What you need to know

- NVIDIA CEO Jensen Huang assures fair allocation, but former AMD exec Scott Herkelmen suggests NVIDIA may delay shipments if it suspects simultaneous deals with rival companies.

- The CEO of AI startup Groq expressed their own concerns and those of similar companies over potential delays if not aligned with NVIDIA.

- Despite allegations, NVIDIA's dominant position in AI remains driven by its trillion-dollar valuation and leading data center GPUs.

A recent report by the Wall Street Journal dove into NVIDIA's enormous position in the AI market through its various data center GPU (graphics card) hardware and closed-source CUDA software platform. Still, the most intriguing revelation, as spotted by Tom's Hardware, comes from rival companies claiming that customers are "fearful of being punished" if they make simultaneous deals with opposing firms.

This contrasts with NVIDIA CEO Jensen Huang's previous comments highlighted by Fortune during its Q4 earnings call: "We allocate fairly. We do the best we can to allocate fairly, and to avoid allocating unnecessarily." Deciding who gets priority access to the latest NVIDIA GPUs, whether OEMs or hardware resellers, can't be an easy task, but the company insisted that it doesn't allow favoritism to influence distribution.

Ex-AMD boss accuses NVIDIA of foul play

The former Radeon Senior Vice President at AMD, Scott Herkelmen, responded to Tom's Hardware via social media to suggest that NVIDIA's attitude and behavior toward customers are negatively affected if suspected rival brands are involved in simultaneous deals: "This happens more than you expect .. (NVIDIA) just don't ship after a customer has ordered."

This happens more than you expect, NVIDIA does this with DC customers, OEMs, AIBs, press, and resellers. They learned from GPP to not put it into writing. They just don't ship after a customer has ordered. They are the GPU cartel and they control all supply.February 27, 2024

Herkelmen references the now-defunct GeForce Partnership Program and its controversial implication that NVIDIA might have restricted consumer-grade GPU distribution if partners refused to sign up. However, this implied tactic was never explicitly stated in writing, but a combination of rumors and adverse reactions led to NVIDIA canceling the program, resonating with recent fears expressed by AI chip manufacturers.

AI chipmakers avoiding deals with NVIDIA's rivals

CEO of AI startup company Groq, Jonathan Ross, has reignited the rumor of underhanded tactics supposedly employed by NVIDIA in his comments to the Wall Street Journal: "A lot of people that we meet with say that if Nvidia were to hear that we were meeting, they would disavow it." If budding artificial intelligence hardware manufacturers fear seeking alternative designs to NVIDIA's market-leading AI hardware, it echoes sentiments felt by the consumer-level customers during the GeForce Partnership Program controversy that any orders placed with the company could be withheld without explanation.

Ross continues: "The problem is you have to pay Nvidia a year in advance, and you may get your hardware in a year or it may take longer."

Although there's no real implication of NVIDIA outright canceling orders or turning customers away, he explains that the fear is about artificial or inflated delays: "Aw shucks, you're buying from someone else and I guess it's going to take a little longer." If the allegations hold any weight, as the comments made by ex-AMD staff seem to corroborate, it puts practically every other AI chipmaker in a tough place against NVIDIA as the absolute dominating force.

Is NVIDIA using unfair tactics to win the AI war?

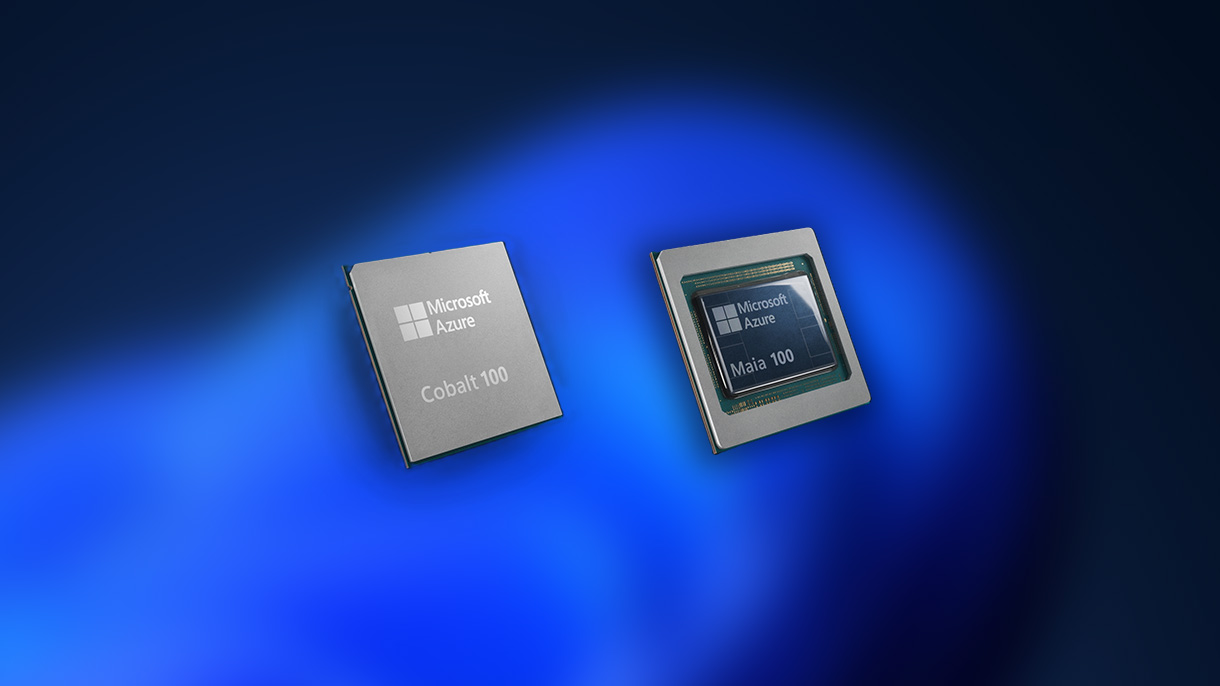

While giants like NVIDIA and AMD are often at the forefront of GPU-centric hardware, moves into self-made AI manufacturing are becoming more common as Microsoft recently partnered with Intel on its own Arm processors for AI and computing workloads. Still, it's impossible to deny NVIDIA's position, ranking as the clear leader with its A100, H100, and GH200 data center GPUs contributing to its trillion-dollar valuation thanks to ubiquitous adoption across the industry.

Microsoft is still the world's most valuable company, and its move into custom-made chips could shift NVIDIA's dominance. Still, dethroning the monopolistic champion will undoubtedly be a slow process, and rumors of underhanded strongarm tactics from NVIDIA don't come as much of a surprise. Whether it's part of a strategy to remain on top or hints of a deeply rooted problem remains to be seen, and without concrete proof, there's nothing seriously affecting NVIDIA's continued success in AI yet.