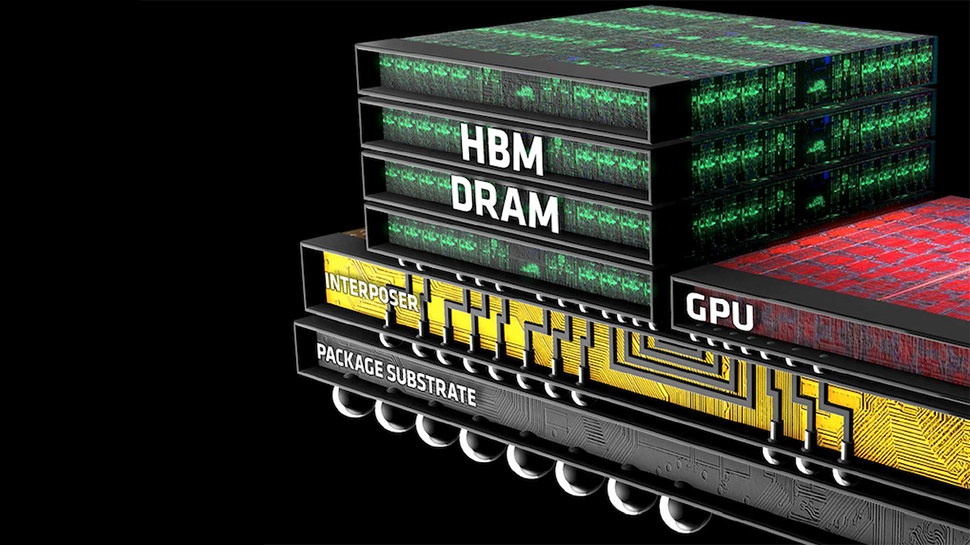

Huawei is reportedly building a consortium of memory producers to build high bandwidth memory (HBM) to break free of Western sanctions. HBM is crucially important for AI and HPC processors because no matter how much compute power they have, performance is often limited by memory bandwidth. Huawei understands this perfectly, so it is now backing the development of HBM2 memory at one China-based DRAM maker, according to The Information.

The Huawei-led consortium is reportedly backed by the Chinese government and includes several other Chinese semiconductor companies, including memory maker Fujian Jinhua Integrated Circuit, as well as specialists in advanced chip packaging. The consortium is currently developing HBM2 memory, which is generations behind what market leaders often use. The facilities even have two production lines. Huawei reportedly aims to complete development and start mass production of HBM2 memory by 2026.

In addition, ChangXin Memory Technologies (CXMT) is also trying to develop HBM technology, though its achievements in this realm are unclear. There is also a media report that XMC, another China-based semiconductor company, is also working on an HBM project. XMC is controlled by Yangtze Memory Technology Co. (YMTC), China's leading producer of 3D NAND, which is in turn controlled by state-owned Tsinghua Unigroup.

HBM is currently sold by Micron, Samsung, and SK hynix, and these memory stacks are not available on the spot market. Since HBM memory is made using American technologies, these companies have to apply for an export license from the U.S. government, which reviews the applications with a presumption of denial.

Huawei badly needs HBM for its Ascend-series processors for AI applications, and while SMIC (presumably) can make these chips for Huawei, HBM availability is clearly a bottleneck for Huawei's AI processors. It is unclear how the company gets HBM memory now, though it is theoretically possible to get these stacks indirectly. Of course, this means limited availability for Huawei and leads to limited availability of Ascend processors as the Chinese high-tech giant primarily wants to use these devices for its own AI services.

Of course, Huawei's and other HBM companies' endeavors face considerable obstacles, notably the international regulations that limit sales of advanced chipmaking equipment to China.

Huawei's formation of the group and CXMT's efforts can be considered another strategic move by China to become self-sufficient in key technologies for AI and supercomputing.