Ford Motor (F) -) and General Motors (GM) -) shares edged lower Monday after the United Auto Workers Union rejected pay deals from the Big Three U.S. carmakers and warned of strike action as early as next week if a deal isn't reached.

UAW President Shawn Fain described the highest of the three pay offers — a 14.5% increase spread over four years from Chrysler owner Stellantis (STLA) -) — as "deeply inadequate." He vowed to bring cost-of-living adjustments, tied to inflation, back to the bargaining table as a result.

Automakers are offering inflation-protection payments valued between $10,500 and $12,000 over the next four years, but have rejected the notion of cost-of-living adjustments on an ongoing basis.

Last week, Ford offered a 9% pay increase, with General Motors offering 10%. The UAW has set out targets including a 46% increase in wages, cost-of-living adjustments, defined benefit pension plans for new hires and the end of tiered wage structures.

Stellantis said Monday it would make a new counterproposal to the UAW, telling employees in a companywide email that it remains "committed to reaching a tentative agreement without a work stoppage that would negatively impact our employees and our customers."

"We are ready to negotiate in Detroit 24/7, just as we have been for the past seven weeks since we gave them our Members Demands," UAW president Fain said in a statement. "Despite receiving no response for over a month, when the CEOs are ready to make a serious offer we'll be there, day or night."

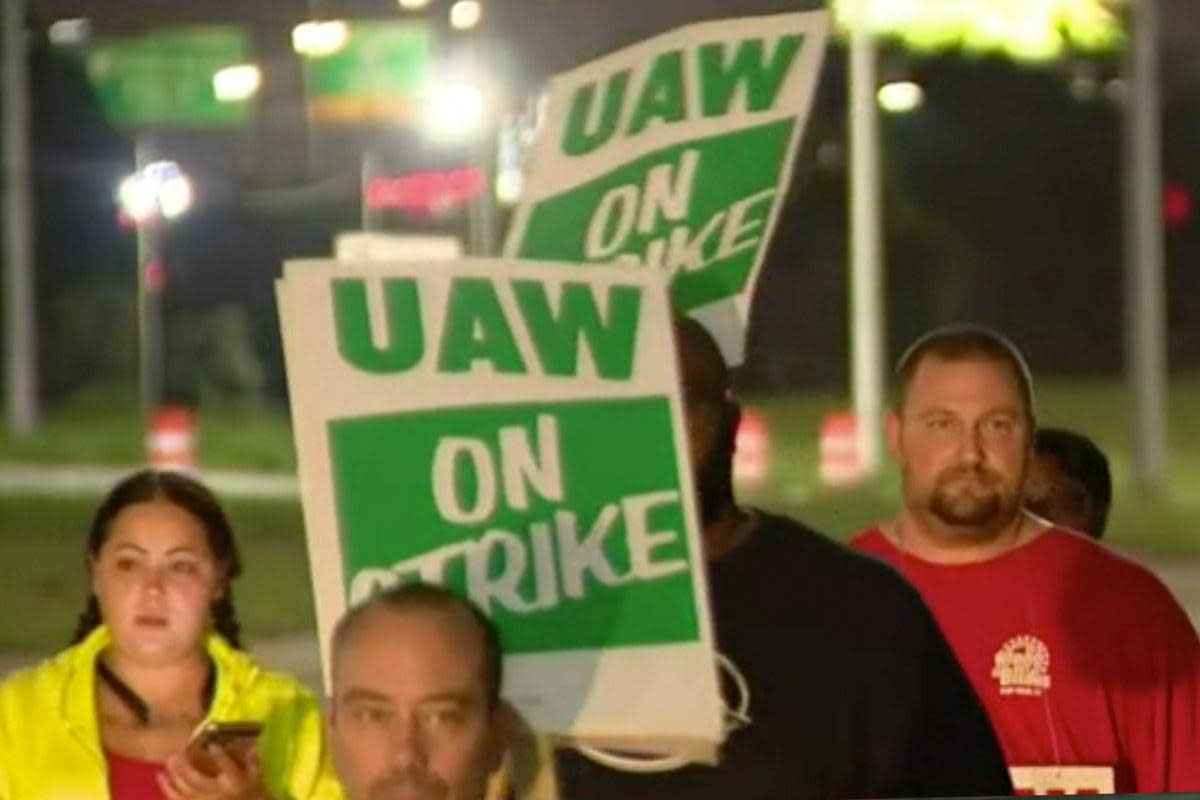

UAW votes overwhelmingly in favor of strike

Last month, The UAW said its members who work at GM, Ford and Stellantis voted 97% in favor of strike action amid what Fain called "slow going" talks with company management. The negotiations began in early July.

The current contract, which was reached in 2019, expires at one minute to midnight on Thursday, Sept. 21.

Ford shares were marked 1.02% lower in early afternoon trading on Monday and changing hands at $12.18 each. GM shares, meanwhile, slipped 0.7% to $32.72 each.

Anderson Economic Group, the Lansing, Mich., consultancy, published a weekend report suggesting that even a 10-day strike could cost the U.S. economy around $5.6 billion and tip the economy of the state of Michigan itself into recession.

“If we were to have a long strike in 2023, the state of Michigan and parts of the Midwest would go into a recession,” said CEO Patrick Anderson. “When GM workers went on strike in 2019, you saw gross state product drop in Michigan in the fourth quarter, while in the rest of the country it was largely unaffected."

"That won’t be the case this time if the UAW goes through on its threat to strike all three companies.” he added.

- Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.