The world of road cycling is no stranger to innovation. Over the years, we’ve seen the rise of aerodynamic frame designs, the widespread adoption of disc brakes, and the seamless integration of electronic shifting. Each advancement has promised to make our rides faster, lighter, and more enjoyable. But over the last couple of years, some would argue that there has been somewhat of a stagnation, at least in bike design, with many two-wheeled racing machines starting to appear a little samey. So what is the next big thing for the cycling industry, and will it even be focused on our bikes themselves?

The truth is, when you look at the various patents from the sports big brands, and take a deep dive into technology on the horizon, there is plenty to look forward to. From weight-saving revolutions to cutting-edge data integration, the future of road cycling is packed with exciting developments.

Here’s a look at the trends and technologies poised to shape the next chapter of the sport.

Lower weight for everyone, not just the pros

For years, the buzzword in road bike design has been “aero.” But as engineers refine these wind-cheating machines, a familiar obsession is creeping back into the spotlight: weight.

Take the new Scott Addict RC, for example. At an astonishing 5.9kg, it’s well below the UCI’s 6.8kg minimum weight limit - yet reportedly only 9 watts slower than its aero sibling. Advances in materials science and carbon layups are enabling engineers to trim grams without sacrificing stiffness or performance. While UCI regulations continue to enforce the weight limit in professional racing, sub-limit bikes are already finding favor with everyday riders. After all, lighter bikes climb effortlessly, feel nimble, and bring a sense of joy to every pedal stroke.

The question is: will enough consumer demand push the UCI to reconsider its rules? Whether or not professional racers adopt these featherweights, the trend signals a broader shift. For the everyday rider, the featherweight revolution promises bikes that are not just functional but genuinely fun to ride.

An important point too, is what this means for second and third-tier framesets - you know, the ones most of us can actually afford. While range toppers shout their UCI rule-breaking weights from the hill-tops, the midrange bikes are often left behind, and crucially, often end up weighing more than our rim brake bikes of old which can be found so cheaply on the second-hand market. But as technology trickles down and manufacturing technologies are refined and scaled up, it will start to have a real impact on some of our favourite bikes next year.

The rise of Chinese brands

The global cycling industry is experiencing a shake-up, with lesser-known brands making their way onto the WorldTour stage. Take the most recent example, X-Lab, a high-performance sub-brand of Chinese manufacturer XDS Carbon-Tech, which recently became a bike sponsor for Astana Qazaqstan.

X-Lab’s aero-focused AD9 and lightweight RS9 bikes have been tested in the Silverstone Wind Tunnel and boast performance claims rivaling established names. Built with ultra-high modulus Toray T1100 carbon - the same material used in Pinarello’s Dogma F - these bikes are engineered for both speed and climbing prowess.

Why now? It’s a combination of strategic marketing and technological capability. With Shenzhen - a global hub for bike manufacturing - backing XDS, the brand is leveraging top-tier racing to establish credibility and reach a wider audience. And X-Lab is unlikely to be the last new entrant. As established players face financial challenges, expect more emerging brands to seize the opportunity to redefine the market.

Many people have their reservations about whether brands like XDS can really challenge the big players in the industry, but I really think they can. The “made in China” stigma once symbolized cheap, low-quality goods, but those days are largely over. While platforms like Temu and AliExpress perpetuate uncertainty around Chinese carbon fiber products, dismissing all Chinese brands is unfair. As of 2022, China leads global carbon fiber production with 43% market share, driven by cutting-edge manufacturing hubs like Shenzhen. These facilities can produce world-class bikes given sufficient funding and expertise.

Brands like Specialized outshine competitors not because of superior production but due to larger budgets that enable on-site engineers, tighter quality control, and faster design iterations. Emerging Chinese brands like XDS Carbon Tech may lack experience but are poised to grow rapidly with the right resources. The question isn’t if Chinese brands will challenge industry giants, but when.

More data

As cycling continues its transformation into a data-driven sport, two areas stand out: glucose monitoring and aerodynamic analysis.

Real-time glucose monitoring, like the non-invasive devices being developed by Afon Technology, could revolutionize how riders fuel during efforts. While current systems are banned in competition, wearable options could sidestep these restrictions, offering insights that help optimize performance on the fly.

On the aerodynamic front, technologies like Body Rocket are bringing wind tunnel-level insights to everyday rides. By measuring drag in real time, these systems enable riders to fine-tune their positions and equipment without costly lab visits. Combined with innovations like Wahoo’s wind-sensing Elemnt Ace, these tools are pushing the boundaries of what’s possible in cycling analytics.

The challenge for governing bodies like the UCI will be balancing technological progress with fair competition. As data becomes increasingly integral to the sport, it’s clear that cycling is on the cusp of a new era.

Big developments from SRAM

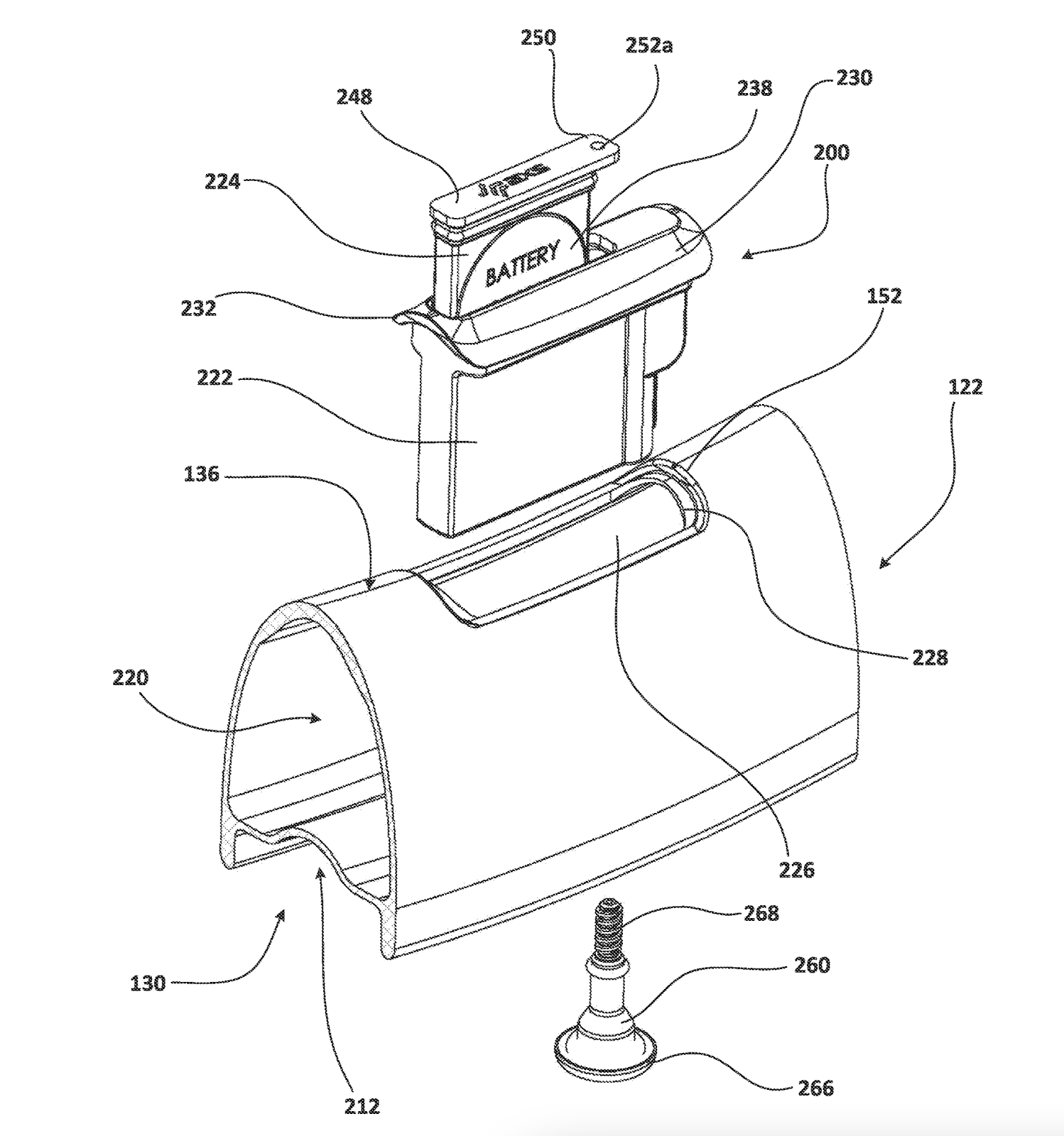

Rumours suggest that SRAM has something big in store for 2025. While a new Force groupset seems unlikely, the company’s recently filed patent hints at a groundbreaking innovation: in-rim sensors.

This smart wheel accessory promises real-time data on tyre pressure, wheel speed, odometer readings, and more. Unlike current external sensors, the in-rim design minimizes aerodynamic drag. Imagine receiving live alerts about slow punctures or rim defects, or tracking yaw angles to optimize your position. Such a system could revolutionize both product development and rider experience.

If SRAM moves forward with this technology, it may debut alongside new Zipp carbon wheels. While it might not adjust tyre pressure mid-ride like some competing systems, the potential for increased precision and performance is enormous. This is one space to watch closely.

'System efficiency' - yawn or yay?

Now then, this one falls under two camps. System efficiency is both something we should be excited about as consumers, but also perhaps a warning to the next generation of marketing spiel to come.

As road bike design matures, the differences between top-tier frames are becoming increasingly marginal. So, where do brands go from here? The answer lies in system efficiency.

Rather than chasing isolated gains, manufacturers are focusing on optimizing the bike as a complete package. This means integrating components like wheels, handlebars, tyres, and drivetrains to work together seamlessly. Expect to see innovations like custom tyre profiles, redesigned handlebars, and wheelsets tailored to specific frames.

While claims of incremental speed gains can often feel like marketing hype, the move toward system efficiency offers a genuine opportunity to make bikes faster, more cohesive, and ultimately more enjoyable to ride. It’s a shift from fragmented upgrades to holistic improvements - and one that promises to redefine the cycling experience.

This is certainly all well and good, but these claims are to be taken with a pinch of salt. Overall efficiency of a given system, particularly when we are talking aerodynamics, is impossible to apply to any rider. Narrower shoulders, wider legs, or even just a different hand positions can all change a system drastically. System efficiency will make us all faster, but can't always be taken as gospel.

The return of mechanical groupsets?

While electronic groupsets continue to dominate the high-end market, mechanical shifting is making a surprising comeback - particularly at more affordable price points. The reasoning is simple: cost.

Consider the new Pinarello F1. By using a mechanical groupset, the prestigious brand has managed to release a bike priced around £3,000, making high-end performance accessible to a broader audience. Shimano’s upcoming Cues system, which promises streamlined compatibility and smart gear combinations, could further disrupt the market by bringing modern innovations to budget-conscious riders.

This trend highlights a critical reality: not every advancement needs to be high-tech. For cyclists who value simplicity and reliability, mechanical groupsets remain a practical and attractive option. Sometimes, progress means revisiting the basics.