The S&P 500 (SPY) violently broke below the 200 day moving average on Monday and now has stayed below for a 2nd straight session.

This begs the obvious question; Are we headed towards a bear market?

I will share my answer to that vital question, and what that means for our trading plan in today’s Reitmeister Total Return commentary

Market Outlook

Here is the current chart of the S&P 500 showing the break below the 200 day moving average on Monday.

(Yellow = 50 Day Moving Average / Orange = 100 Day MA / Red = 200 Day MA)

So is this the next bear market?

Short answer = maybe

And here is the more complete answer.

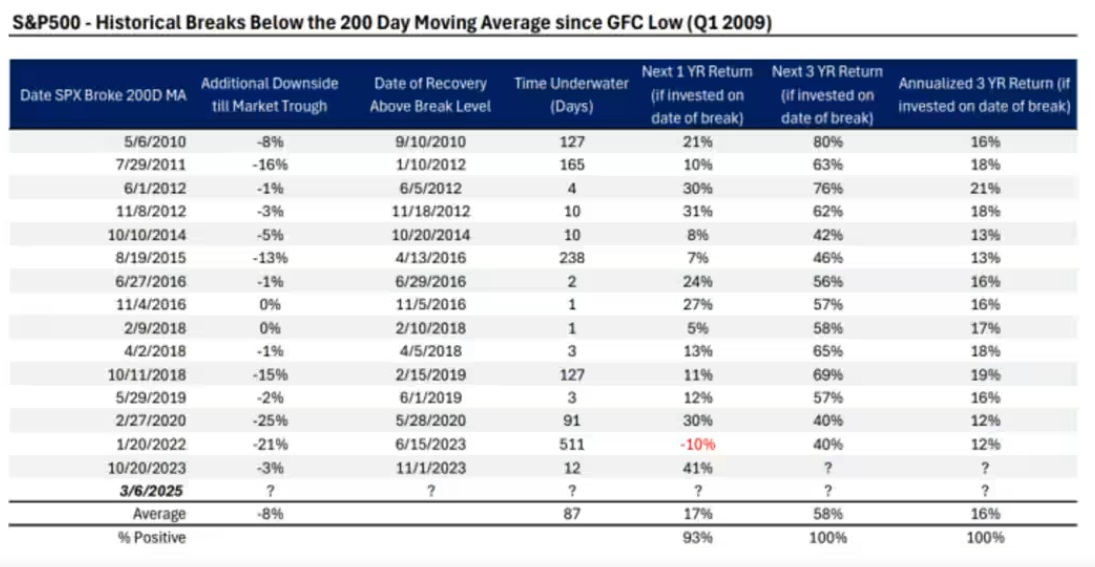

We have long been told that a break below the 200 day moving average is a serious problem for the stock market. So I did some research today to find out how often a break below this key level foreshadows a new bear market. That led me to the following vital information:

First, we find that only 2 of the last 15 breaks below the 200 day moving average resulted in a bear market. That provides a big sigh of relief because I thought it was going to be worse than that with higher probability of a bear on the prowl.

Second, the key is how long you stay under the 200 day moving average. It appears that most resolve within 2 weeks with a break back above this key level.

However, the longer stocks stay below...the more it increases the odds of a lot more downside to come.

2 times it became a full blown bear market (2020 & 2022). But another 3 times it went down a lot more and ALMOST became bear markets (2011, 2015, 2018).

Meaning that 5 out of 15 times it paid to get more defensive as stocks had a lot more downside action following the 200 day breakdown.

So what will happen this time around?

I could make a convincing case for both bull or bear...and thus am prepared for either outcome.

My gut tells me that few Presidents are more aware of the stock market than Trump given how many times he talked about the height of the market during his first administration. Thus, I think he will either soften his tone on tariffs and/or start talking more about tax cuts as a means to settle the nerves of investors.

As shared in other recent commentary, it is hard to be a bear when tax cuts may soon be on the way. That is especially true if the tax cuts are for corporations given this chain reaction:

Lower corporate taxes > higher EPS > higher stock prices

That certainly was the case when this was last served up back in 2017 and the S&P 500 rallied +19.42% on the year. I would expect it would be equally beneficial this time around.

At this stage the odds point to this being no more than a well deserved correction after 2 years of tremendous gains. Likely we soon will hit a point of capitulation with a lasting bounce to follow

On top of that we find that in recent days the S&P 500 and tech heavy Nasdaq are down the most with small caps outperforming. That flies in the face of a traditional Risk Off market where smaller stocks fall much more than their larger counterparts.

As pointed out, too many times to count, the large caps have topped their smaller peers for 4 years in a row. In particular, the Mag 7 stocks, which got overinflated. TSLA being the poster child for this irrational exuberance.

So a lot of the recent action is about letting some air out of that balloon with the PE for Mega Caps down to 26 from a previous 32. Still high...but more palatable.

On top of that you have all large caps now closer to 20 PE and small and mid caps a quite appealing 15.

As long as the economy avoids recession and investors become reacquainted with Trumps unique style of implementing policy (like tariffs)...then we should soon bounce back above the 200 day moving average putting bear market fears to rest.

In that case, we will put more of our cash stock pile to use in the most attractive POWR Ratings stocks for the next leg higher.

On the other hand, if things keep devolving (staying under 200 day too long and/or increased odds of recession) then we will prepare for bear market. That includes selling off more of our aggressive positions to first raise cash...then redeploy into inverse ETFs to make more money as the bear market takes hold and stocks trend much lower.

Remember the average bear market equates to a 34% drop from previous top to bottom. If that were the case now, we would be talking about retreating to about 4,000. Meaning we would not be too late to the party to take action.

This is definitely one of the more confusing times for investors in recent memory. Gladly having helpful stats like the chart shown above has us not be too overreactive to the recent break below the 200 day moving average.

However, it does very much have us on high alert that things could get worse...as in devolve into the next bear market.

Long story short, my eyes are wide open to either possibility unfolding and ready to act. Hopefully this commentary has you at the ready as well.

What To Do Next?

Check out my portfolio with hand selected picks for the current market environment:

- 8 stocks to buy

- 1 stock to short

- 1 ETF to buy

All the stocks have been selected using the proven outperformance that comes from our POWR Ratings stock selection model which has done 4X better than the S&P 500 since 1999.

Now add in my 44 years of investing experience seeing bull markets...bear markets...and everything between. This helps me pick the right stocks for the current environment.

If you are curious to learn more, and want to see my current 10 recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Recommendations >

Wishing you a world of investment success!

SPY shares were trading at $557.01 per share on Tuesday afternoon, down $3.57 (-0.64%). Year-to-date, SPY has declined -4.96%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Has the Next Bear Market Already Arrived? StockNews.com