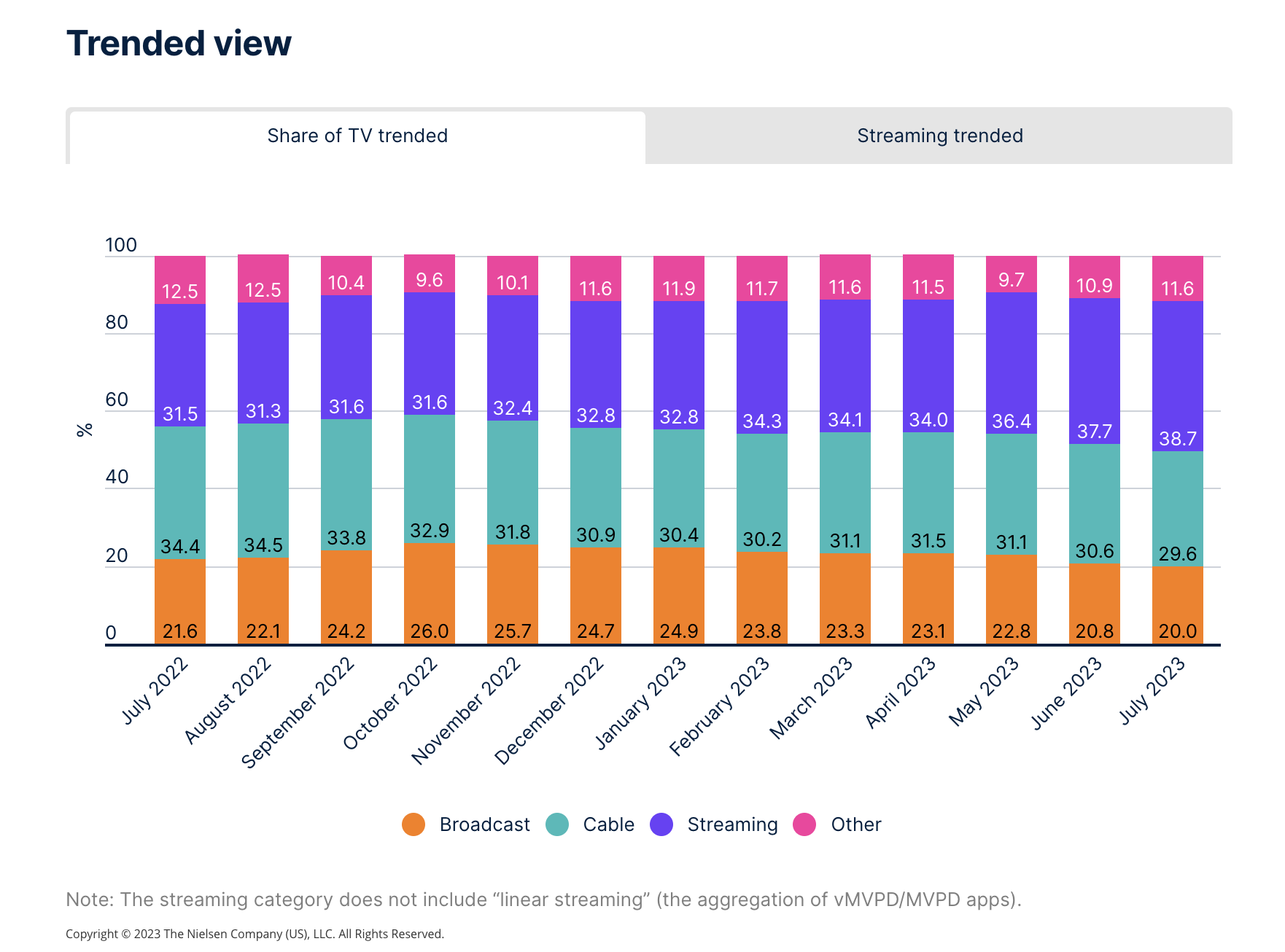

Ratings for streaming services outpaced U.S. broadcast and cable TV in July according to new numbers from Nielsen, marking the first time that viewing for broadcast and cable fell below 50% since the ratings researcher began tracking streaming services in the fall of 2020.

Although the numbers were likely skewed by an increase in kidvid ratings as well as what was considered a soft month for professional sports, the fact remains that the decline in broadcast and pay-TV viewership continues apace. On the same day that Nielsen released its July figures, LRG reported that more than 1.7 million subscribers cut the cord during Q2.

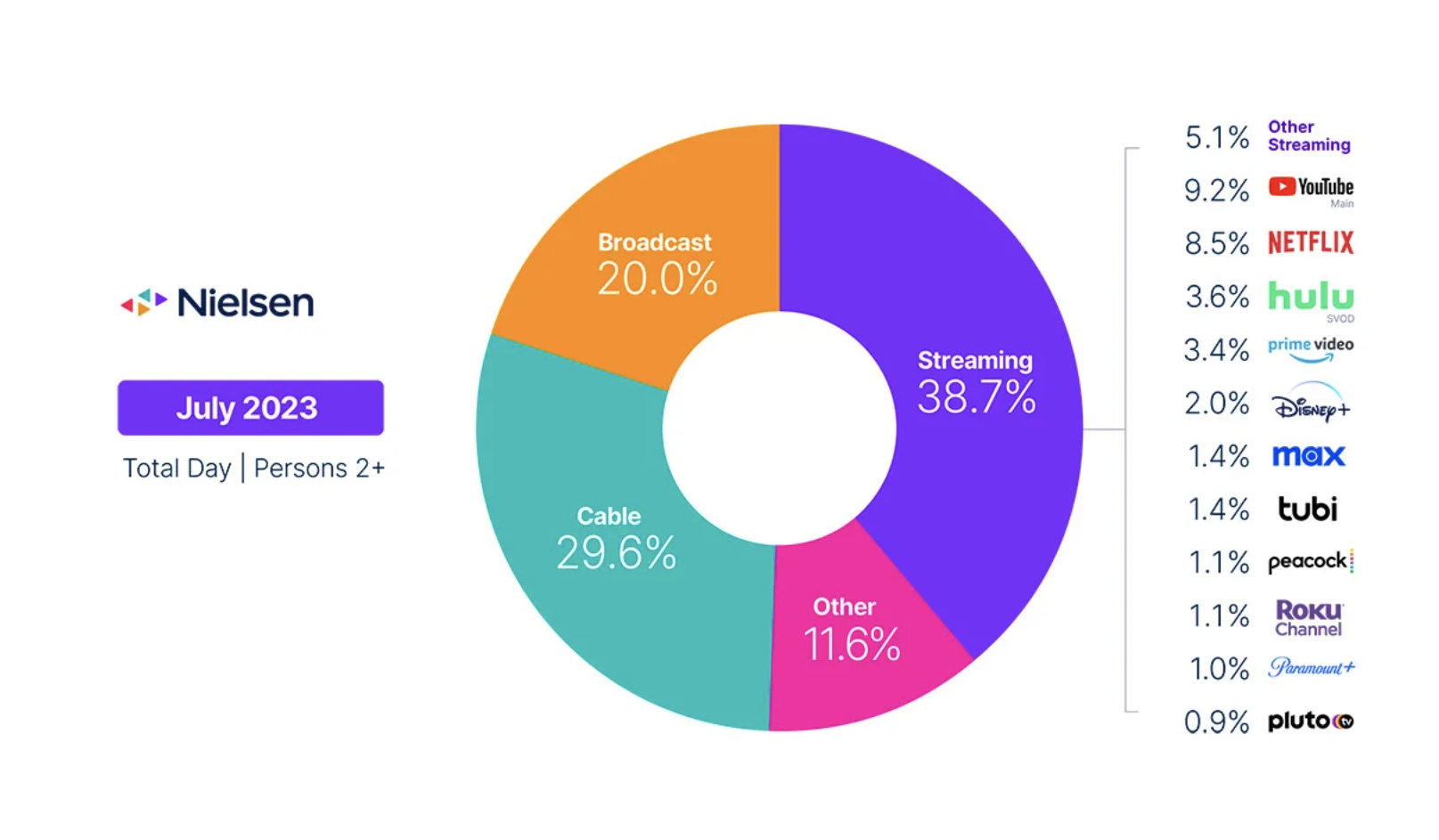

Broadcast viewership reached a new low, at just 20%, while cable viewing garnered just 29.6%, which meant that combined non-streaming numbers dipped just below 50%. While overall TV usage was up just slightly from June (0.2%), viewing among people under the age of 18 increased 4%, and viewing among adults 18 and older fell 0.3%. These trends resulted in increased streaming and “other” usage, which is primarily attributed to video game consoles.

On the streaming side, Suits, streaming on Netflix and Peacock, and Bluey on Disney+ were the most watched programs in July, accounting for 23 billion viewing minutes. Suits, however, set new viewing records for an acquired title, amassing almost 18 billion minutes, Nielsen said. In aggregate, the heavy viewing levels pushed streaming’s share of TV to 38.7%, a new record, with Amazon Prime Video, Netflix and YouTube all hitting all-time highs.

Comparatively, sports on broadcast generated almost 25 billion viewing minutes in July, albeit across a range of channels. Most would consider July a slow month for sports, given that broadcast sports viewing typically more than triples when September starts. While the FIFA Women’s World Cup provided a boost at the end of the month, drama remained the most watched category, capturing 25.7% of viewing. Overall, total broadcast viewing was down 3.6% to finish the month at 20% of TV, representing a new low. On a year-over-year basis, broadcast usage was down 5.4%.

Cable viewing slipped as well, losing a full share point to capture 29.6% of TV in July. Feature film was the only genre to see a rise in viewership (0.5%), despite the fact that usage fell 1.5%. Viewing across virtually all others dropping from June. ESPN’s Home Run Derby and the College World Series took the top 2 slots, followed by When Calls The Heart on The Hallmark Channel. On a year-over-year basis, cable usage was down 12.5%.

With the fall TV season in disarray due to the ongoing writers/actors strike against Hollywood studios, the next few months will provide a unique outlook on the future of non-streaming services, Nielsen said.

“The arrival of fall will likely result in a seasonal shift in TV viewing, especially with the arrival of a new NFL season,” the ratings firm said. “In November 2022, for example, sports accounted for 150 billion viewing minutes on broadcast. The potential for less new original primetime content this fall presents a unique situation for broadcast and cable, but the recent success of acquired programming on streaming channels highlights the outsized strength of quality content, regardless of when it was created.”

Stefan Lederer, Founder and CEO of Bitmovin, a Silicon Valley-based provider of streaming video technology, says that broadcasters and cable operators should take a page from streaming’s playbook if they want to survive in an era where on-demand programs and live sports and news dominate viewer’s choices.

“Despite streaming experiencing some turbulence, this research demonstrates that consumers align with studios in the sense both parties see streaming as the future,” Lederer said. “Our own research provides further insight into why this is the case—and a key answer is live streaming. With the addition of live events to streaming services, and the expansion to include reality TV live streams, live streaming became the second most viewed format at an average of 3.54 hours per week. This was only beaten by traditional streaming at 3.76 hours, whilst Linear TV lagged behind just reaching 3 hours.

For some time now linear TV has been hemorrhaging viewers, but in order to achieve lofty expectations of moving to an almost entirely streaming service world these businesses must embark on a research mission with streaming infrastructure providers,” Lederer continued. “This deep-dive must uncover how they can efficiently deliver live streams and video-on-demand to hundreds of millions more viewers. Moreover, they must work alongside streaming infrastructure providers to ensure they can deliver their streaming platforms in a sustainable manner, as with each new subscription and each new viewer, comes a carbon price.”

The Gauge provides a monthly macroanalysis of audience viewing behaviors across key television delivery platforms, including broadcast, streaming, cable and other sources. It also includes a breakdown of the major, individual streaming distributors. The chart itself represents monthly total television usage, broken out into share of viewing by category and by individual streaming distributors.