The Australian share market has slumped to a two-month low after China's manufacturing industry contracted again, and annual inflation has risen to 6.8 per cent over the year to April, in a result worse than economists had predicted.

It comes after RBA boss Philip Lowe faced a grilling at Senate Estimates over interest rates.

Disclaimer: This blog is not intended as investment advice.

Key events

Live updates

Markets snapshot at 4:30pm AEST

By Sue Lannin

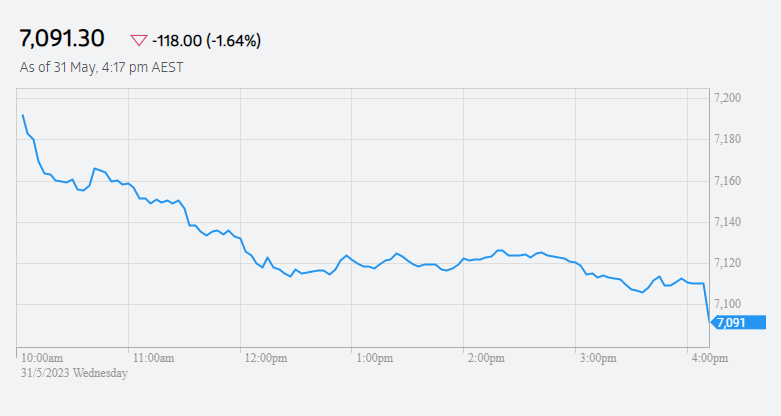

ASX 200: -1.6% to 7,091

All Ordinaries: -1.5% to 7,274

Australian dollar: -0.5% to 64.88 US cents

Nikkei 225: -1.4% to 30,888

Shanghai Composite: -0.8% to 3,200

Hang Seng: -2.6% to 18,115

Dow Jones: -0.15% to 33,043

S&P 500: steady at 4,206

Nasdaq Composite: +0.3% to 13,017

FTSE: -1.4% to 7,522

Spot gold: +0.1 to $US1961.89 an ounce

Brent crude: -0.1% to $US73.45 a barrel

West Texas: -4.4% to $US69.46 a barrel

Iron ore: -3.7% to $US96.40 a tonne

Bitcoin: -0.5% to $US27,628

ASX movers

By Sue Lannin

All sectors finished in the red on the ASX 200 today with energy, miners and financial stocks leading the falls.

Biotech Imugene (+4.8 per cent) was the biggest gainer on the ASX 200, while coal miner Whitehaven Coal (-6.5 per cent) fell most.

Australian market slumps as China's manufacturing industry contracts

By Sue Lannin

The Australian share market has tumbled after China's manufacturing industry contracted for the second month in a row.

The ASX 200 index lost 1.6 per cent with energy stocks and miners driving the falls.

China is Australia's biggest export market and a slowdown in economic activity means lower demand for commodities like coal and iron ore.

Weaker iron ore prices weighed on the big miners with market heavyweight BHP losing 3.4 per cent.

Coal prices also slumped at the Port of Newcastle which pulled down coal miners.

Newcastle coal futures fell to $135.10, the lowest level since June 2021.

Stronger than expected inflation in April also weighed on confidence as the chance of a interest rate rise next month by the Reserve Bank increased.

Some economists, such as George Tharenou from UBS, think next week's RBA meeting is "live".

While the market is now betting on a 35 per cent chance of a rate hike next week, rates staying on hold is seen as the most likely outcome.

And the Australian dollar fell to a seven month low of 64.85 US cents on the weaker China data.

Australian dollar falls to lowest since November

By Sue Lannin

The Australian dollar is taking a hit today on signs the Chinese economy is slowing down.

The local currency fell 0.5 per cent to 64.85 US cents, the lowest since November last year.

That's after it jumped to 65.38 US cents after April's hotter than expected inflation numbers, which increased expectations of a rate rise by the RBA next week.

RBA governor says PwC banned from future contracts

By Sue Lannin

As you've hearing, RBA governor Philip Lowe appeared before a Senate Estimates hearing this morning.

He said PwC was working for the RBA to advise on worker underpayments.

The ABC also hired PwC to do a review of underpayments to thousands of workers.

Mr Lowe slammed PwC's tax leaks as "appalling" and says PwC is banned from future RBA work.

Here's senior business correspondent Peter Ryan.

Atlassian says business not doing enough to reduce pollution

By Sue Lannin

Tech giant Atlassian says companies aren't doing enough to reduce their carbon footprint.

The software firm aims to achieve net zero emissions by 2040, mainly by reducing emissions rather than using offsets.

It has written a guide for other companies to follow, and it's warned they can't depend on offsets to meet the majority of their carbon reduction targets.

I spoke to Jess Hyman, head of sustainability, at Atlassian for ABC News Channel.

China's manufacturing industry continues to slow down

By Sue Lannin

Investor confidence is also being hit by another slowdown in manufacturing in China.

The official manufacturing purchasing managers' index fell from 49.2 last month to 48.8 this month according to China's National Bureau of Statistics.

The services index fell from 56.4 to 54.5 over the month.

China's recovery from three years of pandemic lockdowns has been patchy, and the data shows that the economy has slowed down from its burst of activity earlier in the year.

Calls are growing for more stimulus measures from authorities.

Lowe: 'We need more people to live in each dwelling'

By Kate Ainsworth

If you're just joining us, RBA boss Philip Lowe spent two hours in Parliament House this morning being questioned in Senate estimates.

It was a wide-ranging hearing, but one of the more interesting snippets came when he was asked about the rental market.

Liberal Senator Dean Smith asked Lowe about how rents were affecting inflation.

Lowe said it all came down to supply and demand, and the COVID-19 pandemic saw a shift in household composition, coupled with a rising population.

As for how it is solved? He says higher rent prices are part of the market forces of supply and demand.

You can hear his full justification below:

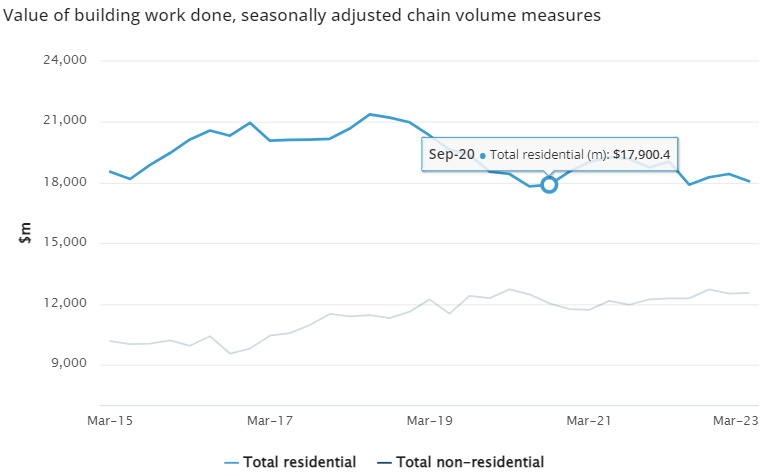

Home building falls over the March quarter

By Sue Lannin

Inflation has dominated the headlines today but let's have a look at some of the other figures out.

Construction work completed rose 1.8 per cent to $57.7 billion over the first few months of the year according to the Bureau of Statistics.

That was driven by more engineering work mainly from the public sector, but the value of residential construction fell by 2 per cent over the March quarter, and by 5.1 per cent over the year.

You can see why Australia has a housing crisis, not enough homes are being built.

Here's the analysis from CBA economist Harry Otley, who says it was a mixed result.

"Residential construction was weak but engineering construction was strong," he wrote in an economics note.

"Both the public and private sector investment in infrastructure have solid momentum."

"Price pressures remain, but inflation in the industry is in a clear downward trend."

Australia faces a shortage of more than 100,000 new homes over the next five years, and figures from the corporate regulator show that 1753 companies have gone broke so far this financial year because of cost rises and labour shortages.

As my colleague Jane Norman reports that is an average of five a day.

Markets snapshot at 2:40pm AEST

By Sue Lannin

ASX 200: -1.2% to 7,125

All Ordinaries: -1.2% to 7,302

Australian dollar: -0.4% to 64.95 US cents

Dow Jones: -0.15% to 33,043

S&P 500: steady at 4,206

Nasdaq Composite: +0.3% to 13,017

FTSE: -1.4% to 7,522

Spot gold: steady to $US1958.89 an ounce

Brent crude: -0.3% to $US73.35 a barrel

West Texas: -4.4% to $US69.46 a barrel

Iron ore: -3.7% to $US96.40 a tonne

Bitcoin: -0.5% to $US27,628

Which way will the RBA go next week?

By Sue Lannin

Stephen Koukoulas, managing director at Market Economics, and a former prime ministerial economic adviser, says the Reserve Bank will be concerned about the rebound in inflation.

"There was some surprise, some slight disappointment that that trajectory for lower inflation that we had from the end of 2022 when inflation peaked at 8.4 per cent didn't continue on into April."

"These numbers would certainly cause a little bit of concern that that trajectory towards the 2 to 3 per cent inflation target could be slower to achieve than they were hoping."

But he noted that since the RBA's surprise rate hike earlier this month unemployment has increased, and retail sales and building approvals have weakened.

The Reserve Bank says 15 per cent of all variable rate housing loan borrowers will experience negative cashflows by the end of the year if there are no changes to their spending.

Mr Kouloulas says that could also factor into the RBA's thinking.

"At this stage the softer economy, the pipeline of financial stress on alot of mortgage holders which is still to impact on actual spending decisions, is something that will probably cause them to sit tight for now."

He spoke to my colleague David Chau on the ABC News Channel.

What does higher than expected inflation mean for next week's interest rate decision?

By Kate Ainsworth

It's a valid question — with monthly inflation data being higher than many economists expect, what can we expect next Tuesday at the RBA's board meeting?

Here's what some economists are saying in the wake of the ABS data.

David Bassanese from Betashares:

"At face value today’s lift in the annual rate of headline CPI inflation from 6.3% to 6.8% could be a cause for concern, suggesting pricing pressure remains stubbornly firm and the Reserve Bank needs to lift interest rates further.

"Digging below the surface, however, the recent disinflationary trend still seems intact. The RBA need not yet have to reach for its gun just yet - especially given other signs of a cooling economy such as weaker building approvals and consumer spending.

"At this stage it is still too early to tell if Australia’s disinflationary trend is waning, suggesting the RBA still has a little more time on its hands before deciding whether to lift interest rates again.

"That said, there is a growing risk of at least one and possibly two further rate rises in coming months, especially if the resilience in the United States economy - and its own stubborn inflation pressures - forces the US Federal Reserve to embark on further monetary tightening."

Dr Brendan Rynne, chief economist at KPMG:

"Australian inflation developments are similar to what is being seen in most advanced economies, with headline inflation peaking and core inflation cooling. However, inflation remains high, and services prices are sticky, driven by wages growth higher than inflation targets, which maintains concerns over a wage-price spiral.

"While today’s CPI data shows an increase in headline inflation, this direction is mostly anticipated given the base effects from automotive fuel and the disequilibrium in the rental market driving rent inflation.

"With underlying inflation coming down, and most categories easing, coupled with unemployment picking up and retail volumes seeing negative growth, we believe the RBA is likely to keep the cash rate unchanged in next week’s meeting, to give it time to assess additional data flows."

ICYMI: Lowe confirms the RBA has underpaid staff

By Kate Ainsworth

If you missed it earlier, RBA governor Philip Lowe confirmed that the central bank has underpaid its staff, and hired PwC to help fix the issue.

Mr Lowe also acknowledged that they were hired before the taxation scandal that is currently engulfing the firm broke.

You can watch his full comments back below:

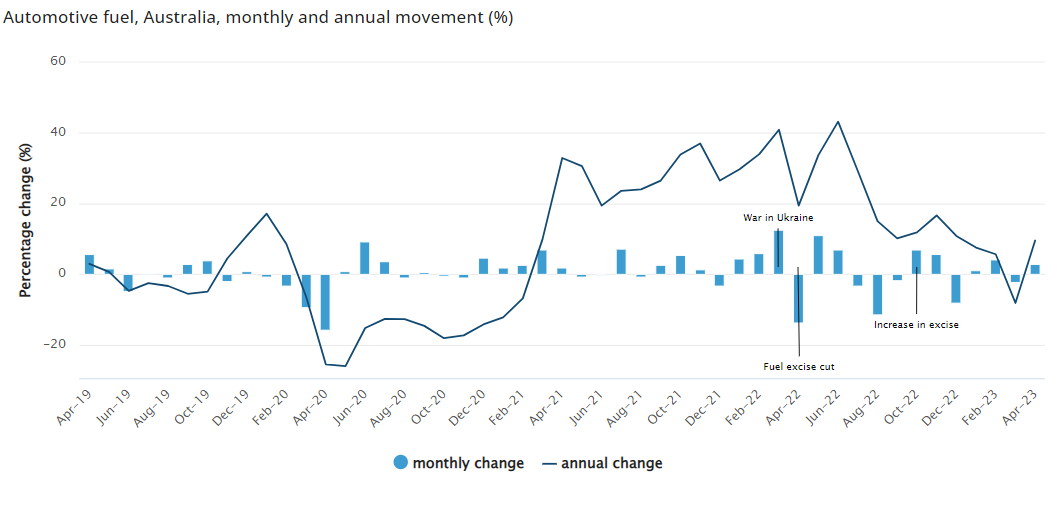

Petrol drives inflation rise in April

By Sue Lannin

The main reason the Consumer Price Index rose in April was because the cut in the fuel excise in April 2022 ended in October last year.

So over the year fuel prices increased as the fuel excise returned to its normal level.

The fuel excise for petrol, diesel, and all other fuel and petroleum based products was halved for six months on March 30 2022 as a cost of living relief measure.

That saw the rates for petrol and diesel fall from 44.2 cents to 22.1 cents a litre.

Here is Michelle Marquardt, head of prices statistics, at the Bureau of Statistics.

“It’s important to note that a significant contributor to the increase in the annual movement in April was automotive fuel."

"The halving of the fuel excise tax in April 2022, which was fully unwound in October 2022, is impacting the annual movement for April 2023."

She says taking out volatile items like petrol and food means the monthly Consumer Price Index comes in at 6.5 per cent in April, lower than the 6.9 per cent recorded in March.

Markets snapshot at 12:15pm AEST

By Sue Lannin

ASX 200: -1.2% to 7,121

All Ordinaries: -1.2% to 7,299

Australian dollar: -0.3% to 65 US cents

Dow Jones: -0.15% to 33,043

S&P 500: steady at 4,206

Nasdaq Composite: +0.3% to 13,017

FTSE: -1.4% to 7,522

Spot gold: -0.2% to $US1954.79 an ounce

Brent crude: -0.1% to $US73.46 a barrel

West Texas: -4.4% to $US69.46 a barrel

Iron ore: -3.7% to $US96.40 a tonne

Bitcoin: -0.4% to $US27,647

Hotter inflation data sees ASX extend falls

By Sue Lannin

The higher than expected inflation figures have sent the Australian stock market further into the red with the odds of the Reserve Bank raising interest rates next week increasing.

At midday, the ASX 200 index is down 1.3 per cent, compared to 0.8 per cent before the data came out.

Higher petrol prices drove inflation higher in April, compared to the year before when the halving of the fuel tax excise was being unwound.

The Australian dollar initially jumped to 65.38 US cents when the figures came out at 11:30am AEST, but fell 0.2 per cent to 64.93 US cents five minutes later when traders read through the ABS release.

IG Markets Tony Sycamore says the chances of the RBA raising official rates next Tuesday is higher.

"This is an ugly number, and despite a run of softer data earlier this month across wages, employment and retail sales, the probability that the RBA raises rates by 0.25 per cent to 4.10 per cent at its meeting next week has increased to ~25 per cent"

"Heading into the number, the market was pricing a 10 per cent chance of an RBA rate hike next week."

What does the inflation rate look like now?

By Kate Ainsworth

The increase to the monthly inflation rate has taken economists by surprise, increasing in the 12 months to April to 6.8%.

In the 12 months to March, the monthly CPI was 6.3%.

If you want to see how Australia's inflation rate over time, I've got you covered with this handy chart below.

(It's also worth bearing in mind that monthly inflation is quite volatile, and quarterly inflation data provides the most comprehensive snapshot.)

Consumer inflation up 6.8% over year to April

By Sue Lannin

The Bureau of Statistics says consumer inflation surged over the year to April despite higher interest rates.

The monthly figures show that the Consumer Price Index rose 6.8 per cent from April last year.

That's compared to a rise of 6.3 per cent over the year to March.

The most significant price rises were housing, food and non alcoholic beverages and transport.

ANZ economists had expected annual inflation to rise by 6.4 per cent.

US debt ceiling bill passes key hurdle

By Sue Lannin

A bill to raise the US debt ceiling and prevent a default has passed another hurdle.

A key House of Representatives committee voted to send it to the full chamber for a vote tomorrow.

The Republican-controlled House Rules Committee voted 7 to 6 to send the bill to the floor of the House tomorrow evening.

That's despite opposition from ultra conservative Republicans in the House of Representatives.

The US treasury has warned that the US government will run out of money on Monday if the debt ceiling isn't raised.

The bill requires a simple majority for approval in the Republican controlled House to go to the Democrat controlled Senate.

That's it for Philip Lowe at Senate estimates

By Kate Ainsworth

After an extensive and wide ranging two hours, the hearing has come to an end.

"We will see you in October" Senator Dean Smith says.

"We'll see," Lowe replies.