After a harsh end to the first quarter on Thursday, GameStop (GME) stole the headlines after the close. That’s when the company announced that it plans to split its stock.

Specifically, management wants to increase its share count to 1 billion shares, up from 300 million.

As TheStreet reported earlier: “GameStop did not provide further details. The company does not for example spell out the mechanism of this split, like the ratio, in the form of a stock dividend.”

GameStop stock was up as much as 14% in Friday’s regular session and 22.5% in last night’s after-hours session. Now though, the stock is up just 2.5% on the day.

Apple (AAPL), Tesla (TSLA) and a few others have been on a tear, but many investors didn’t expect GameStop to be on that list as well. I know I didn't!

From the low on March 14, GameStop stock rallied in 10 straight sessions and registered a 157% rally from the low to this week’s high. Since topping out, the stock has been wobbling, but continues to hold a key support area.

Will that remain true following this stock split news?

Trading GameStop Stock

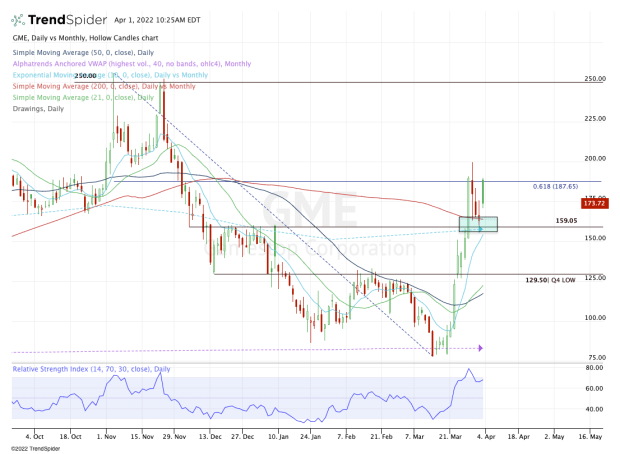

Chart courtesy of TrendSpider.com

Looking at the daily chart, GameStop stock did a great job punching through the fourth-quarter low and prior resistance area near $130. Then it quickly reclaimed the $159 to $160 area.

This was meaningful, as there are multiple key levels in this area. They include the 10-month and 200-day moving averages, as well as a key resistance level in December.

After rallying to the 61.8% retracement, GameStop couldn’t push higher without a rest. That’s the same measure that’s acting as resistance for Friday’s rally.

That leaves us with a focus on two zones: $190 (the 61.8% retracement) on the upside and $160 on the downside.

If shares can push through the $190 resistance area, it puts this week’s high in play near $200. Above $200 opens the door to the $217.50 level, followed by $250 resistance.

Bears would be astounded by that move, but it’s what the technicals say when you move from level to level.

On the downside, it’s fairly obvious why the $160 area is key. There we have recent support, as well as the 10-day, 10-month and 200-day moving averages.

To lose this area puts the $130 area back in play.