This story is part 2 of Drifting Toward Disaster, a Texas Observer series about life-changing challenges facing Texans and their rivers. It is published in partnership with Inside Climate News, a nonprofit, independent news organization that covers climate, energy and the environment. Sign up for the ICN newsletter here.

Tip us—and tell us your river stories!

Five years ago, when ExxonMobil came calling, city officials eagerly signed over a large portion of their water supply so the oil giant could build a $10 billion plant to make plastics out of ethane gas.

A year later, they did the same for Steel Dynamics to build a rolled-steel factory.

Never mind that Corpus Christi, a mid-sized city on the semi-arid South Texas coast, had just used up the resources laid out in its 50-year water plan 13 years ahead of schedule. Planners believed they had a solution: large-scale seawater desalination.

According to the plan presented in 2019, the state’s first plant needed to be running by early 2023 to safely meet industrial water demands that were scheduled to come online. But Corpus Christi never got it done.

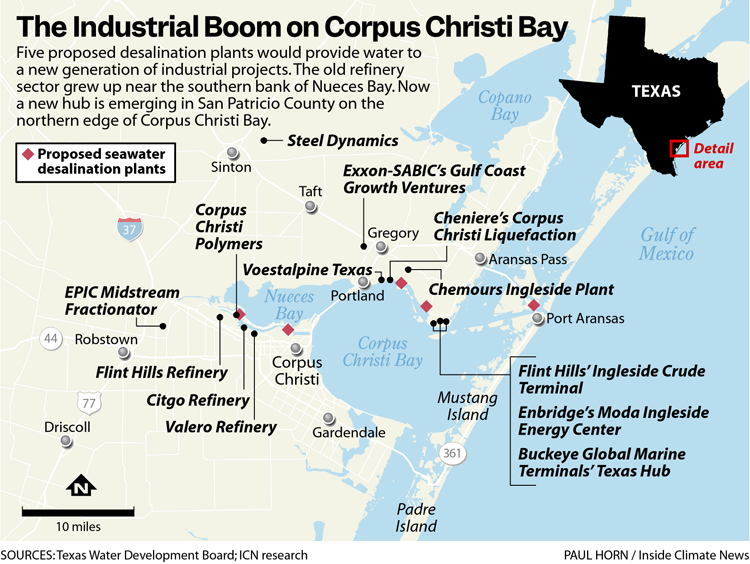

That hasn’t stopped the city and its port authority from pursuing plans to develop a next-generation industrial sector around Corpus Christi Bay and make this region a rival to Houston, home to the nation’s largest petrochemical complex, 200 miles up the Gulf Coast.

As efforts to cut carbon emissions fall far behind the timetables set during decades of global accords, Corpus Christi is building out a sector to sell oil and gas from Texas shale fields on global markets for decades to come.

All that’s missing is fresh water. Now the commitments city officials made over the past five years are coming due. Exxon’s plastic plant started operations this year and will eventually consume 25 million gallons per day, even as the region’s latest water plan foresees demand exceeding supplies in this decade.

This summer, severe drought and heat pushed Corpus Christi into water use restrictions. Plans for desalination remained years away from completion, hung up on questions from state and federal environmental regulators—the Texas Commission on Environmental Quality and the U.S. Environmental Protection Agency—over the ecological consequences of dumping hundreds of millions of gallons of salty brine per day into Corpus Christi Bay.

“I would love nothing more than to get right in front of their faces—the state, TCEQ, EPA, all of those agencies—and say, ‘Hey people! Do you realize that we need this permit now? We provide water for 500,000 people,” Corpus Christi mayor Paulette Guajardo told the city council in July, answering complaints over years of delays. “This is of urgency. We have to have this permit.”

Today, the pursuit of desalination has become an increasingly desperate race to meet incoming demands. The number of proposed plants has grown to five—two for the City of Corpus Christi, two for the Port of Corpus Christi and one for a private polymer manufacturer.

Last month, the TCEQ issued its first wastewater discharge permit to a plant proposed by the port, despite a challenge from the EPA signaling what could be a long legal fight ahead.

Regulators and scientists worry that each plant’s discharge of tens of millions of gallons of hyper-salty wastewater per day could disrupt major reproductive cycles for a host of aquatic species, which rely on the half-salty waters of the coastal bays for their larvae to mature.

All together, environmentalists say, the five plants’ discharge, coupled with the water pollution and ocean freighter traffic from the industrial boom they would unleash, may constitute a near-fatal blow for life in Corpus Christi Bay—so named by a Spanish explorer in 1519—whose once-teeming ecosystems nursed coastal communities for thousands of years before the city of the same name was founded.

While plant developers have produced studies showing their discharge won’t affect ambient salinity or wildlife, Paul Montagna, the Endowed Chair for Hydroecology at the Harte Institute for Gulf of Mexico Studies at Texas A&M University in Corpus Christi, doesn’t buy it.

“I don’t see how you can add brine to a salty system and not increase the salinity, I just don’t understand how that could happen,” he said from his corner office at the university, with two-story windows looking out to the bay. “I’ve read the engineering studies and I just don’t get it.”

Montagna agrees that Corpus Christi needs desalination, he just wants the brine piped one or two miles offshore and released into the open Gulf instead of the shallow, almost stagnant bay. The idea is supported by scientists but dismissed by developers as too expensive.

Other activists hope to block desalination altogether with the aim of holding up the buildout that has unfolded here in recent years, fueled by a spate of new pipelines carrying oil and gas from the Permian Basin and the Eagleford Shale since 2010, and by Congress’ lifting of the oil export ban in 2015, which has made Corpus Christi the nation’s top port for crude exports. One piece remains for the growth to continue.

“That’s the chokehold,” said Isabel Araiza, a professor of social work at Del Mar College and founder of a group called For the Greater Good. “In order to bring heavy industry in they’re going to need water.”

Speaking out against desalination

Corpus Christi is no stranger to water scarcity. In its earliest days, horse carts hauled in water by the barrel. In the 1950s the city rationed its reservoir amid historic drought.

By the 1980s, planners knew Corpus Christi was on track to outgrow its water supply, the Nueces River system,and they launched an ambitious effort to engineer a solution.

The plan, presented in 1993, called for a pair of pipelines, 101 miles northeast to Lake Texana then 40 miles further to Texas’ Colorado River, which would deliver up to 68 million gallons of water per day and meet the region’s needs through 2050. The first needed to be running by 2007; the second by 2029.

When the plan was presented, reservoirs were 100 percent full. Then three consecutive drought years saw them fall to 25 percent. The city was suddenly in an emergency, so it rushed its first pipeline to completion by 1998.

In 2011, Texas’ driest year on record stressed water supplies again and Corpus Christi built its second pipeline in 2016.

The water plan was finished. No further supplies were in the works. That didn’t stop Corpus Christi from offering 25 million gallons per day to ExxonMobil for its proposed $10 billion plastics plant in 2017, when the city was supplying an average of 80 million gallons a day to several cities of the region and all its industrial customers. The new plant would begin operations in 2022.

Six days after Exxon accepted the offer, Corpus Christi authorized an application for state funding to develop preliminary plans for a seawater desalination plant.

When Steel Dynamics came seeking water in 2018, Corpus Christi offered another 6 million gallons a day, citing “plans for additional water sources in the planning and implementation phase.”

But that wasn’t exactly true. Preliminary plans had yet to be shared with city council, and implementation remained years away at best.

When the plans were presented in 2019, they noted upcoming supply commitments to Exxon and Steel Dynamics.

“Large increases in water demand are projected to occur in 2022,” the city’s presentation said. “Based on supply and demand projections, the first desalination plant needs to be operational (supplying water) in early 2023.”

The council voted unanimously to adopt the plan. Activists quickly pushed back. Araiza, the activist leader of For the Greater Good, stood outside Fry’s Electronics on Black Friday speaking out against desalination.

“It’s for industry, not for us. And we pay for it,” she remembers telling shoppers.

Araiza’s family had been in the area for a century. On her dad’s side she was the first generation in memory not to pick crops. Growing up in the 1970s she rode buses across Corpus Christi during a belated integration of white and Hispanic schools. She earned a Ph.D. from Boston College, then returned home to organize and teach.

Araiza hoped to engage the public in such big decisions about the city’s future, which she said were too often made by small cliques of business elites for their own benefit.

“What’s happening with industry and water is symptomatic of a bigger problem,” she said. “Our way of life is problematic: consumerism, disposable products, single use plastics.”

Araiza joined a growing activist movement that was heaping challenges on the desal plans, forcing a slate of environmental permit applications to go through tedious administrative reviews.

“Water was the Achilles heel,” said Errol Summerlin, a retired legal aid lawyer and co-founder of the Coastal Alliance to Protect our Environment. “If we fought these desal facilities we could influence industry’s final decision to settle here.”

Soon the plans were falling far behind schedule, and in April 2021 the Corpus Christi water department hosted the city council at the Texas State Aquarium to address complaints about progress.

Council member Mike Pusley, a retired petroleum geologist and former Exxon employee, was not impressed. The original plans were no longer sufficient, he said.

“I can assure you that within the next five years, you’re going to have several Exxons here, and you’re not going to be ready with a plan. We’re not going to be ready. We’re not going to be ready at all with the water,” he said.

‘How did they get ahead of us?’

While city planners stumbled, the water supply was shrinking. Ten million gallons per day had been recalled from Corpus Christi’s first water pipeline, diverted to another massive plastics plant up the coast. The Colorado River fell too low for the second pipeline to draw. The city’s reservoirs fell to 40 percent of capacity as drought and heatwave grew acute this summer.

At a city council meeting this July, officials announced residential watering restrictions: anyone caught running a sprinkler outside of their one allocated night per week would be fined $500.

Pusley was upset. For years the city had been chasing plans for desal plants. The first was supposed to be nearing completion, but construction hadn’t even begun. Meanwhile, Exxon was beginning to draw water. The Port of Corpus Christi Authority had jumped into the race and claimed a clear lead, threatening the city’s historic monopoly on the regional water supply.

“It’s taking way too long for this to happen. The port has out-warriored us, they’ve out-lobbied us, they’ve out-engineered us,” Pusley told the city council meeting. “How did they get ahead of us? We’re the regional water supplier.”

“They spent more money on lawyers and lobbyists,” responded Mike Murphy, chief operating officer for the Corpus Christi water department, who moved to the city in 2021.

(The port’s lobbyists and lawyers wouldn’t secure their first controversial permit, issued by the Industry-friendly TCEQ over the EPA’s objections, until September.)

“This drought we’re in right now, there’s no solution for it but conservation,” Corpus Christi City Manager Peter Zanoni told the council. Zanoni moved to the city in 2019.

Conservation, however, only applied to residential users. According to a 2018 city ordinance, high-volume industrial users can pay $0.25 per thousand gallons consumed for exemption from restrictions during drought. Most pay it. While citizens face fines for sprinkler use, large facilities continue consuming millions of gallons per day.

That ordinance began: “A committee of large volume industrial customers determined that the value of their industrial processes creates a need to provide a water supply that will be resistant to drought despite further increases in industrial demand.”

A proliferation of energy and industrial products

It was part of a broader plan to expand industry around Corpus Christi, the eighth largest city in Texas, with 330,000 people, 64 percent of whom are Hispanic. Known for beaches, fishing and an aging refinery sector, the city sits isolated on a rugged coastline, the only seaside city along 300 miles between Houston and the Rio Grande.

The natural beauty and peaceful isolation drew Montagna, the Texas A&M professor, to stay and raise his family here. A New Yorker by birth, he had bounced through Washington State and Alaska before he found South Texas in 1986 and never left.

“It’s pretty hard to find such a long stretch of relatively pristine coast,” he said. “Where else in the whole country?”

Today times are changing. Recent years have seen a proliferation of energy and industrial projects around Corpus Christi and all along the Texas coast. It started more than a decade ago, when the fracking boom unlocked a wealth of oil and gas in Texas shales. A few new pipelines carried the bounty to Houston, the old “energy capital of the world,” but many more ran to Corpus Christi.

After Congress lifted the oil export ban in 2015, huge terminals went up to load shale oil and gas into ocean-going freighters on the coast.

“I think there has been more change in this region in the last four years than there had been in the last 20,” Montagna said.

Valero and FlintHills expanded refineries. Cheniere Energy built the region’s first facility to compress and export natural gas with plans to double its output. Vostalpine built a plant that makes iron briquettes. Three huge, adjacent crude export terminals cropped up on the bay, operated by Enbridge Inc., FlintHills and Buckeye Global Marine Terminals. Elon Musk wants to build a lithium refinery.

This year, Exxon opened its plastics plant, turning ethane, a form of natural gas, into ethylene and polyethylene, building blocks for plastics, on 1,300 acres across the bay from Corpus, in San Patricio County.

When the plant uses its ground flare—sportsfield sized units for burning off chemicals—Elida Castillo can see the sky glow orange from her house in the small town of Taft, about eight miles away, near a cemetery where her great, great grandparents are buried. Sometimes, she said, the sheriff posts on Facebook saying not to be alarmed. No one ever tells the community what chemicals are being burned.

In the last few years, new concrete and steel plants have also cropped up around town, bringing air, noise and light pollution. This year, Castillo launched the Texas branch of Chispa, a project by the League of Conservation Voters, to push back.

“Our aim is to block the infrastructure that industry needs to cut our roots and establish its own roots here,” said Castillo, who launched a Texas branch of Chispa, a national Latino organizing project, to push back against development.

While decisions are made in Corpus Christi, most of the new projects have been built across the bay in San Patricio County, where Castillo lives. Her comments at Corpus Christi city council meetings are limited to one minute, while city residents get three.

Castillo also gets little representation at the port, a political subdivision that owns, leases and develops land on both sides of the bay, in Nueces and San Patricio counties. It is managed by seven appointed commissioners: three by Corpus Christi, three by Nueces County and one by San Patricio County.

The port is pursuing its own $650 million expansion plan, including a 75-foot-deep channel running 11 miles into the Gulf to enable the world’s largest oil tankers to enter Corpus Christi Bay. A colossal, new billion-dollar bridge (by the same builders of a bridge that collapsed in Florida in 2018) will allow them into Corpus Christi Harbor and its port.

The two desalination plants proposed by the port would produce up to 80 million gallons per day.

The port declined to answer questions about projects in the pipeline, industrial water demand projections or plans for desalination.

“We are not engaging with media,” said Lisa Hinojosa, director of communications for the Port of Corpus Christi Authority, in the lobby of an upscale waterfront conference center attached to the port’s new, four-story, $41 million headquarters.

(Port CEO Sean Strawbridge, a former director of the Port of Long Beach in California who came to Corpus Christi seven years ago and made $650,000 in 2021, told a meeting of the Ingleside City Council in August last year that the port began pursuing desal plans after he “got a call” from someone who “decided to invest here and they’ve got a large project going on. Basically said, ‘What the heck is going on with your water situation down there?’ And the port commission decided to take a leadership role.”)

Environmental activists here admit they seldom get popular support for their opposition to oil. The refineries have provided many families a path out of poverty here. Locals often cheer on industrial growth for the money it brings and officials are proudly pro-business.

Esteban Ramos, whose Spanish ancestors settled here in the 1700s, believes desalination can pave the region’s way to prosperity that will keep families whole.

“Everybody wants to say, ‘You’re only doing this for industrial purposes.’ But the answer is, it’s not that simple,” said Ramos, director of water resources with the city. “This is generational growth.”

Both of his parents were teachers and Ramos saw their best students skip town for San Antonio, Austin or Houston, leaving longing parents and leaderless neighborhoods without their brightest youth. Corpus Christi’s top employment sectors are office administration, food service and freight transportation.

A big, new, drought-resistant water supply can unlock job growth in higher paying fields.

“Corpus needs its own identity and we have this opportunity, we just don’t need to be afraid,” Ramos said. “What’s keeping you from making a true, realistic living, having a family and those children staying here? Why are we afraid of that?”

A century of rising salinity

Whether the port and the city ultimately get the permits they need for their desalination plants will depend upon forthcoming environmental assessments of Corpus Christi Bay, where the deadly effects of rising salinity are not theoretical—they are the lived experience.

These placid, shallow waters, sheltered from the Gulf by more than 200 miles of barrier island, once teemed with shrimp and oysters that nourished bayside communities for millenia. Today dolphins still splash and great herons still stalk the wetlands, but the bounty of shellfish is gone.

In Nueces Bay, an inland appendage of Corpus Christi Bay, oysters disappeared in the late 1930s. Two dams on the Nueces River, and two railroads across its delta, were reducing fresh water flows. Efforts to save the oysters came too late.

“Oysters did not come back when fishing and dredging ceased because the salinities were too high,” a 2011 report from the Harte Research Institute for Gulf of Mexico Studies at Texas A&M said.

Fifty years later, the shrimp were vanishing too. Two much larger dams stopped any freshwater at all from reaching the bays. Local shrimpers begged for state intervention. Texas ordered water released from Corpus Christi reservoirs to the bay. Again, it was too late.

The mid-90s drought ravaged city water supplies, leaving nothing to spare for the shrimp. Nueces Bay died then. Rather than a half-salty marshland where the river meets the sea, it became the reverse: a wide shallow mudflat where stagnant ocean water evaporates, leaving extra-salty water and few living things.

It was saltier than seawater,” said Montagna. “It became evident that the bay wasn’t producing shrimp or oysters anymore.”

The bays, formed by rivers that flowed to the ocean until the 21st Century, distinguish Texas’ coast from the successful examples of seawater desalination in California, where plants release brine into the deep, open Pacific. In Corpus Christi, developers want to discharge into a shallow, almost stagnant body. It takes one year for the contents of Corpus Christi Bay to be replaced by new water, Montagna said. The brine is going to accumulate, he said.

All manner of ocean fish and crustaceans rely on the shelter and moderate salinity of the bays to mature. Less salt in the water means more oxygen, which larvae need to survive. Without the bays, species can’t reproduce.

“They literally grow there,” Montagna said. “The life cycle requires these low salinity nursery habitats.

And it’s not only about the salty waste. Some of the freshwater will pass though plants and refineries then re-enter the bay as industrial discharge laced with toxins.

Stranded assets and brownfields

Exxon’s new plastic plant is permitted to dump up to 13 million gallons a day of polluted wastewater, including 8,000 pounds of suspended solids (mostly plastics), and 1,000 pounds of oil and grease. A draft permit for Valero allows discharge up to 2.4 million gallons a day of “treated process wastewater,” including “chromium-containing wastewater.” Another for Flint Hills allows 6.9 million gallons a day of utility wastewater, including “contaminated water generated at other facilities,” and also removes limits on copper and zinc. Another for Steel Dynamics allows 1.2 million gallons a day of “coil coating process wastewater.”

“This is going to be bad for the world,” said Patrick Nye, a former petroleum geologist, looking over the bay from the spacious balcony of the waterfront beach house his parents built in Ingleside On The Bay in the 1960s.

Nearby, across a green vibrant marshland, a tanker docked at the continent’s largest crude export terminal, which Nye had watched take shape in recent years.

He pointed down to the shallow water where, he said, he played as a child on a wide, dry beach before the rising sea consumed it, forcing his parents to build a concrete seawall in its place.

Born in 1954, the son of a state appellate court justice, Nye played on the Texas Tech University tennis team then went into oil exploration.

“A lot of my peers would disagree,” he said. “But I believe climate change is here.”

He left oil and gas more than 20 years ago to start his own wind power venture, which has continued to expand. Thousands of white wind turbines spin today in the sprawling fields outside Corpus Christi.

He thinks the global market for fossil fuels is preparing to peak, and he’s not alone. Although decades of international protocols, climate accords and ambitious emissions reductions goals have not succeeded in reversing the growth in oil demand, even oil producers now acknowledge the crest is coming.

Exxon is ramping up plastic production near Corpus Christi while the world’s two largest markets, China and India, implement bans on single-use plastics.

For now, Russia’s war in Ukraine is keeping oil prices high and energizing the coastal buildout in Texas.

“It’s a gold rush to get as much in place before the whole thing craters,” Nye said.

While he hopes for a future with less fossil fuel, less plastic and less air pollution, those changes in global markets raise grim prospects for Corpus Christi, conjuring visions of other places where industrial booms have come and gone, like the sprawling collection of discarded refineries in Oklahoma.

Or like the abandoned coal mines of West Virginia. Or parts of Ohio, one the first great oil states, where the good times left a legacy of “stranded assets” and “brownfields.”

“That’s their business model,” said Jim Klein, who teaches history at Del Mar College. “My worry is: that’s what will happen to Corpus Christi.

Correction 11/4 1:00pm: A previous version of this article incorrectly stated that Paul Montagna wanted brine waste piped 12 miles offshore for discharge. Montagna wanted the brine piped one or two miles offshore.