What Is Hydrogen?

Hydrogen is touted as an alternative and clean energy source that can power electric vehicles, releasing nothing but water vapor and heat into the atmosphere. The electrolysis process of separating water into two atoms of hydrogen and one atom of oxygen, though, is power intensive—it requires large amounts of electricity.

Hydrogen is becoming popular among alternative energy sources, but production in large quantities is limited. It faces competition—at the consumer and commercial levels—from lithium-based batteries, which have become the dominant source in powering electric vehicles. It’s also a highly flammable gas, making storage and transportation a challenge.

How Is Hydrogen Produced?

Production of hydrogen varies by method—natural gas reforming/gasification, electrolysis, renewable liquid reforming, fermentation (via biomass)—and these are differentiated by color designation. The prevalent preferred method is production without harmful greenhouse gas emissions, and that is classified as green hydrogen. Solar, wind, and biomass energy are among the alternative power sources used to produce this type of clean hydrogen. The term yellow hydrogen applies specifically to production via solar power.

Other methods classified as blue, gray, black, and brown require the use of fossil fuels, namely natural gas and coal, and these methods release greenhouse gases into the atmosphere. Natural gas, for example, is combined with high-temperature steam to produce hydrogen.

Hydrogen produced by nuclear energy is called pink, purple, or red. White hydrogen is naturally occurring and can be captured via fracking. Turquois is the latest form of hydrogen—it is produced from methane but emits low levels of greenhouse gases.

Currently, the bulk of hydrogen produced in the U.S. is from natural gas and coal, but the push is to increase production through electrolysis via solar and wind.

Still, the efficiency of hydrogen may not be on par with batteries due to systemic loss during production, storage and delivery.

How Big Is the Hydrogen Market?

One estimate forecasts the entire hydrogen generation market jumping from $150 billion in 2021 to $220 billion in 2028. As of August 2022, there were few large-scale projects being undertaken to produce green hydrogen because of the high costs involved in creating the facilities and the amount of space required to accommodate large arrays of solar panels.

The U.S. and a small number of countries, including Australia and China, are backing projects to produce green hydrogen in large quantities with the aim of bringing the cost of hydrogen to a level that’s competitive with lithium batteries and gasoline. In 2021, the U.S. Department of Energy aimed to reduce the cost of clean hydrogen to $1 per 1 kilogram in 1 decade, in a plan dubbed 1-1-1.

California is the most ambitious among the 50 states to focus on hydrogen-fueled cars, and its energy commission worked with Toyota Motor Co. and Honda Motor Co. in the construction of hydrogen charging stations in California. Almost all of the hydrogen stations in the U.S. are in California.

How Is Hydrogen Used?

The production of hydrogen is largely for use in the automotive sector—in fuel cells for electric vehicles or using it outright as a compressed fuel for combustion engines. Hydrogen in fuel cell electric vehicles (FCEVs) is used to create a chemical reaction that produces electricity.

Toyota’s Mirai passenger car has a range of up to 402 miles on a single charge with its fuel cell, and that is comparable to the long-range performance of 405 miles on Tesla’s Model S. By comparison, the Honda Civic can travel up to 520 miles. But the costs vary, with hydrogen the most expensive.

As of August 3, 2022, the price of hydrogen in San Francisco was about $20 a kilogram. The cost of fueling a 5-kilogram capacity Toyota Mirai would set its owner back $100. That compares to about $26 for Tesla’s long-range Model S, and about $70 for a full tank of gas for a Honda Civic. If the U.S. government were to realize its goal cost of $1 a kilogram by the 2030s, hydrogen could become the cheapest source to power vehicles.

While battery performance may be practical for passenger vehicles, such performance on heavy-duty vehicles is poor. That’s where hydrogen could have a greater advantage. For this reason, heavy-duty vehicle manufacturers such as JCB of the U.K. and Caterpillar Inc. are working on hydrogen-powered combustion engines. The engines are similar to gas combustion engines but are configured to accept hydrogen as the fuel source and have zero-carbon emissions.

How to Invest in the Hydrogen Market

Hydrogen is a niche market that is quite volatile. Companies span the globe, mainly in developed countries with the resources to build facilities and scale up technology on hydrogen. While there is no open market price on hydrogen as there is with materials like copper that trade on commodities exchanges, portfolio exposure to hydrogen can be achieved via indexes, exchange-traded funds, and individual stocks.

Indexes

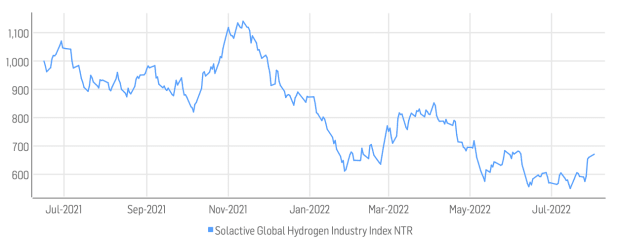

Investing in hydrogen is still in its early stages, and there is at least one index on which exchange-traded funds and stocks can be benchmarked. The Solactive Global Hydrogen Industry Index NTR focuses on more than 20 stocks, including shares of companies engaged in hydrogen production, fuel cell technology, and distribution.

Below is a graph of Solactive’s ETF from inception in mid-June 2021 to early August 2022.

ETFs

Exchange-traded funds that focus on hydrogen are relatively new, but there are some ETFs that have been around for more than a year. One of the newer funds is the Global X Hydrogen ETF (NASDAQ: HYDR) from Mirae Asset Financial Group. According to its mandate, the ETF seeks to invest in companies that run the gamut from hydrogen production to the integration of hydrogen into energy systems. The makeup of the fund is skewed toward companies based in the U.S. and the U.K.

Stocks

Investors and analysts who track indexes and ETFs can review constituent stocks. Companies in the production of hydrogen from renewable sources include Norway-based Nel ASA. Connecticut-based FuelCell Energy and Toyota are among those actively engaged in fuel cell technology.

What’s the Bottom Line on Investing in Hydrogen?

Hydrogen technology remains in its early stages of development, but it has a promising future with the potential to power FCEVs, heavy-duty vehicles, and even aircrafts and ships.

Processing hydrogen has its economic challenges and also poses a unique environmental quandary: Is it worth it to use large amounts of power to produce another type of power? Yet, the same argument can be made for gasoline or jet fuel, two types of fossil fuels that are relied on for travel. And still, unlike crude oil or natural gas, water is a plentiful resource.

Yet, unlike lithium, hydrogen remains an abundant material that has little procurement impact on the environment. Lithium remains the main source of material for batteries but requires invasive mining to extract.

Hydrogen has been derided by Tesla founder Elon Musk, who referred to fuel cells as “fool sells” in a tweet. But the truth of the matter is that government support is needed to make it a viable alternative energy source.

Just as with any new type of technology, economies of scale will drive costs lower as demand increases down the road—just as battery production costs dropped with increased demand for electric vehicles.