Not too long ago, Microsoft (MSFT) stock's glory days looked to be behind it as sales of desktop PCs slipped into a seemingly irreversible decline. Although the dot-com days of the 1990s minted many a "Microsoft millionaire," the aftermath of the tech bust led Microsoft stock to trade mostly sideways for more than a decade.

But the past 10-plus years have been nothing short of a renaissance for the tech giant. When CEO Satya Nadella ascended to the top job in 2014, he not only began instituting cultural changes, he transformed Microsoft's core strategy too. Cloud computing and subscription-based services were in; the days of selling software licenses via physical compact disks were passé.

That focus on enterprise customers and – most importantly – Microsoft's shift to selling cloud-based services such as Azure and Office 365 have been an astounding success. Today, Microsoft is a dominant player in cloud computing and a leader in generative artificial intelligence (AI) – and MSFT's returns prove it.

Indeed, Microsoft stock has been so remunerative since Nadella took over that long-term investors might not even notice that dud decade-plus following the tech bust.

Between January 1990 and December 2020, shares in Microsoft, which joined the Dow in 1999 at the height of the dot-com boom, generated a total return of 57,730%. The S&P 500's total return came to a mere 1,950% over the same span.

Along the way, Microsoft generated $1.91 trillion in wealth for shareholders, good for an annualized dollar-weighted return of 19.2%, according to Hendrik Bessembinder, professor of finance at the W.P. Carey School of Business at Arizona State University.

Only Apple (AAPL) generated more wealth for shareholders over those three decades, making Microsoft one of the best stocks of the past 30 years, per Bessembinder's findings, which account for cash flows in and out of the business and other adjustments.

The bottom line on Microsoft stock

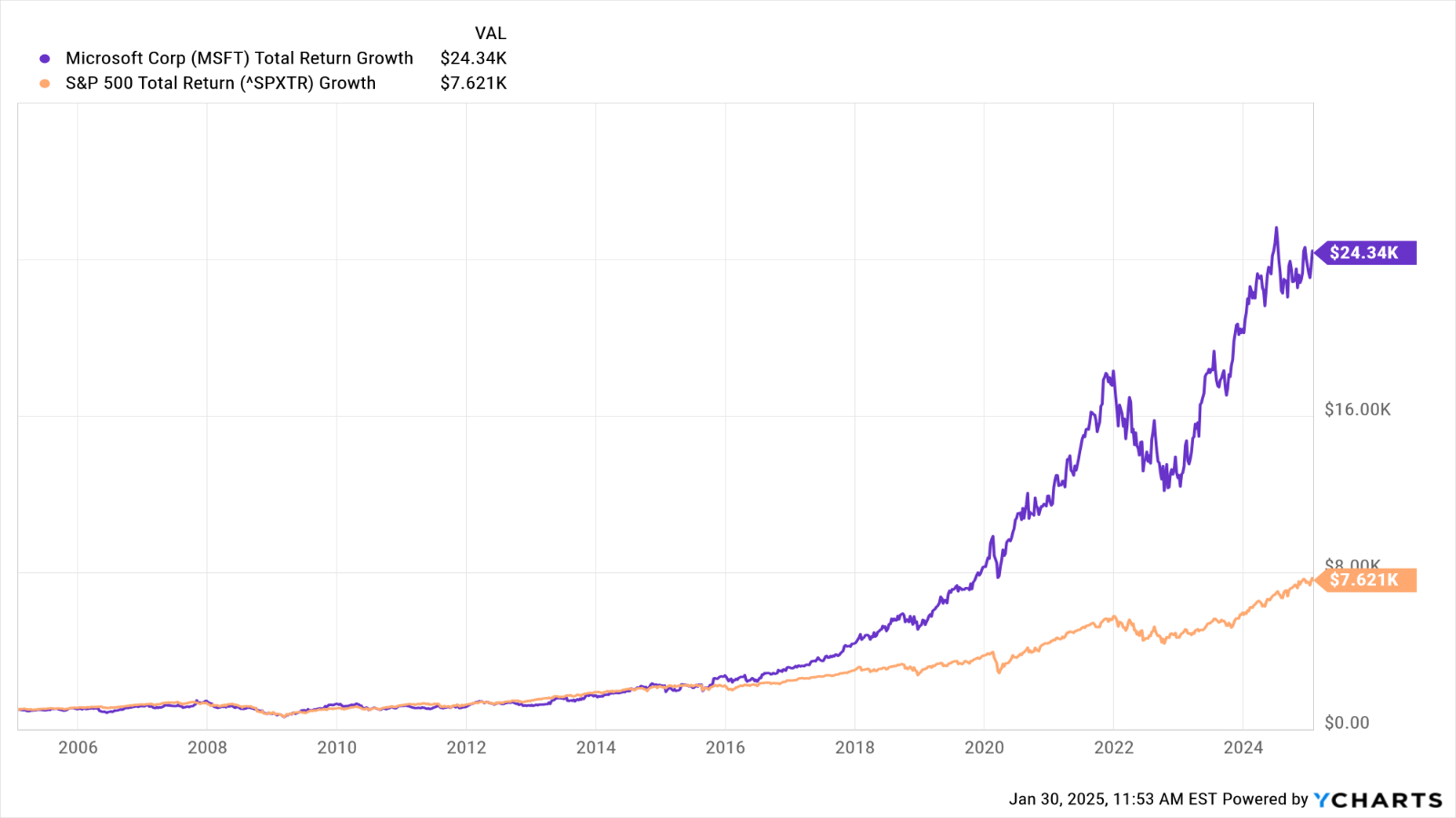

With Microsoft trading below its all-time highs, it seemed like a good time to remind folks what $1,000 invested in Microsoft 20 years ago would be worth today.

Have a look at the above chart and you see only market-matching returns until around 2015. Then MSFT takes off. Indeed, it took off so much that if you put a grand into Microsoft stock two decades ago, today it would be worth more than $24,000. That's good for an annualized total return (price change plus dividends) of 17.3%, according to data from YCharts.

The same amount invested in the S&P 500 20 years ago would theoretically be worth about $7,600 today, or 10.7% annualized.

But wait, there's more.

Over its entire life as a publicly traded company, Microsoft has generated an annualized total return of 25.7%. The S&P 500's total return comes to 10.6% annualized over the same span.

Happily for Microsoft bulls, analysts very much expect shares to continue their market-smashing ways.

Of the 56 analysts issuing opinions on Microsoft stock surveyed by S&P Global Market Intelligence, 38 call it a Strong Buy, 13 say Buy and five have it at Hold. That works out to a rare consensus recommendation of Strong Buy, making MSFT a top-rated Dow Jones stock. Indeed, at Strong Buy, Microsoft is one of analysts' top S&P 500 stocks to buy now.

Check out the stocks billionaires are buying or hedge funds' top blue chip stocks and you'll see that much of the putative smart money agrees with Wall Street's assessment.