Is Nvidia (NVDA) no longer the undisputed market leader among artificial intelligence (AI) stocks?

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

The prominent Magnificent 7 stock kicked off this trading week on a low note, showing signs that it had fallen into a slump. This prompted speculation that AI spending could either decline or shift toward Nvidia’s competitors. However, NVDA stock has since reversed course and is climbing again.

Despite Nvidia’s recent declines, many Wall Street analysts remain highly bullish. But that doesn’t mean that experts aren’t starting to look toward other AI stocks for exposure to the booming industry.

Other chip makers and leading tech companies are trying hard to secure a piece of the lucrative market, and some experts are noticing. In fact, one hedge fund manager is highly bullish on one of Nvidia’s chief competitors.

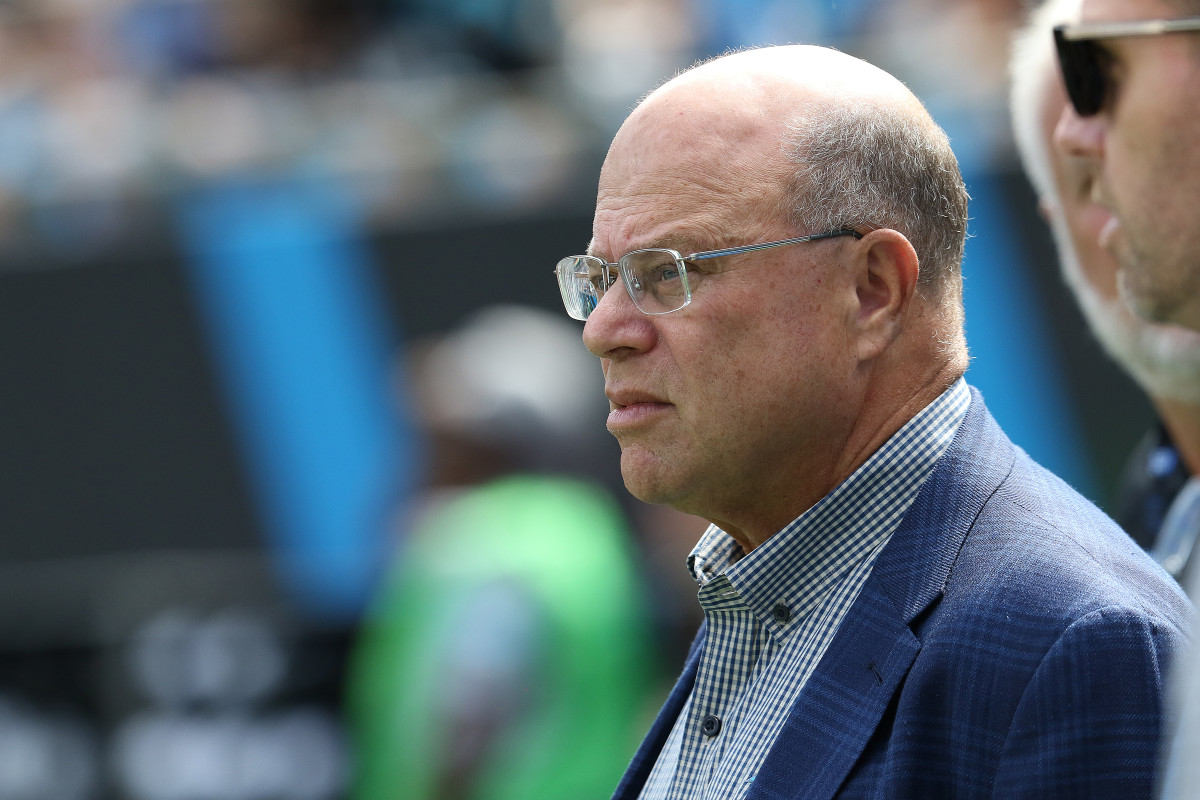

Jacob Kupferman/Getty

One hedge fund likes AMD more than Nvidia

With Nvidia consistently in complete focus, even when shares are slumping, some may find it hard to consider an AI sector in which it isn’t the dominant leader.

But with competition for its place as the leading chipmaker consistently increasing, some experts are shifting focus to other companies that threaten Nvidia’s market share.

Related: Nvidia is shipping a lot of AI chips to some unexpected companies

David Tepper, founder of prominent hedge fund Appaloosa Management, seems to view Advanced Micro Devices (AMD) as a likely Nvidia challenger.

According to data cited by Insider Monkey, his fund holds a $186.23 million stake in the rival chipmaker, which has been trending downward lately.

Given their similar chips, it makes sense that AMD would be considered a likely Nvidia challenger.

Both companies produce graphics processing units (GPUs), powerful AI chips that, due to their parallel processing abilities, power large language models (LLMs) and perform other machine learning tasks.

While AMD is better known for producing general-purpose central processing units (CPUs), Nvidia reentered this field in 2021 with the introduction of the Nvidia Grace processor after being mostly focused on GPUs.

Related: Fintech startup is helping people invest in SpaceX

CPUs are often used in powering data centers, a niche that has helped AMD build a list of clients, including Meta Platforms (META) , Google (GOOGL) , and Microsoft (MSFT) .

“Advanced Micro Devices [] is already recording strong demand for its data center chips, Insider Monkey reports. “Meta Platforms acquired 1.5 million units of its EPYC computer processor, contributing to a 122% increase in data center segment revenue in the third quarter. The unit now accounts for about half of the company’s total revenues.”

The outlet also notes that AMD is focused on expanding its AI endeavors in 2025, as evidenced by its recent $4.9 billion acquisition of server building company ZT Systems, which is expected to close in the first half of 2025. It also adds that currently, 107 hedge funds hold positions in AMD stock.

More Tech Stocks:

- New trade war with China could be a major blow to top tech stocks

- UnitedHealthcare spotlight reveals pivotal AI failure

- Tesla robotaxis are coming in 2025 with an unexpected addition

AMD ranks among Tepper’s top ten stock picks going into 2025, a ranking based on Appaloosa's portfolio and the size of the fund’s investment in each company.

This list includes Magnificent 7 favorites such as Meta, Microsoft, and Amazon but not Nvidia.

Experts may embrace AI stocks outside of Nvidia

If one leading hedge fund president is bullish on AMD stock as a likely AI winner, it raises a key question: will this trend persist?

Eddie Pan, an investment writer and author of the Hedge Vision newsletter, shared his insights with TheStreet, discussing institutional sentiment toward AI stocks outside of Nvidia.

According to his observations, institutional investors generally don’t seem to be embracing AI stocks outside of Nvidia yet.

That said, he does highlight similar trends, noting, “Hedge funds like Philippe Laffont’s Coatue have increasingly turned positive on AI infrastructure stocks geared toward electricity, such as Constellation Energy (CEG) and GE Vernova (GEV) .”

Related: Broadcom CEO sounds alarm on crucial shift in AI-chip market

Pan adds that Laffont also owns Broadcom (AVGO) , a fellow chipmaker that experts such as TheStreet Pro’s Ed Ponsi predict could threaten Nvidia in the coming year, especially as the market appears to be shifting toward Broadcom’s custom silicon chips.

Ponsi describes it as having strong potential to become “not just a market leader, but the one stock that must be owned” in 2025.

Another example of a hedge fund leader turning to AI stocks beyond Nvidia that Pan highlights is Stanley Druckenmiller, who holds positions in chipmaker Coherent (COHR) and equipment manufacturer Woodward (WWD) .

“The AI revolution is still in its early stages,” he states. “There are many more companies besides NVDA that are set to benefit from it.”

Related: The 10 best investing books (according to stock market pros)