According to the latest data published by Cox Automotive and Kelley Blue Book, Tesla (TSLA) has a wide margin as the leader in U.S. EV sales, holding steady with 48.2% of the market share. However, the brands that make up the Detroit mainstay General Motors GM are in a distant but well-fought second place, with a solid 9.4%.

Though it may not sound like much, it is a feat worth noting for an automaker that has made a huge shift in its EV strategy to adapt to market conditions.

Related: General Motors suffers from back-to-back recalls in consecutive days

During an appearance at the Deutsche Bank Global Auto Conference on June 11, GM CFO Paul Jacobson cited slower market penetration as the reason for scaling back the Detroit giant's production forecast by a whopping 50,000 vehicles, reducing its previous forecast of about 300,000 EVs to between 200,000 and 250,000 EVs by the end of 2024.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

"We don't want to end up in a position where we give out a production target and then we just blindly produce and end up with hundreds of thousands of vehicles in inventory because the market's just not there yet," Jacobson said at the time.

"We think that this is a really good blend of being able to drive the scale benefits that we need but still not get crazy with inventory levels, such that we have to start engaging in deep discounting to where customers who have already bought one start to see their residual values suffer."

GM's preventative actions continue even in good times.

Despite reporting positive earnings during the third quarter of 2024, General Motors is dramatically reducing its worldwide headcount.

According to reports by Automotive News and CNBC, on November 15, over 1,000 people across General Motors' worldwide operations were impacted by layoffs, with most affected in North America.

Related: Jeep has a major problem that its factory workers will pay for

A source who spoke to AutoNews noted that the layoffs were conducted to streamline GM's operations and that many of the layoffs impact GM employees who report to the automaker's Global Technical Center in Warren, Michigan. GM touts this design and engineering facility as "the preeminent innovation center for automotive engineering, design, and advanced technology."

A separate source who spoke to CNBC says that the layoffs were conducted to identify and release employees displaying poor performance, while others were laid off following a review to reorganize the automaker's priorities.

“In order to win in this competitive market, we need to optimize for speed and excellence,” GM spokesperson Kevin Kelly said. “This includes operating with efficiency, ensuring we have the right team structure, and focusing on our top priorities as a business. As part of this continuous effort, we’ve made a small number of team reductions. We are grateful to those who helped establish a strong foundation that positions GM to lead in the industry moving forward.”

Political turmoil is sounding EV industry alarm bells

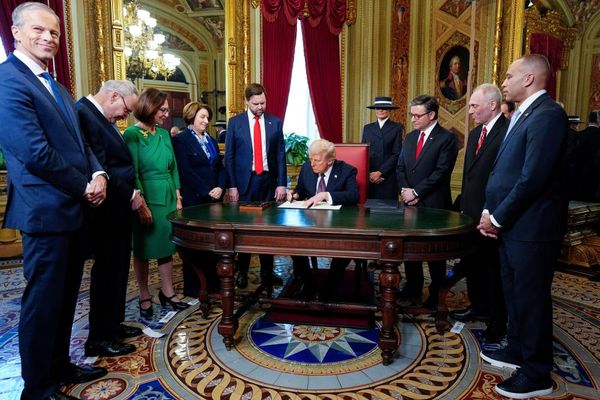

The cuts from GM's innovation center come as the upcoming Trump Administration reveals plans to turn the fate of the future of the American auto industry upside down and inside out as soon as the President-elect is sworn in on the steps of the Capitol.

Related: Honda's reputation is threatened by big problem

According to a report by Reuters, Trump's transition team plans to kill the $7,500 tax credit supported by the Inflation Reduction Act signed during the Biden administration. The tax credit, which was initiated through legislation that garnered zero Republican votes in both houses of Congress, is expected to be killed as part of a larger tax-reform legislation agenda.

Despite its negative implications for automakers like General Motors, Ford (F) , Rivian (RIVN) , and even Tesla (TSLA) , Tesla CEO and Trump's "first buddy" Elon Musk is a fan of this move. Earlier this summer, he told Wells Fargo analyst Colin Langan during Tesla's Q2 2024 earnings call that he is not worried about the potential IRA cut because he believes Tesla is more than just EVs.

"I guess that there would be like some impact, but I think it would be devastating for our competitors and for Tesla slightly," Musk said back in July. "But long term, probably actually helps Tesla, would be my guess, yes. But as I said this before in earning calls, it -- the value of Tesla overwhelmingly is autonomy. These other things are, I think, no way it's relative to autonomy."

"So I recommend anyone who doesn't believe that Tesla would solve vehicle autonomy should not hold Tesla stock. They should sell their Tesla stock. If you believe Tesla will solve autonomy, you should buy Tesla stock. And all these other questions are in the noise."

In an August 19 interview with Reuters, Trump signaled his intent to make this move, saying that eliminating the tax incentives would help drive market-facing "fairness."

More Business of EVs:

- Bentley's first foray into EVs will debut in 2026

- Trump’s EPA pick Lee Zeldin is the EV industry’s worst nightmare

- Toyota exec slams "impossible" EV mandate amidst political chaos

"Well, we are looking at [EV tax credits], that is a big thing, but you know tax credits and tax incentives are not generally a good thing," Trump told Reuters back in August.

"I am not making any final decisions. I am a big fan of electric cars, but I am a fan of gasoline-propelled cars and also hybrids, and whatever else happens to come along. And you can't mandate that you can only buy an electric car."

The Alliance for Automotive Innovation, a trade group representing GM, Ford, and other automakers, decried this possibility in a letter sent to Congress on October 15. In it, the group begs lawmakers to keep them, calling them “critical to cementing the U.S. as a global leader in the future of automotive technology and manufacturing.”

In reaction to the Trump transition team's announcement, U.S. Energy Secretary Jennifer Granholm told reporters at the COP29 climate conference in Baku, Azerbaijan, on November 15 that such a move would give up the EV game and reverse the "good work" that has already been done.

“It would be so counterproductive,” Granholm said. “You eliminate these credits, and what do you do? You end up ceding the territory to other countries, particularly China.”

Related: Veteran fund manager sees world of pain coming for stocks