Valued at a market cap of $96.4 billion, Altria Group, Inc. (MO) is a leading American tobacco and nicotine products company. The Richmond, Virginia-based company owns some of the most well-known brands in the industry, including Marlboro, Copenhagen, and Skoal and has expanded its portfolio beyond traditional tobacco, investing in smokeless alternatives, e-vapor products, and cannabis.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and MO fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the tobacco industry. The company’s strengths lie in its strong brand portfolio, market leadership in the U.S. tobacco industry, and robust pricing power. Additionally, its consistent cash flow generation and shareholder-friendly policies, including dividends and share buybacks, further enhance its competitive advantage.

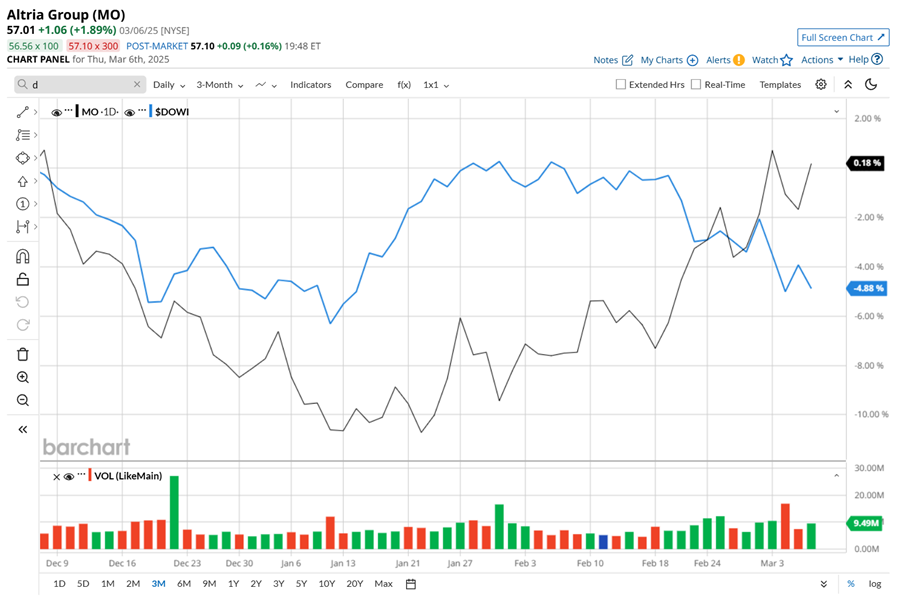

This tobacco giant touched its 52-week high of $58.59 recently on Mar. 4 and is currently trading 2.7% below it. Shares of MO have declined marginally over the past three months, outpacing the broader Dow Jones Industrials Average’s ($DOWI) 4.6% downtick during the same time frame.

In the longer term, Altria has rallied 37.5% over the past 52 weeks, considerably outperforming DOWI’s 10.1% return. Moreover, on a YTD basis, shares of MO are up 9%, compared to DOWI’s marginal rise over the same time frame.

To confirm its bullish trend, MO has been trading above its 200-day moving average since mid-April, 2024, and has remained above its 50-day moving average since early February, with slight fluctuations.

On Jan. 30, shares of MO plunged 2.1% after its Q4 earnings release, despite delivering above-par Q4 adjusted earnings of $1.29 per share and adjusted revenues of $5.1 billion, which improved 9.3% and 1.6% respectively from the year-ago quarter. However, a notable decline in revenue from its smokeable products segment and the all-other category, driven by lower domestic cigarette shipments, likely weighed on investor sentiment.

Moreover, looking ahead to fiscal 2025, Altria forecasts adjusted EPS between $5.22 and $5.37, indicating 2% to 5% growth but falling short of analysts' consensus of $5.35. The company continues to grapple with regulatory challenges and rising competition from both legal and illegal vape products, further dampening investor confidence.

Altria has outpaced its rival, British American Tobacco p.l.c.’s (BTI) 35.9% gain over the past 52 weeks but has lagged behind BTI’s 10.6% rise on a YTD basis.

Despite MO’s recent outperformance relative to the Dow, analysts remain cautious about its prospects. The stock has a consensus rating of “Hold” from the 11 analysts covering it. While MO currently trades above its mean-price target of $53.78, the Street-high price target of $61 suggests a 7% upside potential.