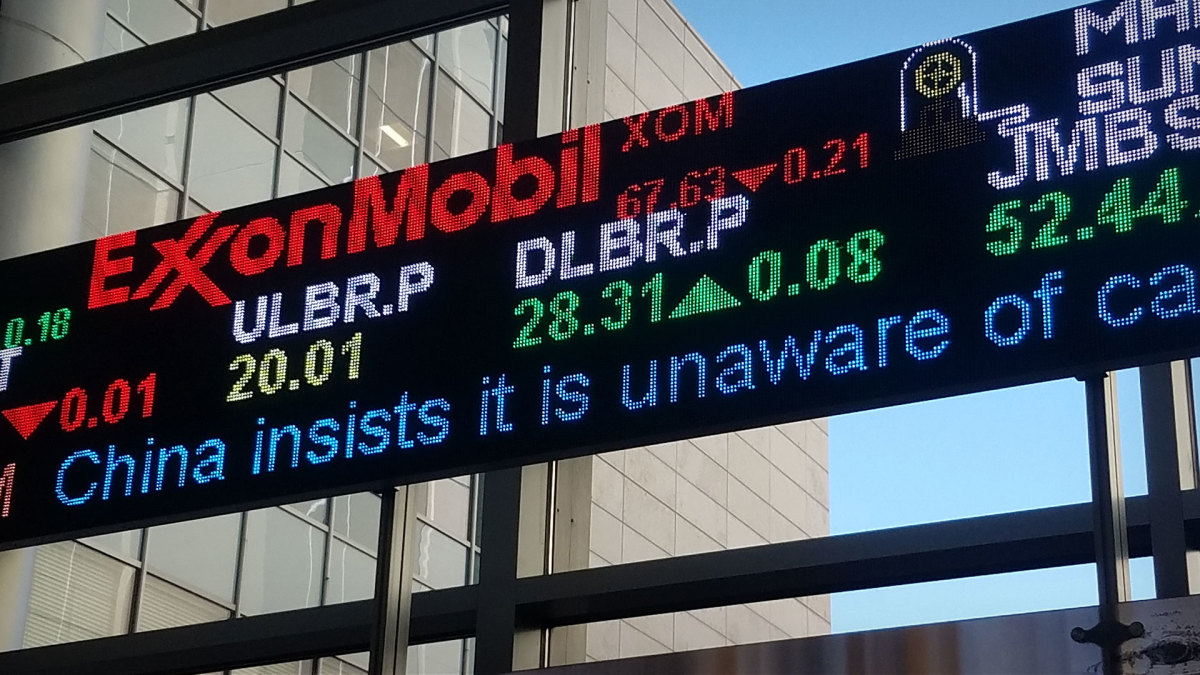

Exxon Mobil (XOM) -) shares moved lower in pre-market trading, tracking the biggest pullback in global crude prices in several months, as it forecast healthy overall profits for the third quarter.

In a Securities and Exchange Commission filing published late Wednesday, Exxon said it sees operating profits for the three months ending in September in the region of $8.3 billion to $11.4 billion. Around half of that, or $5.2 billion to $6.7 billion, will come from the group's main oil and gas business, Exxon said.

That's largely in-line with analysts' forecasts and firmly ahead of the group's $7.9 billion second quarter tally, thanks in part to a surge in global oil prices that has lifted WTI crude, the U.S. pricing benchmark, more than 28.5% over the third quarter.

The move was in part linked to a coordinated effort by Saudi Arabia, the lead producer in OPEC, and the cartel's main non-member ally Russia to limit global output in an effort to maintain higher prices over the second half of the year.

Crude prices were hammered in yesterday's session, however, with Brent prices, the global benchmark, falling more than $5 a barrel amid concerns over muted global demand and a pending recession in Europe.

Exxon is expected to post its formal third quarter earnings report on November 3

Exxon shares, which hit an all-time high of $120.70 on September 27, were marked 1.17% lower in pre-market trading to indicate an opening bell price of $110.19 each.

- Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.