Walmart (WMT) reported better-than-hoped revenue of $152.3 billion and earnings per share of $1.47 on May 18. The quarterly earnings results were significantly higher than estimates, besting forecasts by – get this -- $4.4 billion and $0.15, respectively.

Walmart’s management also boosted its full-year earnings estimate, lifting its EPS forecast to at least $6.10 from $5.90.

Beat and raise. A good combination. However, is Walmart stock a buy?

TheStreet/Shutterstock

First, let’s dig into Walmart’s quarter

There was a lot to like in Walmart’s first-quarter earnings release.

First, management made progress in reducing inventory, a problem that’s plagued it since last spring. It also attracted more foot traffic as stubborn inflation led more consumers to visit low-price retailers.

As a result, comparable store sales at stores open for at least one year rose 7.4% from one year ago, and total revenue increased by 7.6%. Walmart’s top-line performance handily outpaced competitor Target, which reported sales only increased by 1% year-over-year last quarter on Tuesday.

Walmart’s outperformance likely stems from generating a more significant percentage of its revenue from groceries than Target (TGT), which is more heavily dependent on discretionary general merchandise sales.

Walmart – the nation’s biggest grocer – reported it gained grocery market share in the quarter, partly because it won over more higher-income shoppers. It also reported growing sales of its private-label products.

Overall, Walmart’s U.S. general merchandise sales fell by mid-single-digits while sales of food and consumables increased by low double-digits.

In the U.S., Walmart’s inventory levels fell by 9% from last year as ordering better-matched turnover, suggesting fewer profit-busting markdowns. Its operating margin improved by 0.34%, a testament to its efforts to keep costs down and grow profit faster than sales.

Worldwide, profit increased by 17.3% last quarter – much faster than revenue. Overseas, profit grew 41%, significantly more than its 12.9% sales growth, excluding currency conversion impacts. The trend of profit growing faster than revenue is likely to continue, according to management.

“We want operating profit growing faster than sales, and we expect to see an inflection in ROI in the coming quarters as we begin to lap large one-time items from past quarters, ” said CEO Doug McMillon on Walmart’s earnings conference call.

Walmart's e-commerce business also performed well. Online sales grew by 27%, partly thanks to more third-party sellers. That’s good news for its ad business because more sellers mean more advertisers. Ad sales grew 30% from one year ago last quarter.

For perspective, e-commerce sales only rose by 7.8% in the U.S. during the first quarter, according to the U.S. Census Bureau’s retail trade report.

Altogether, the quarter’s strength allowed Walmart to increase its full-year sales growth forecast to 3.5%. It also boosted its operating income growth to 4% and earnings per share to $6.10 to $6.20. Analysts were looking for $6.16 for the full year, so their guidance aligns with Wall Street’s outlook.

Again, there is a lot to like in Walmart’s results.

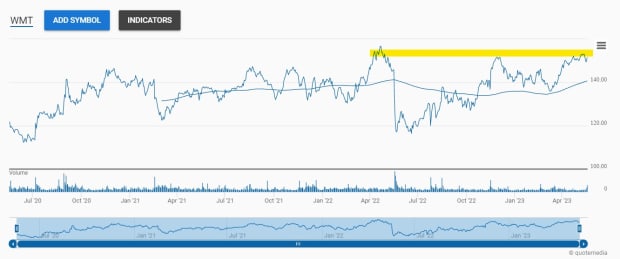

Walmart’s Stock Is Attempting to Break Out

Walmart stock has marched steadily higher since mid-March. It’s now bumping against resistance at its December highs near $154. If it can clear this hurdle, then there’s more resistance at near $160 – its all-time high set in April 2022 before it reported disappointing results caused by supply disruptions and too much inventory.

A close above $161 would set a new all-time high, removing any overhang from trapped sellers who may have been sitting with a loss since last Spring.

Walmart Isn’t Necessarily Cheap

The company’s $6.10 target for this year means shares are trading at about 25 times this year’s earnings per share, a P/E ratio that falls about in the middle of its 5-year P/E range of between 17 to 29.

Next year, analysts expect Walmart's EPS will improve to $6.84, a double-digit percentage increase. Yet, the forward P/E using that estimate is still 22. That’s not ridiculously expensive, but it’s hardly a bargain basement valuation.

Ultimately, buying Walmart’s stock means making assumptions about what’s likely to happen to the economy.

If the U.S. enters a recession later this year, Walmart may benefit from more shoppers trading down from more expensive competitors, but it won’t be immune from slowing consumer spending.

However, if job losses don’t climb markedly and the economy slows but sidesteps a recession, it could be a goldilocks scenario for Walmart. They could wind up with more foot traffic from those tightening their belts, allowing revenue and profit growth to improve if general merchandise sales remain stable or increase.