Bitcoin was largely flat, while Dogecoin and Ethereum registered gains on Tuesday evening as the global cryptocurrency market cap remained mostly unchanged at $1 trillion at 9:01 p.m. EDT.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 0.06% | 1.8% | $20,493.44 |

| Ethereum (CRYPTO: ETH) | 1.15% | 7.8% | $1,588.40 |

| Dogecoin (CRYPTO: DOGE) | 14% | 125.4% | $0.14 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Dogecoin (DOGE) | +14% | $0.14 |

| Toncoin (TON) | 11% | $1.67 |

| Shiba Inu (SHIB) | +4.8% | $0.000013 |

See Also: 10 Best Robinhood Alternatives In 2022

Why It Matters: The apex coin managed to hold on to the $20,000 mark even as stocks closed in the red. The S&P 500 and Nasdaq were down 0.4% and 0.9% respectively intraday. Stock futures were seen flat at the time of writing.

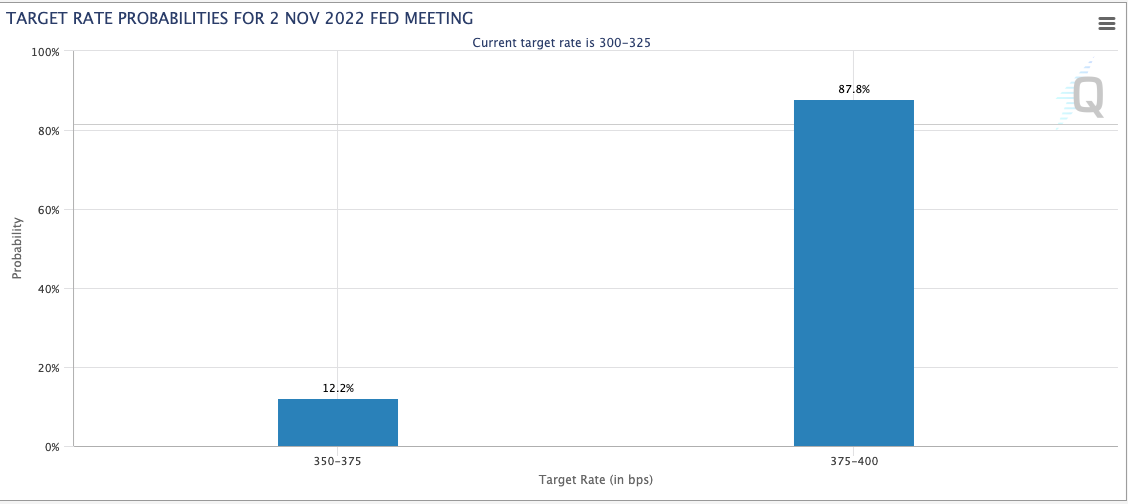

Investors are on the lookout for the U.S. Federal Reserve decision on interest rates, which is expected on Wednesday.

U.S. employment openings rose 10.7 million in September, data from the Bureau of Labor Statistics revealed on Wednesday. The number was above the average economist estimates of 9.85 million.

The central bank of the United States is likely to closely watch this figure as it attempts to fight the hottest inflation in more than 40 years.

A majority, 87.8%, believe that the U.S. Federal Reserve will dish out a 75 bps rate hike on Nov. 2, according to CME Group’s “FedWatch” Tool.

“Bitcoin continues to hover above the $20,000 level ahead as the Fed begins their two-day policy meeting. Bitcoin dropped after the latest JOLTS [Job Openings and Labor Turnover Survey] report showed the labor market was not willing to cool,” said Edward Moya, a senior market analyst with OANDA.

Justin Bennett said he found it a “little suspect” believing the argument that Bitcoin has decoupled from stocks. “It's tough to show something that hasn't happened,” said the trader.

Also suspicious is that 90% of those claims come from Bitcoin maxis.

— Justin Bennett (@JustinBennettFX) November 1, 2022

Probably not a coincidence. Lol

“Also suspicious is that 90% of those claims come from Bitcoin maxis. Probably not a coincidence,” said Bennett.

Michaël van de Poppe sees “some slight signs” of correction in the market. The trader pointed out to the dollar index showing strength while Bitcoin “hangs around support.”

Looking at the markets, some slight signals of a short correction are here. $DXY is showing strength, while $BTC hangs around support and on the edge of a decision, probably 4-8 hours max.$AVAX bearish divergence.

— Michaël van de Poppe (@CryptoMichNL) November 1, 2022

Targeting $17.25 and $18 for potential longs. pic.twitter.com/JWXWZIoSXA

The dollar index, a measure of the greenback’s strength against six other currencies, was down 0.15% at 111.33 at the time of writing.

Glassnode said in a recent blog post that Bitcoin is yet to experience a “convincing influx of new demand yet.” The on-chain analysis firm said, “It does not appear that the bear-to-bull transition has formed as yet, however, there does appear to be seeds planted in the ground.”

Pointing to The Balanced Price of $16,500 and Realized Price of $21,100, Glass node said they have once again helped establish range-bounds as the market “ hammers out a foundational floor.”

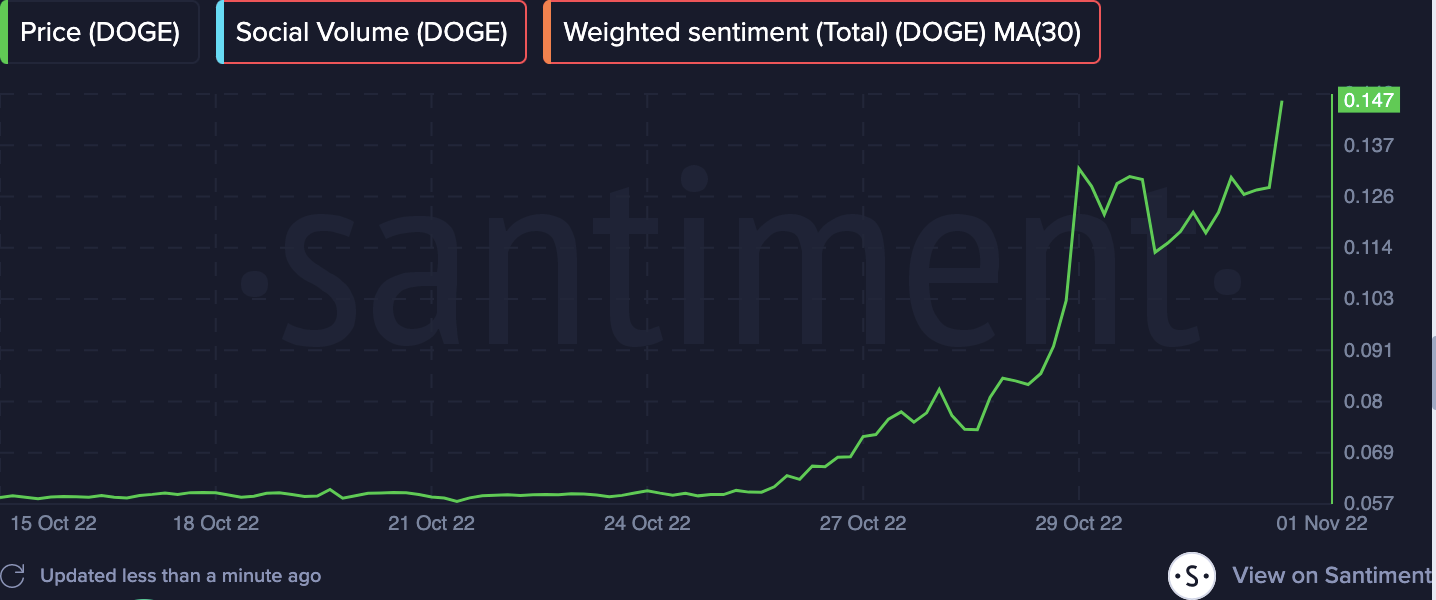

Meanwhile, Dogecoin shot up nearly 14% intraday boosted by a tweet from Tesla Inc (NASDAQ:TSLA) Elon Musk. The post featured a Shiba Inu dog dressed in a Twitter outfit.

DOGE’s 24-hour trading volume shot up 45.4% to $7.9 billion, according to CoinMarketCap at the time of writing. Coinglass data indicated $30.8 million worth of the meme coins were liquidated over 24 hours.

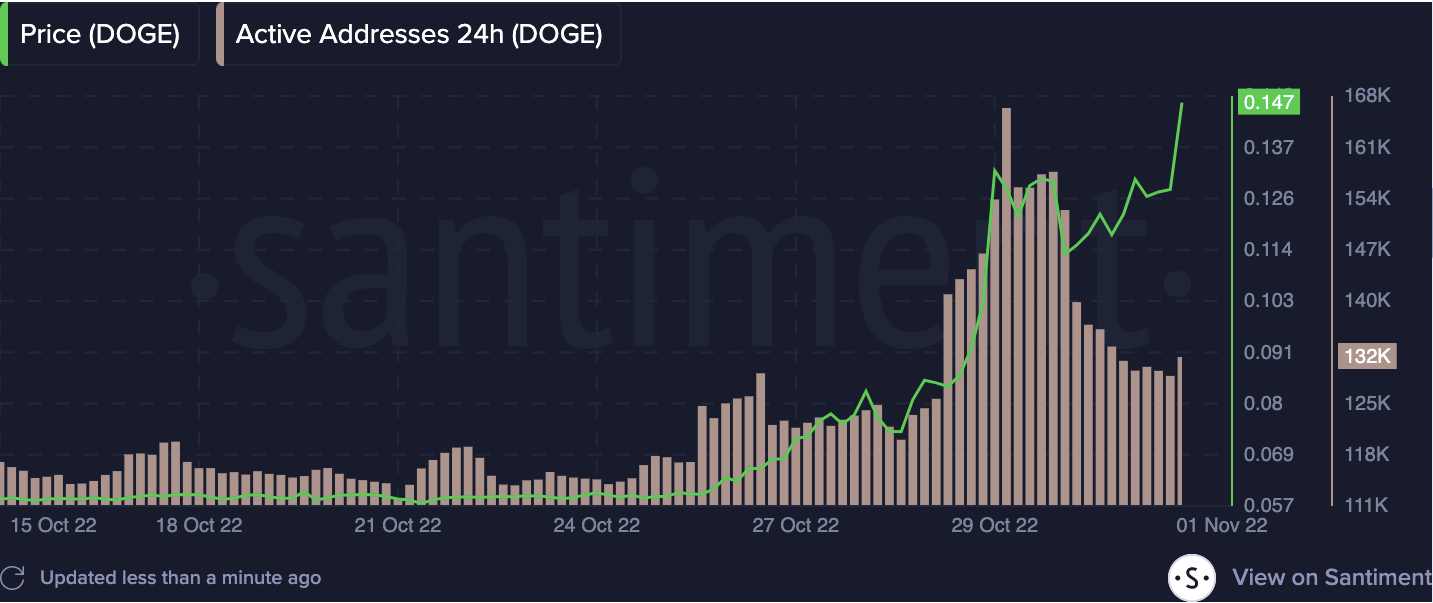

Santiment said in a note that the first time the DOGE price reached 15 cents, the number of active addresses was much higher than the coin touching similar levels now. The same is true for the trading volume.

The market intelligence platform said while DOGE and related words had been among Santiment’s top five social trends for the last 4-5 days, it has finally lost the number one spot, which is “very often an indicator of incoming price decline.”