Inflation can be a nuisance for investors, eating away at portfolio returns. The U.S. Labor Department reported a 7.5% increase in the consumer price index in the month of January, the fastest inflation growth since 1982.

Inflation And Dividend Growers: One potential way for investors to offset the impact of inflation is to look to stocks with high dividend yields. Dividends have accounted for about 40% of overall stock market returns since 1930, according to Fidelity.

"Based on history, if high inflation is here to stay, I believe dividend growth stocks look likely to outperform," Denise Chisholm, director of quantitative market strategy for Fidelity, recently said.

Historically, the fastest dividend growers in the S&P 500 have outperformed in environments in which inflation stays higher for longer.

Dividend Aristocrats: The Dividend Aristocrats list is a list of 66 S&P 500 companies that have raised their dividends for at least 25 consecutive years.

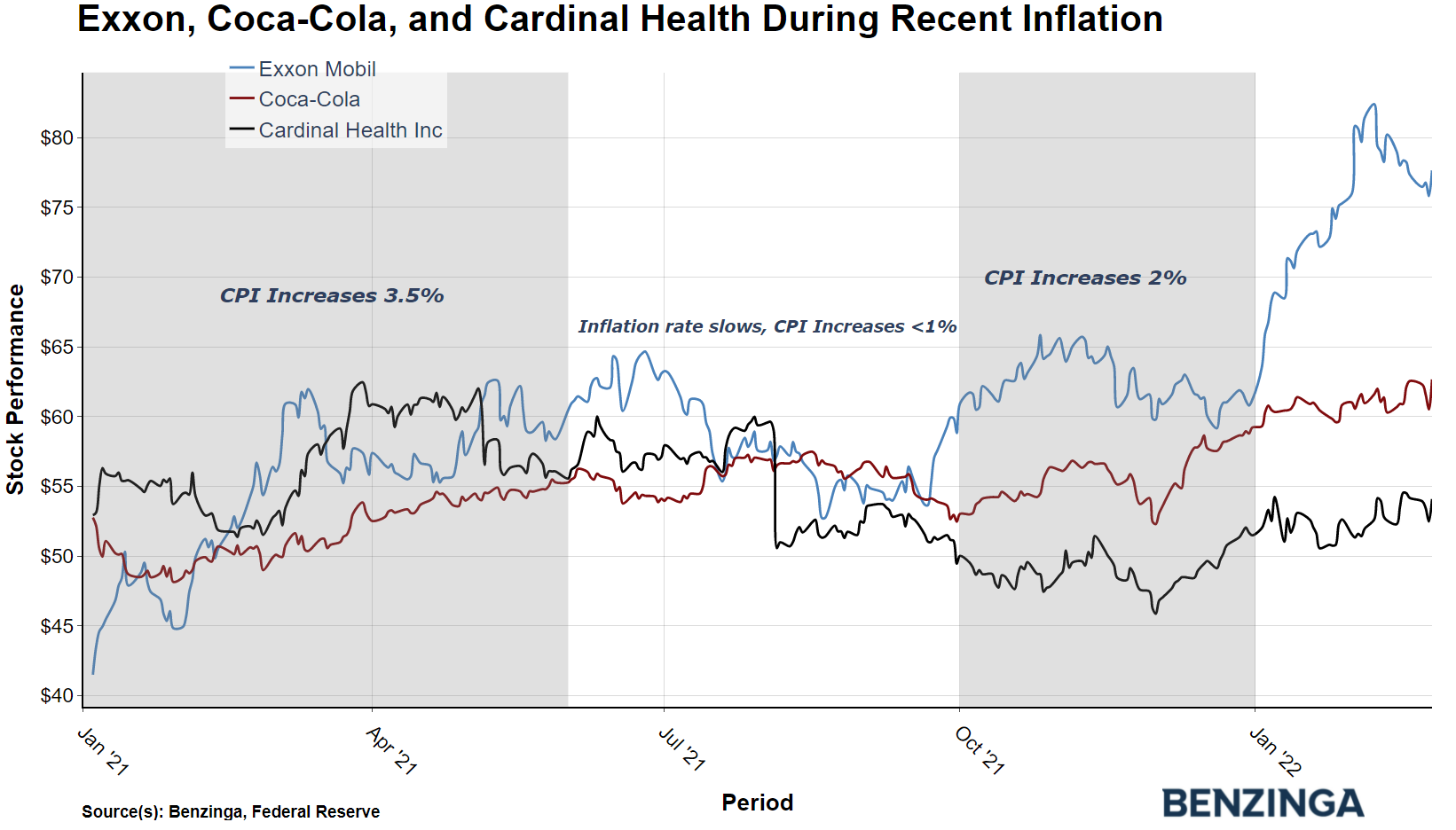

During the inflationary period from April 1989 to May 1991, shares of Dividend Aristocrats Exxon Mobil Corp (NYSE:XOM), and Cardinal Health Inc (NYSE:CAH) and Coca-Cola Co (NYSE:KO) all more than doubled the returns of the S&P 500. Year-to-date in 2022, all three stocks are higher, while the S&P 500 is down 7.9%.

In addition to outperforming during times of elevated inflation, Dividend Aristocrats are the definition of reliable investments. Only the companies with the healthiest balance sheets on Wall Street could afford to not only maintain but even raise their dividends through multiple recessions, financial crises and even a global pandemic. This type of consistency can give investors peace of mind in the event of a market downturn.

Related Link: 'Another Surprise Jump': Experts React To 7.5% CPI Inflation, Highest Since 1982

Diversified Alternative: Exxon, Cardinal Health and Coca-Cola are just three examples of Dividend Aristocrats that have performed particularly well during inflationary periods. The stocks have dividend yields of 5.4%, 3.8% and 3.2%, respectively.

For investors looking for more diversification, ProShares conveniently includes all 66 Dividend Aristocrats in their ProShares S&P 500 Dividend Aristocrats ETF (BATS:NOBL).