The rise in inflation last month is likely to mean higher borrowing costs for longer.

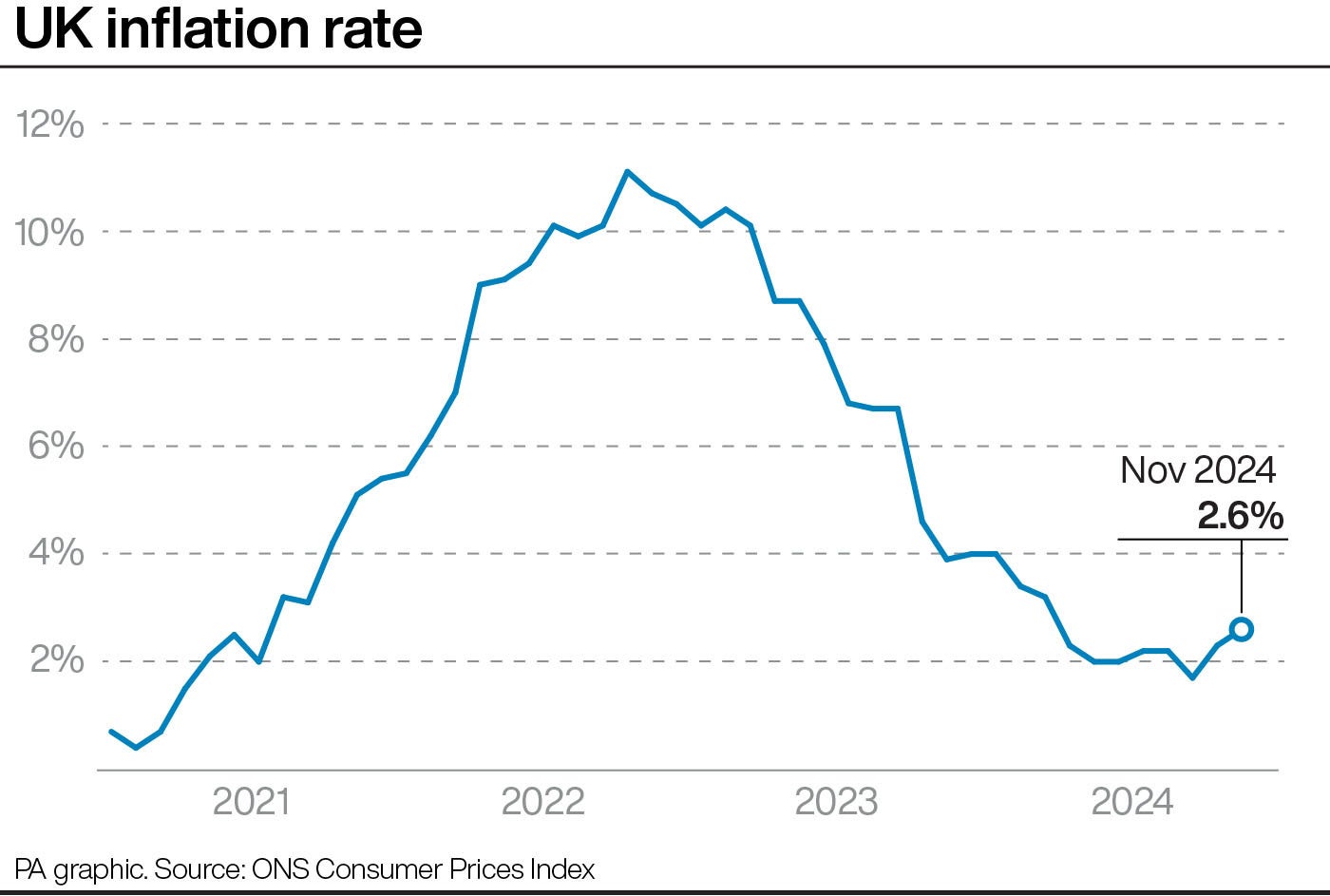

Prices rose at the faster rate of 2.6 per cent in November, up from 2.3 per cent in October.

The faster price gains for consumer goods like food and energy place inflation outside the Bank of England’s target rate of 2 per cent, which means a fall in interest rates is unlikely, economists say.

Petrol prices, train travel and products such as margarine and eggs helped drive up prices the most, the Office for National Statistics said.

The Bank of England meets to decide whether to cut interest rates again after it trimmed its base rate to 4.75 per cent last month. Stubborn inflation will make that unlikely when the decision is published on Thursday.

Monica George Michail, National Institute of Economic and Social Research Associate Economist said: “We expect the MPC to keep rates on hold in tomorrow’s meeting, and to gradually cut rates in 2025.

“However, we think the Bank will remain cautious given elevated wage growth, global uncertainty around the Trump presidency, and inflationary pressures introduced in the latest budget. Interest rates may therefore remain higher for longer than previously thought."

The UK economy shrank in October. The ONS said last week that output fell by 0.1 per cent following the 0.1 per cent decline recorded in September, raising the spectre of a quarter of shrinkage if growth does not return.

The poor figures led shadow business secretary Andrew Griffith to claim that the UK could already be in recession.

He told Sky News: “If this were a plane and there were so many dials in the red, you’d be looking for a parachute. I think we may already be in recession.”

The price rises come following a host of other downbeat data. Data released on Tuesday showed that vacancies fell by 31,000 to 818,000 in the three months to November and the number of people on payrolls in the UK fell by 35,000 to 30.4m between October and November.

Sarah Coles, head of personal finance at stockbroker Hargreaves Lansdown said: “Inflation is staying put for now, like an unwelcome Christmas party guest hogging the sofa into the small hours. The question is whether it can be shifted, or if it’s going to hang around to ruin our plans for months – eating us out of house and home and driving up the cost of everything again.

“Food and drink price inflation rose to 2%. Poor harvests in a number of areas have pushed up the prices of trolley favourites, including olive oil, up 26.6 per cent in a year and chocolate up 9.9 per cent.”

New figures out today will also add to the feeling of gloom. Manufacturing output volumes fell at the fastest pace since mid-2020, according to the Confederation of British Industry, the business lobby group.

Production of cars, glass, ceramics, furniture and upholstery led the fall, the CBI said.

Its survey of 331 manufacturers said output fell by 25 per cent in the three months to December.

Ben Jones, CBI Lead Economist, said: “Manufacturers are facing a perfect storm of weakening external demand on the one hand, amid political instability in some key European markets and uncertainty over US trade policy. And on the other hand, domestic business confidence has collapsed in the wake of the Budget, which has increased costs and led to widespread reports of project cancellations and falling orders.”

The Bank of England raised interest rates to 5.25 per cent last year, taking them to their highest rates since before the great financial crisis of 2007-8. It then cut lending rates to 5 per cent in August of this year.

Commercial lenders use the bank base rate as a guide on how much to charge borrowers and how much to reward savers.

Money market traders have pushed back their expectation of a rate cut to May. Previous market activity suggested that a cut could have come in March.