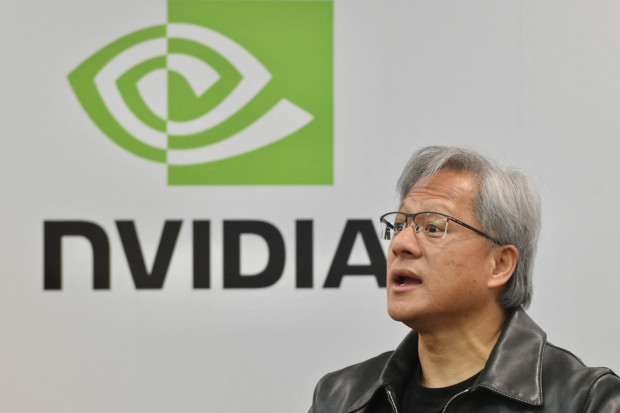

When Nvidia (NVDA) -) reported earnings last week, investors were more than pleased with the results. After rising to superstardom last quarter, the semiconductor company had another blowout quarter, reporting adjusted earnings per share of $2.48, above analyst estimates of $2.08 and ten times higher than the year-ago period.

The company also beat revenue expectations by a heavy margin, reporting $13.5 billion to the Street's prediction of $11.2 billion. And to cap it all off, Nvidia told investors that it expects to see $16 billion in revenue for the current quarter.

DON'T MISS: Jim Cramer, trusted analysts are raving over one incredible tech stock

The rosy story was one of ever-increasing demand for AI products. And the company's stock rose more than 7% in after-hours trading on the double-beat, opening at a record-high of $502 per share. But the stock bump didn't last for long; Nvidia's stock closed that day at $471 per share, the same level it was at prior to reporting earnings.

Nvidia's inability to rise on such positive news has Gene Munster, Deepwater Asset Management's managing partner, convinced that the rest of Big Tech might feel a bit of pain in the near future.

"We're going to be in a flatish to potentially down zone for the next month, two months for Big Tech as investors anticipate what the September quarter is," Munster told CNBC. "The Nvidia results were impressive. I've been doing this for a long time, I've never seen two quarters in a row like that. That begs the question: what's it going to take for the rest of tech to move higher on the September print?"

Though a select number of Big Tech companies, dubbed by some the "Magnificent 7" remain up by significant percentages for the year, many of these same tech stocks have been sliding for the past month.

"I think that mood is going to taint the near term for some of these big tech companies," Munster said. "They've been trading lower more recently. But the upside surprise and upward revisions to guidance still pale in comparison to what's going on with Nvidia. I still believe that what Nvidia's done has tainted investor's expectations about some big tech here."

More Business of AI:

- Here's the startup that could win Bill Gates' AI race

- Meet your new executive assistant, a powerful AI named Atlas

- The company behind ChatGPT is now facing a massive lawsuit

Even as he points to potential weakness in the tech sector, with Big Tech companies struggling to find their footing in the latter half of the year, Munster remains incredibly bullish on Nvidia and its position in the coming AI revolution.

"They said demand will be strong into 2024. This is something we typically don't see. I would just step back and look at the bigger picture: Nvidia is unchallenged in their pole position with compute for AI, and AI is something that is going to profoundly change how we live our lives," he said. "The combination of those two is going to put Nvidia in a great spot for the next three years and I suspect the stock is going to move higher."

One Stock We Believe Will Win in The AI Race (It's not Nvidia!)