In a surprise turn of events, Tesla (TSLA) CEO Elon Musk reversed course on a dire warning regarding Chinese automakers he made earlier this year.

In an appearance at the VivaTech conference in Paris via videoconference on May 23, Musk revealed that he was against the newly rolled out tariffs implemented by the Biden administration; declaring that he's against any measures that "distort the market."

Related: Stellantis CEO has stern warning about Chinese EV tariffs, as China plans retaliation

"Neither Tesla nor I asked for these tariffs, in fact I was surprised when they were announced," Musk said. "Things that inhibit freedom of exchange or distort the market are not good."

“Tesla competes quite well in the market in China with no tariffs and no deferential support. I’m in favor of no tariffs."

Musk's about-face

The latest comments by Musk are an about-face to prior statements he made about Chinese automakers in the past, when he claimed they would bring doom to the industry as a whole.

During Tesla's Q4 earnings call on Jan. 24, Elon Musk called Chinese car companies "the most competitive car companies in the world," and warned that they may be a problem if tariffs or any other protective measures aren't in place.

"I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established," Musk said. "Frankly, I think if there are not trade barriers established, they will pretty much demolish most other companies in the world."

CEOs of other auto giants agree

Musk is not alone in making these sort of statements about their Chinese competition, joining a number of CEOs in charge of other automotive household names.

In response to impending tariffs pending a June 5 deadline for a major EU probe into Chinese EVs, Ferrari CEO Benedetto Vigna stopped short of calling the competition between European automakers and its Chinese counterparts a "war," during an appearance on Bloomberg TV. He noted that the presence of Chinese vehicles on European soil should motivate automakers to produce better cars than their Eastern competition.

Related: Ferrari CEO compares the Chinese EV challenge to Formula 1

"For me, this is a call to action for Europe. This is a call to action to become more [...] pushy, less complacent," Vigna told Bloomberg TV.

"In my life, I was told if someone is faster than you, better that you are faster than them. This is what we are doing in Formula 1. In racing, that's what you have to do; if someone is faster, be faster than them, don't try to stop them."

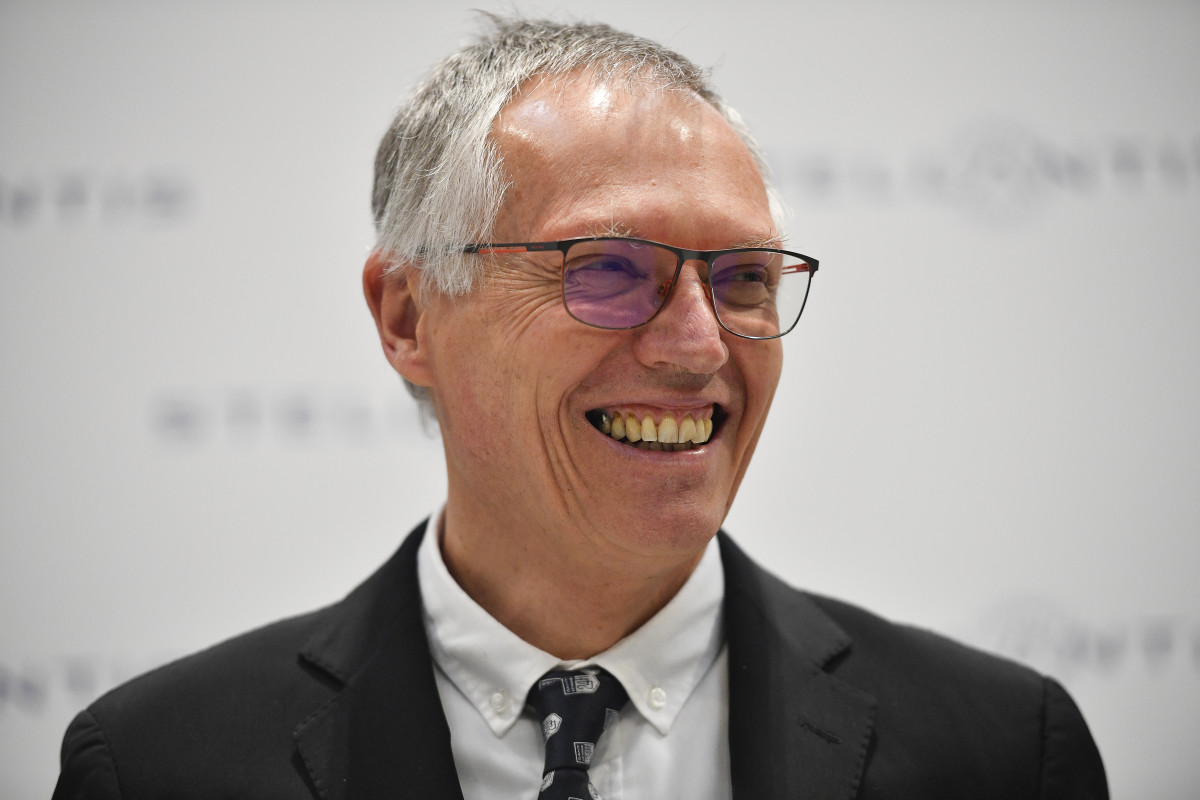

The Ferrari boss's comments are similar to those made by Mercedes-Benz CEO Ola Källenius. In a March 2024 interview with the Financial Times, he expressed support for lowering tariffs on Chinese EVs, supporting the idea that the impending levels of increased competition will challenge his European automaker contemporaries to make and sell higher quality cars.

“Don’t raise tariffs,” Källenius told the Financial Times. “I’m a contrarian, I think go the other way around: take the tariffs that we have and reduce them … that is the market economy. Let competition play out.”

Similarly, Stellantis CEO Carlos Tavares said in a recent interview with Reuters that impending tariffs against Chinese EV imports, including the one imposed by President Biden are a "a major trap for the countries that go on that path," noting that it would impede on an automaker's abilities to meet the price challenge faced by its new competition.

"When you fight against the competition to absorb 30% of cost competitiveness edge in favour of the Chinese, there are social consequences. But the governments, the governments of Europe, they don't want to face that reality right now," Tavares said.

Additionally, he warned that a "Darwinian Chinese-led price war" will end up adding costs across the automotive supply chain; which will end up being paid with higher prices faced by consumers.

"We are not talking about a Darwinian period, we are in it," Tavares said. "This is not going to be easy for the dealers. It's not going to be easy for the suppliers. It's not going to be easy for the OEMs. As we know in Europe, everybody is talking about change as long as change is for somebody else."

Does the Chinese market play a role in these CEO's statements?

When taken into full context, it should be noted that the statements made by the CEOs may come from a fear of retaliation by the Chinese, as they have their own business interests in China or with Chinese entities.

Tesla has a Gigafactory that pumps out Model Ys for the Chinese and greater Asian markets, and last month, Elon Musk travelled to Beijing to get tentative approval for a rollout of Tesla's Full Self-Driving (FSD) in the People's Republic — a visit that sent its stock soaring.

Stellantis currently owns 51% of Chinese EV manufacturer Leapmotor. Eight days before CEO Carlos Tavares called Chinese EV tariffs "a major trap," he was in China to announce that Leapmotor and Stellantis will be selling the former's T03 compact city car at an eye-watering price on European soil.

"We do not intend to leave the 20,000 euro price band of the market to our Chinese competitors," Tavares said. "You can expect the (Leapmotor) T03 would be priced below 20,000 euros in Europe".

China is also a huge market for Mercedes-Benz. Currently, the German luxury automaker is in a joint-venture with BAIC Motor to produce its A-Class, C-Class, E-Class sedans, EQC EV crossover, and GLA, GLB and GLC SUVs in the country.

According to the Mercedes-Benz Group's full year report for 2023, a large chunk of its sales came from the Chinese market. Its data shows that out of the 2,044,051 cars Mercedes sold worldwide throughout 2023, the United States bought 298,013 of them, while the Chinese have bought 737,226 — about a third of its worldwide figures.

More automotive stories:

- Maserati exec defends the use of a car feature drivers hate

- Feds are skeptical about the safety of popular driver-assist tech

- Young guys who like loud cars are likely to be psychopaths, study suggests

In a statement to TheStreet, AutoPacific President and Chief Analyst Ed Kim said that automotive CEOs will have to tread lightly with having an left-field opinion on the China tariffs issue, as it could jeopardize their ability to operate in the largest auto market.

"While many automakers are justifiably concerned about the competitive threat from China’s very advanced and attractively priced EVs, public expression of support for trade barriers against Chinese-made automobiles can cause unwanted friction with Chinese lawmakers at a time that they are trying to expand the scope of their businesses in China," Kim told TheStreet.

"Politics are always tricky to navigate, especially when a company has interests in rival markets. This is certainly the case for many automakers and perhaps even more so today at a time when Chinese automakers are building the high-tech and affordable EVs that many consumers around the world want that non-Chinese automakers are struggling to bring to market."

What are the effects?

In response to actions by President Joe Biden, as well as impending tariffs in the EU, Beijing is preparing itself to unleash retaliatory tariffs of 25% on imported vehicles with "large engines" exceeding 2.5 liters in response to President Biden's tax hike, a move that AutoForecast Solutions Global Vehicle Forecasting VP Sam Fiorani can see having adverse effects for automakers like General Motors and high-end brands like Rolls-Royce.

"The potential or retaliatory tariffs applied by China would price imports out of the market, and a surprising number of American and European plants make a significant profit on sales to China," Fiorani said in a statement to TheStreet. "While imports play a small but significant role in the financials of brands like Ferrari and Porsche, if China targeted domestic production of foreign brands, the impact could be near catastrophic for many automakers."

Fiorani points out that such a tariff would especially hurt high-end brands, whose order books are filled from cover to cover with vehicles designated to China. Given that many of these high-end luxury cars have engines vastly bigger than two and a half liters under their hoods, their already excessive price tags would only increase for the Chinese well-to-do.

"With no local production, high end brands rely on exports to China for a significant share of their revenue and profit," said Fiorani.

"About 10% of Ferrari’s global production is shipped to China while nearly half of Bentley’s sales are in China. Rolls-Royce, Lamborghini, and Maserati also rely on China for a considerable share of their sales. Porsche sold nearly one in four of its output last year in China, all of which were imported."

"Chinese buyers look to the West to flaunt their wealth. While some local brands are attempting to move into that space, there’s nothing quite like a Ferrari or Rolls-Royce for that immediate impact of conspicuous consumption."

Related: Veteran fund manager picks favorite stocks for 2024