wages since December quarter 2012."

However, the Consumer Price Index (CPI) rose at an annual pace of 7.8 per cent in the December quarter, meaning that base pay growth was less than half the rise in living costs as measured by CPI.

The ABS noted that private sector wage growth over the quarter (0.8 per cent) was slightly higher than the public sector (0.7 per cent), but annual wage growth in the private sector (3.6 per cent) remained significantly higher than the public sector (2.5 per cent).

Market snapshot at 11am AEDT

By Emilia Terzon

- ASX 200: -0.8% to 7,280 points

- All Ords: -0.8% to 7,485 points

- Australian dollar: 0.2% to 68.64 US cents

- Dow Jones (CLOSE): -2.1% to 33,130 points

- S&P 500 (CLOSE): -2% to 3,997 points

- Nasdaq (CLOSE): -2.5% to 11,492 points

- FTSE (YESTERDAY): -0.5% to 7,978 points

- EuroStoxx 600 (CLOSE): -0.2% to 464 points

- Brent crude: -1.5% to $US82.82/barrel

- Spot gold: +2% at $US1,8455/ounce

- Iron ore: +1.3% at $US130/tonne

-

Bitcoin: -1.5% at $US24,444

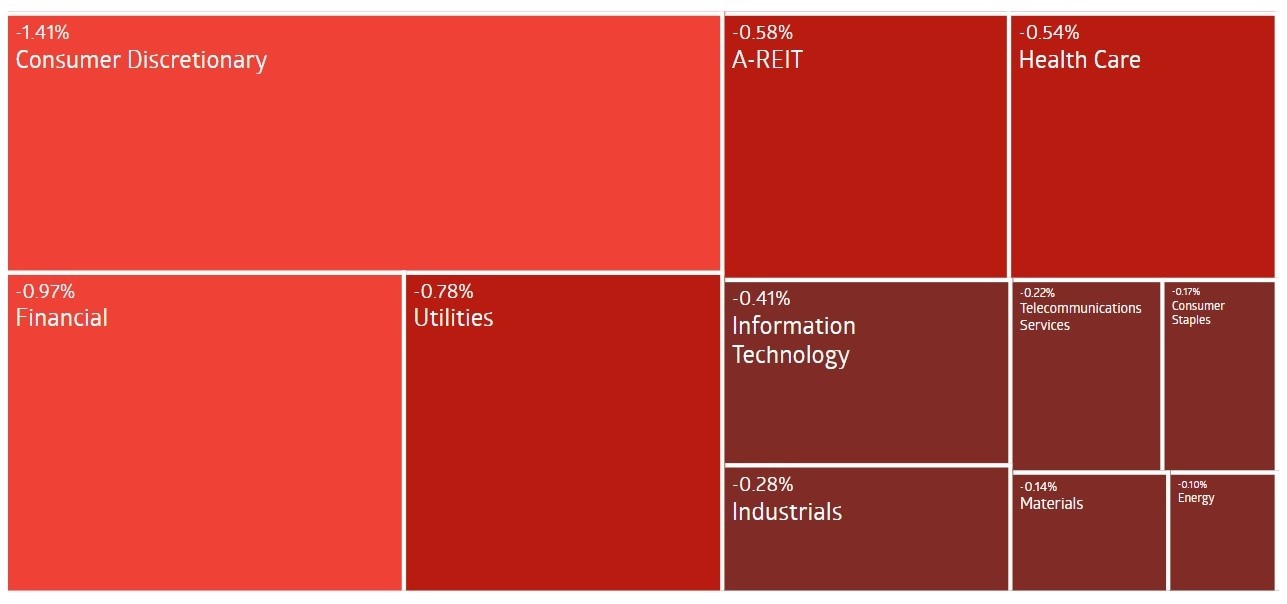

ASX dumps almost 1pc on Wednesday open

By Emilia Terzon

You can't say we didn't tell you!

The ASX 200 has dumped 0.8 per cent on open this morning. That's after Wall Street had heavy losses overnight.

Negativity is contagious.

The Australian wing of Domino's Pizza is not having any slice of the action this morning. (Sorry)

It's dived 22 per cent!!

That's after it put out its result (see Gareth's post below) showing its underlying net profit dived 21.5 per cent to $71 million. It says inflation is hitting its profits.

The pizza chain is actually operated here as a franchise, meaning it's not just the company struggling here, but likely quite a few mum and dad owners.

It's dragged down the consumer discretionary index overall. But not a single sector is doing well today.

Origin bidders cut offer price

By Michael Janda

The consortium bidding for gas and energy company Origin have cut their offer price by 10 cents per share.

The Bookfield/MidOcean Energy consortium had originally offered $9 a share to take over the Australian firm, but have now revised that proposal.

The new offer is $8.90 a share for the first 100,000 shares held by each Origin shareholder and a combination of $4.334 per share pus $US3.194 per share for shares above that threshold.

The bidders say the US dollar component of the revised offer reflects the exposure of Origin's gas assets to that currency.

The buyout price will also be reduced by any dividends paid out by Origin prior to completion of the deal, including the 16.5 cent dividend announced at its results on February 16.

"The Origin board considers the revised proposal has the potential to deliver significant value to shareholders and, accordingly, intends to continue to progress discussions with the consortium."

The company says its shareholders do not need to take any action at this stage while discussions continue.

Origin shares were up 12.7 per cent to $7.90 by 10:36am AEDT.

Woolworths profits rise, as cost of doing business falls

By Rachel Pupazzoni

Hi, Rachel Pupazzoni jumping in with some news on the cost of living.

Higher prices to consumers has lifted Woolworths Group's profits in the first six months of the financial year.

The group's businesses include Woolworths, Big W, Pet Culture and Healthy Life.

The company's net profit after tax was up 14 per cent to $907 million.

But net profit from continuing operations was up 25 per cent to $845 million.

The numbers can get a little confusing, and a big part of that is because Woolworths split off Endeavour Group — its alcohol and pubs business — which was reflected in the prior results.

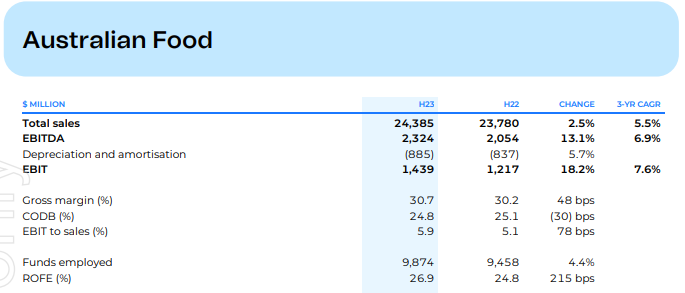

But this table from their results presentation is pretty telling.

The table above separates out the food part of the business.

You'll see in the table an 18.2 per cent increase in earnings before interest and taxes (EBIT) for the category.

Gross margins rose (up 0.48 of a percentage point) while the cost of doing business (CODB) fell (0.3 of a percentage point).

That meant the supermarket earned more profit for each dollar of sales it made (the profit to sales ratio jumped by 0.78 of a percentage point to 5.9 per cent) as it imposed price increases on consumers.

These sound like small numbers, but they add up when you are making more than $24 billion worth of sales.

In presenting the results, Woolworths chief executive officer Brad Banducci noted the impacts of COVID have been replaced by rising inflation.

Like Coles yesterday, Woolworths noted price inflation was up 7.7 per cent in the second quarter of the half.

"Cost of living pressures are being felt by our customers due to industry-wide inflation," Mr Banducci noted.

"Delivering value is our priority."

He said there's been a noticeable reduction in red meat sales, replaced with chicken, as people change their shopping behaviors to offset rising costs.

I'll be looking more at this story for The Business and ABC News tonight, so once you've logged off the blog at the end of today, tune in on your TV tonight for more.

Santos profit surges on rising gas prices

By Michael Janda

Australian gas producer Santos has recorded a 221 per cent jump in full-year net profit to $US2.1 billion ($3.1 billion) on the surge in global energy prices.

The company's preferred underlying profit measure, excluding one-off gains and losses, rose 160 per cent to $US2.5 billion.

"The results reflect significantly higher oil and LNG prices compared to the corresponding period due to stronger global energy demand combined with a higher interest in PNG LNG following the Oil Search merger," the company notes in its ASX release.

Oil and gas prices surged on Russia's invasion of Ukraine, which dramatically reduced a major source of European gas supply and also raised fears about the supply of oil coming from Russia.

Energy prices have since fallen back somewhat, but remain elevated compared to pre-war levels.

Santos will pay out $US755 in unfranked dividends to shareholders, while returning a further $US700 million through a previously announced share buyback, which was roughly half completed by the end of 2022.

Scentre Group profits up, enjoys record rent collection

By Gareth Hutchens

Scentre Group is a shopping centre company that runs 42 Westfield Shopping Centres across Australia and New Zealand.

It has enjoyed a positive year.

- It collected a record $2.59 billion of gross rent (up $334 million).

- Operating profit: +20.8%

- Funds from operations: +20.6%

- Earnings before interest and tax: $1.75 billion (up $215.4 million)

Scentre Group CEO Elliott Rusanow said:

"I am very pleased with these results, driven by the Group's strong operating performance and proactive customer strategy to attract more people to our Westfield destinations.

"Demand from businesses to partner with us by leasing space and accessing customers in our destinations is strong. The Group completed a record 3,409 lease deals during the year, an increase of 912 on the year prior.

"This included 2,232 renewals and 1,177 new merchants, of which 288 are new brands to our portfolio. This has resulted in portfolio occupancy increasing to 98.9% at 31 December 2022, up from 98.7% at the end of 2021.

OZ Minerals fall in profit

By Gareth Hutchens

Full-year financial results:

- Net profit after tax: -61% (down $323 million on previous year), to $207 million

- Earnings before interest and tax: -40% (down $469.7 million on previous year), to $692.7 million.

- Net revenue: -$175 million on previous year, to $1.92 billion

- It has cut its earnings per shares to 62c, down from $1.59c a year ago.

The company says its net revenue was down mainly due to reduced sales volumes and weaker copper prices.

Oz Minerals Managing Director and CEO, Andrew Cole, said:

"2022 saw the OZ Minerals team end the year on a strong note after a challenging first half impacted by adverse weather, COVID-19 absenteeism, supply chain disruption and inflationary pressure.

"Despite the impact to production costs, and a weaker copper prices, we delivered net profit of $207 million on revenue of $1.9 billion.

Market snapshot at 9:00am AEDT

By Michael Janda

ASX 200 futures: -0.6% to 7,214 points

Australian dollar: +0.1% to 68.56 US cents

Dow Jones: -2.1% to 33,130 points

S&P 500: -2% to 3,997 points

Nasdaq: -2.5% to 11,492 points

FTSE: -0.5% to 7,978 points

EuroStoxx 600: -0.2% to 464 points

Brent crude: -1.5% to $US82.82/barrel

Spot gold: Flat at $US1,835/ounce

Iron ore: +1.3% at $US130/tonne

Bitcoin: Flat at $US24,193

Why good news is bad news, again

By Michael Janda

US markets had a bit of a shocker last night after coming back from the President's Day holiday.

The main reason was surprisingly good news on the economic front: services sectors across the developed markets — from Japan to Europe and the UK, and over in the US — are expanding, and even growing at a faster pace, in the face of rate hikes.

"The good economic news is bad news as the resilience of developed market (DM) economies means central banks (CB) still have more work to do," wrote NAB analyst Rodrigo Catril.

Manufacturers aren't faring as well, shrinking in most developed economies.

But services employ a lot more people in those economies now, and the expansion in that sector is seen as likely to drive wages growth higher, which in turn is feared will keep inflation higher for longer.

The main US index (the S&P 500) dropped 2 per cent, with the Nasdaq down 2.5 per cent due to the rate sensitive nature of the speculative tech sector.

Europe's sell-off was more subdued, with major indices generally off closer to half a per cent.

Domino's profits slip

By Gareth Hutchens

First half results:

- Underlying net profit: down 21.5% to $71. million

- Earnings before interest and tax: down 21.3% to $113.9 million

- Interim dividend of 67.4c a share, partially franked

- Network sales: down 4%, -$82.1 million

- 357 new stores added (+79 organic, +279 acquired)

Domino's says it's been tough managing inflation at the moment.

It says it's going to rejig things.

It plans to rebalance its "Value Equation" (delivering product + service + image at an affordable price) after some customers responded to higher delivery prices by reducing how frequently they order.

It says over the last three years it has added three new markets and 1,140 new stores. Its management hopes this increased scale will boost its number of customers.

Group CEO & Managing Director Don Meij said management recognised the company’s response to combating inflation had not been optimal in the first half of FY23, but were confident in Domino’s strategy to grow order volumes, total sales, and earnings.

"We haven’t always had the balance right for some customer groups, largely in delivery, as we responded to inflation to protect our franchisees’ businesses – we are working hard to correct that for all stakeholders," he said.

"In the initial stages of inflation, our expectation was that we could offset increased input costs by providing customers ‘more for more’ rather than passing price through.

"Given the challenging conditions and the effect on our franchisees we felt it was necessary to lift prices, including applying some surcharges. This was successful in protecting franchisee profitability, however given the speed of the change it was difficult to forecast the effect on customer repurchasing rates, especially where customers order less frequently such as Japan or Germany.

"It meant while we saw an initial benefit to franchisees’ unit economics, specific customer groupings, particularly in delivery, reduced their ordering frequency which resulted in December trading being significantly below our expectations."