/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

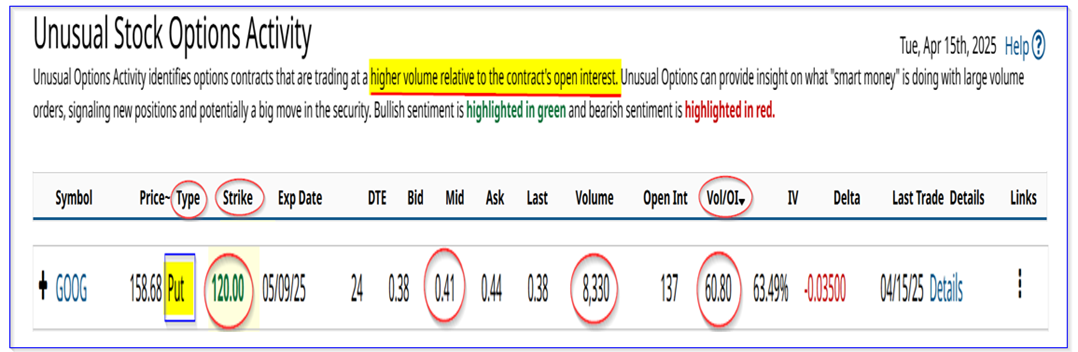

A Barchart report yesterday (April 15) shows how large funds hedge their bets in Alphabet Inc. (GOOG) stock. A large tranche of deep out-of-the-money GOOG puts traded for expiry in 3 weeks (May 9).

In effect, sellers of these puts made easy cash, while the buyers essentially bought crash insurance, likely hedging any downside from large holdings in GOOG stock.

GOOG closed down 1.73% on April 15 at $158.68 per share, well off its recent peak of $207.71 on Feb. 4. But that was up from a trough of $146.58 on April 8.

Strong FCF Results

I discussed Alphabet's recent results in my Feb. 5 Barchart article, “Unusual Activity in GOOGL Options Highlights Alphabet's Value.” I showed that Alphabet's recent 2024 results showed that the company is incredibly profitable.

For example, its Q4 free cash flow (FCF) of $24.8 billion represented almost 26% (25.75%) of its $96.5 billion in quarterly revenue. That was up from 20.1% in Q3 and 1.81 times its 9.15% Q4 2023 FCF margin.

In other words, its FCF profitability is growing faster than underlying sales. That indicates it has strong operating leverage. As a result, using a FCF yield metric, GOOG stock could be worth substantially more.

Target Price for GOOG Stock

For example, analysts now project 2025 revenue of $388.51 billion and $430.15 billion for 2026. That works out to a next 12-month (NTM) run rate revenue of $409.33 billion. We can then forecast its NTM free cash flow:

$409.33 billion x 25% forecast FCF margin = $102.33 billion FCF (NTM)

Moreover, using a 3.3% FCF yield metric, where GOOG stock trades (and the same as a 30x FCF multiple), its estimated market value will be:

$102.33 billion FCF / 0.033 = $3,101 billion (i.e., $3.1 trillion) market cap

That is 61.6% over its present market cap of $1.918 trillion and implies GOOG stock is worth $256.43 per share:

1.616 x $158.68 p/sh = $256.43 target price

However, just to be conservative, let's assume Alphabet makes a lower 22% FCF margin over the next 12 months. Its target price is still % higher than today:

$409.33b x 0.22 FCF margin = $90.5 billion FCF (NTM);

Moreover, let's assume the market gives the stock a lower multiple with a 3.50% FCF yield (i.e., 28.57x multiple):

$90.5 b FCF x 28.57x = $2,586 billion market cap

That is still +34.8% higher than today's market cap of $1,918 billion, or a target price of $213.90 per share.

In other words, even assuming Alphabet has a much lower FCF margin and the market reduced multiple, GOOG stock is still cheap here. But there is no guarantee this will happen. That could be why funds are hedging their bets with out-of-the-money (OTM) put options.

OTM Puts to Hedge and Make Income

The April 15 Barchart Unusual Stock Options Activity Report shows that over 8 million put options traded at the $120.00 put strike price for the May 9 expiry period.

This shows the strike price is deeply out-of-the-money (OTM) - i.e., over 24.3% below the closing trading price on Tuesday, April 15. This gives benefits to both the buyers and sellers of these puts.

For example, large fund holders of GOOG stock might be willing to buy insurance in case GOOG stock crashes again. It only cost them about 27.7 basis points (i.e., $0.44/$158.68 = 0.0027 = 0.27%).

But sellers of these puts also made some easy cash. At the midpoint, the 41 cent put income per contract represents 34 basis points (i.e., $0.41/$120.00 = 0.0034167 = 0.342%). But consider this, if the short-seller could do this every 24 days for a year, the annualized expected return is over 5%:

365/24 = 15.2 x 0.342% = 5.17%

Moreover, the delta ratio is very low, just 3.5%, indicating there is less than a 4% probability, based on historical volatility in GOOG stock, that it will 24% to $120 in the next 3 weeks.

In other words, it makes sense for a hedge fund to secure $96 million (i.e., 8000 put contracts x $120.00) to make $328K (i.e., $0.41 x 8,000 x 100) over the next 3 weeks. In effect, it's a cash alternative.

The bottom line is that both buyers and sellers of these deep OTM puts can benefit. Investors should be careful copying these trades. The Barchart Options Learning Center and the Options Trading Risk tabs will help investors study the risks.