The precious metals sector of the commodities market led the way on the downside in Q2 2023. While the overall asset class edged 0.21% higher, the average performance of the four precious metals declined 8.34%, with palladium leading the way lower with a double-digit percentage loss. Gold was the best-performing precious metal, but it still managed to drop by over 2% for the three months ending on June 30, 2023.

Palladium tanks, platinum falls, and rhodium carnage

Rhodium, the precious metal that only trades in the physical market, had a horrendous Q2, falling 47.14%m adding to Q1 losses that sent the platinum group metal 68.91% lower over the first six months of 2023. The two PGMs that trade on the NYMEX also experienced significant declines.

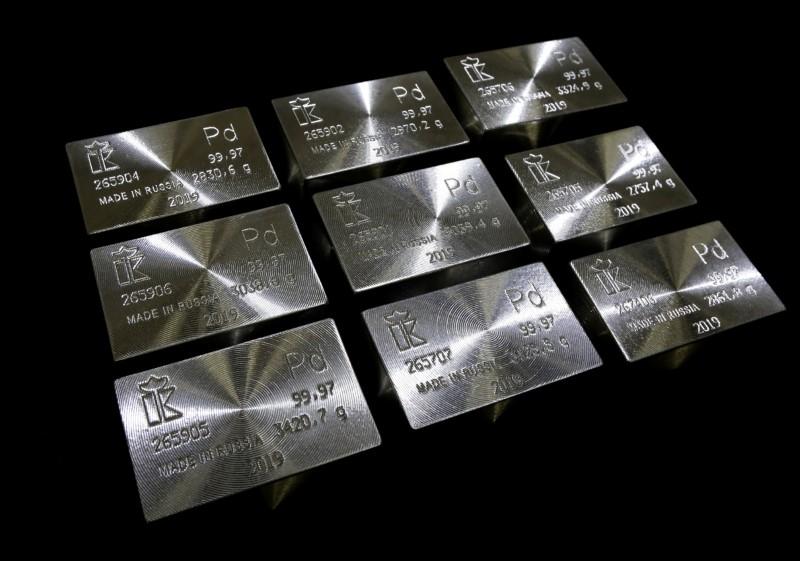

As the chart highlights, palladium futures, the least liquid of the precious metals with the lowest volume and open interest, dropped 16.76% in Q2 and were 32.04% lower since the end of 2022. Nearby NYMEX palladium futures settled at $1,222 per ounce on June 30.

While platinum fared slightly better, the metal failed and dropped 9.01% in the second quarter.

The continuous platinum futures chart shows that after rising to a new high for 2023 in April, the metal turned lower and was 15.76% under the December 30, 2022, at a $904.50 closing price on June 30. Platinum group metals led the precious metals sector lower in Q2.

Speculative silver declined

Silver is the most speculative precious metal as it tends to experience the most significant percentage gains and losses during trends. However, silver only fell 5.57% in Q2 as the industrial and financial metal outperformed the platinum group metals.

The silver futures chart illustrates the decline after silver reached a new 2023 high in May. Nearby silver futures closed Q2 at $22.81 per ounce, 5.12% under the end of 2022 closing price.

Gold falls in Q2 but is still higher in 2023

Gold, the ultimate means of exchange, a hybrid between a commodity and a financial asset, posted a 2.01% decline in Q2.

The chart shows that the continuous gold futures contract exploded to $2,072 per ounce in May, precisely the same record high as in March 2022. Gold put in a bearish double-top formation on the long-term chart, leading to a correction that took the yellow metal to a closing price of $1,929.40 on June 30. Meanwhile, gold was the only precious metal to move higher since the end of 2022, posting a 5.65% gain over the first six months of 2023.

The reasons for the correction

The following factors led to the Q2 corrections across the precious metals sector:

- A continuation of hawkish rhetoric from the U.S. Fed and European central banks weighed on precious metals prices. Central banks remain committed to pushing inflation to their 2% target level.

- Higher interest rates and a rising stock market drew capital away from precious metals and into the stock market and fixed-income assets.

- Recession fears weighed on industrial metals, sending PGMs and silver lower.

- Gold’s double-top formation created a bearish technical environment for gold and other precious metals.

While all precious metals sans palladium and rhodium reached new 2023 highs in April and May, the price action that followed was bearish and corrective. The four precious metals trading on COMEX and NYMEX closed the second quarter lower than the midpoints of the six-month range, with platinum and palladium settling near the lows for this year. Precious metals are heading into Q3 with short-term bearish trends.

The reasons lower prices are a buying opportunity

While the trends remain bearish in early July, there are reasons for hope that the metals will find bottoms and recover over the coming weeks and months. The following factors favor higher prices:

- Every dip in gold since the bull market began in 1999 has been a buying opportunity.

- The trajectory of Fed Funds interest rate hikes will slow after rising from zero in March 2022 to 5.125% in 2023. The Fed paused rate hikes at the early June meeting. The latest inflationary data points to stable to declining price pressures. While the hawkish rhetoric continues, action speaks louder than words, and the potential for further significant rate increases has declined.

- PGMs have fallen to levels that encourage industrial buyers. Platinum below $1,000 per ounce has been a buying opportunity over the past years. Palladium has declined to nearly one-third of the price at the 2022 high. Addressing climate change supports higher platinum group metals prices as platinum, palladium, and rhodium are critical inputs in catalytic converters that clean toxic emissions from the environment.

- The World Platinum Investment Council forecasts a one-million-ounce platinum deficit in 2023, with the supply and demand imbalance widening through 2027, supporting gains in the platinum market.

- Central banks worldwide continue to purchase gold, increasing their strategic reserves. As China and other BRICS countries move towards a BRICS currency to challenge the U.S. dollar’s dominant position on the global financial stage, gold will likely benefit as it is the world’s oldest means of exchange. Central banks hold gold as an integral part of foreign currency reserves, validating gold’s role in the worldwide financial system.

- Silver will follow the other precious metals when the bearish trends reverse.

Markets reflect the geopolitical and economic landscapes, favoring gold and precious metals in mid-2023. Perhaps the most significant reason for buying precious metals on a scale-down basis, leaving room to add on further declines, is that the worst sector of the commodities market during one quarter often turns out to be the best performer in the next quarter.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.