Headquartered in Calgary, Canada, Vermilion Energy Inc. (VET) is a petroleum and natural gas producer that operates across North America, Europe, and Australia. Last month, VET acquired Leucrotta Exploration Inc., a Montney-focused oil and natural gas exploration and development company, for approximately $477 million. This strategic acquisition is expected to add 20-plus years of free cash flow and further position the company to deliver long-term shareholder returns.

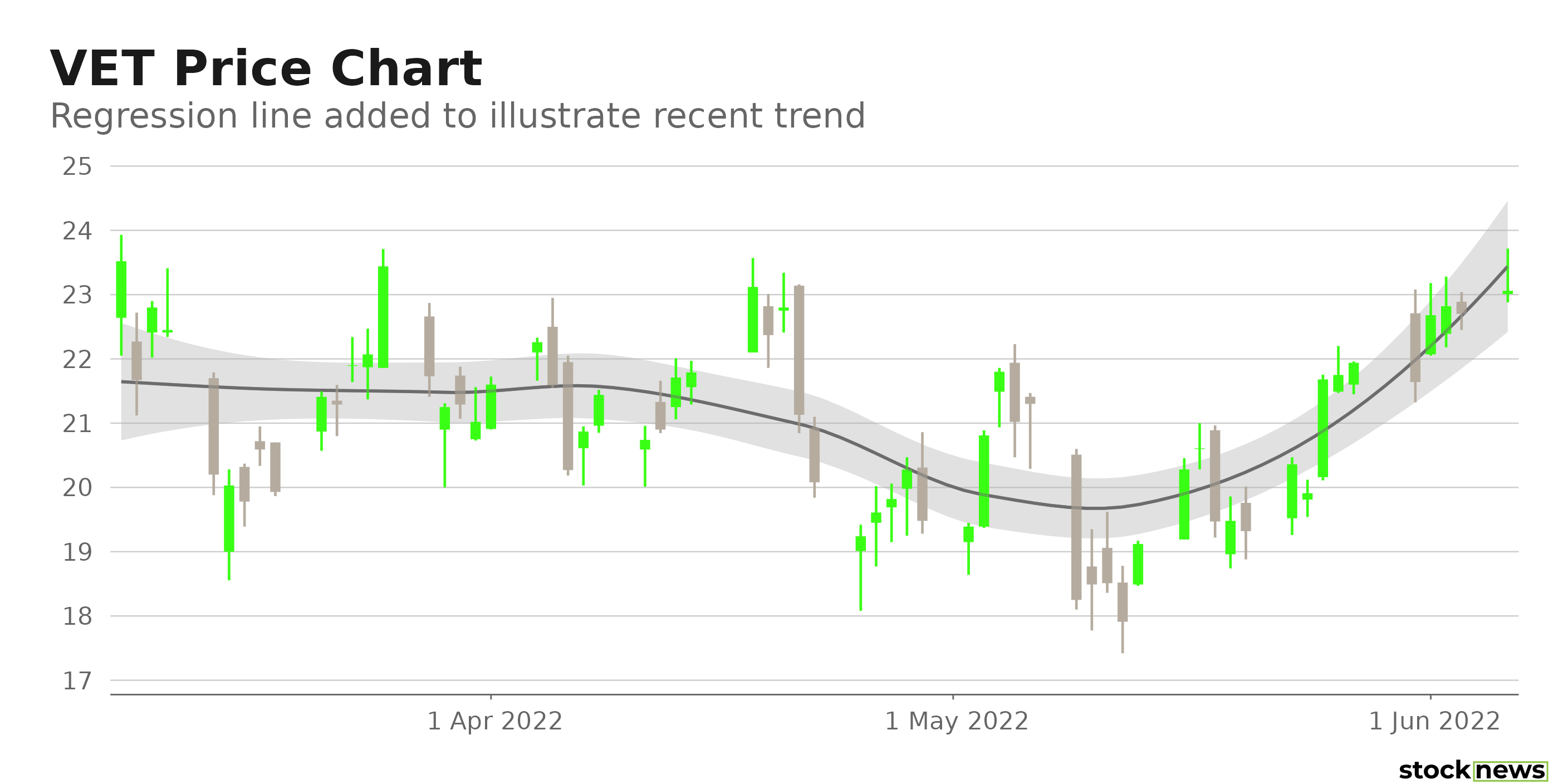

Shares of VET have gained 74.9% in price year-to-date and 172.2% over the past year to close Friday’s trading session at $22.70. Surging oil and gas prices have contributed to the stock’s rally. VET is currently trading near its 52-week high of $23.93, which it hit on March 8, 2022.

Here is what could influence VET’s performance in the upcoming months:

Robust Financials

VET's petroleum and natural gas sales have increased 120.1% year-over-year to $810.18 million in its fiscal 2022 first quarter, ended March 31, 2022. The company’s fund flows from operations, and free cash flow came in at $389.89 million and 304.52 million, respectively, registering an increase of 240.5% and 287%, respectively, from the prior-year period. The increases were primarily due to higher commodity prices.

Favorable Analyst Estimates

Analysts expect VET's revenue for its fiscal year 2022 second quarter, ending June 30, 2022, to be $518.86 million, representing a 60.2% rise from the same period in 2021. It is no surprise that the company has topped the consensus revenue estimates in each of the trailing four quarters. Also, the Street expects the company's EPS for the current quarter to increase 1,125.6% year-over-year to $1.30.

High Profitability

VET’s 44/36% trailing-12-month EBIT margin is 300.8% higher than the 11.07% industry average. And its 111.69% trailing-12-month EBITDA margin is 406.4% higher than the 22.06% industry average. Furthermore, the company’s 40.54% and 17.82% respective trailing-12-month net income margin and ROTC are higher than the 6.18% and 5.26% industry averages.

Low Valuation

In terms of forward non-GAAP P/E, VET’s 4.42x is 51.9% lower than the 9.18x industry average. And its 3.06x forward EV/EBITDA is 54.3% lower than the 6.70x industry average. Furthermore, the stock’s 1.37x forward Price/Book is 39.1% lower than the 2.25x industry average.

Power Ratings Show Promise

VET has an overall B rating, which equates to a Buy in our POWR Ratings system. The POWR Ratings are calculated by accounting for 118 distinct factors, with each factor weighted to an optimal degree.

VET has an A grade for Momentum. This is justified because the stock is currently trading above its 50-day and 200-day moving averages of $20.86 and $14.65, respectively. In addition, VET has a B grade for Value, which is in sync with its lower-than-industry valuation ratios.

VET is ranked #19 out of 42 stocks in the A-rated Foreign Oil & Gas industry.

Beyond what I have stated above, we have also given VET grades for Quality, Growth, and Stability. Get all the VET ratings here.

Bottom Line

VET reported impressive fiscal first-quarter results and affirmed second-quarter continued growth and full-year 2022 profitability expectations. Furthermore, it is well-positioned to benefit from the rising oil and gas prices. So, we think it could be wise to invest in the stock now.

How Does Vermilion Energy (VET) Stack Up Against its Peers?

VET has an overall POWR B Rating. One could also check out these other stocks within the Foreign Oil & Gas industry with an A (Strong Buy) rating: Parex Resources Inc. (PARXF), GeoPark Ltd. (GPRK), and TransGlobe Energy Corp. (TGA).

Note that TGA is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Growth portfolio. Learn more here.

VET shares were trading at $23.01 per share on Monday morning, up $0.31 (+1.37%). Year-to-date, VET has gained 83.17%, versus a -12.76% rise in the benchmark S&P 500 index during the same period.

About the Author: Mangeet Kaur Bouns

Mangeet’s keen interest in the stock market led her to become an investment researcher and financial journalist. Using her fundamental approach to analyzing stocks, Mangeet’s looks to help retail investors understand the underlying factors before making investment decisions.

Is Vermilion Energy a Smart Oil & Gas Stock to Invest In? StockNews.com