Electric vehicle sales have exploded, with over 3 million of them hitting U.S. roads in the last three calendar years alone. Is America’s public EV charging infrastructure keeping up? It’s a surprisingly tough question to answer. But it’s an important one, given that a perceived lack of charging stations is one of the biggest hurdles to wider EV adoption.

Simply calculating the ratio of EV chargers to EVs across the country doesn’t tell the whole story, said Loren McDonald, chief analyst at Paren, a charging data firm. If it were that simple, then a place like Oklahoma, which has tons of chargers but few EVs, would be considered an EV owner’s paradise.

“Using those ratios could lead you to the wrong conclusion,” he told InsideEVs. What’s more useful is comparing utilization across key markets—that is, how busy charging stations are throughout the day. Crunch the numbers, and you realize that the answer to the question of “do we have enough chargers?” varies drastically depending on where you are in the country.

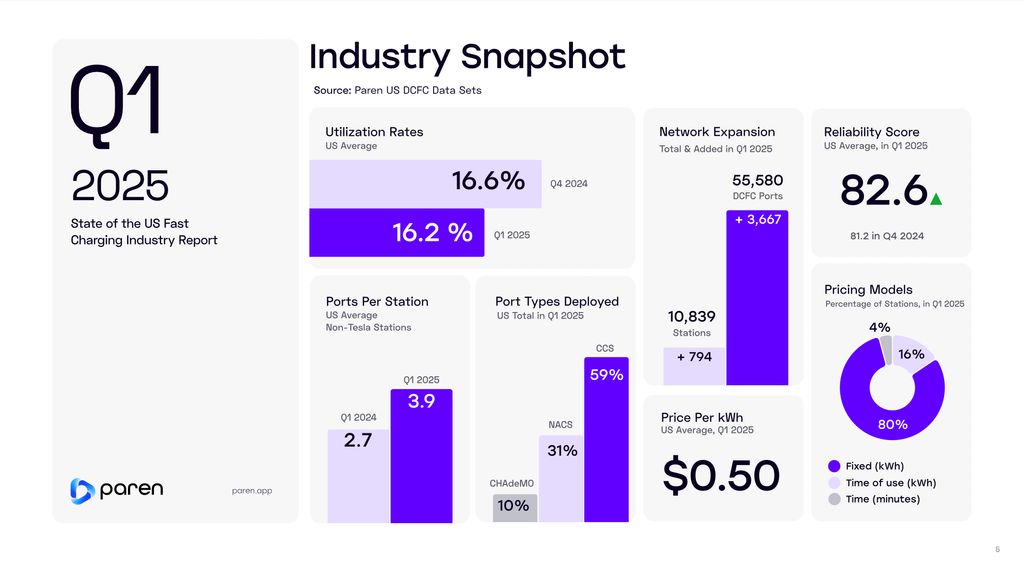

For a report on the state of the EV charging industry out on Tuesday, Paren tracked utilization of EV fast chargers during the peak hours of 12 p.m. to 6 p.m. in major markets. Las Vegas had the highest utilization rate at 43.3%. Columbus, Ohio, had the lowest at 14.3%.

According to McDonald, that means you’ll likely have to wait in line for a charger in some of the top markets. But on the flip side, there’s more than enough infrastructure to meet demand in many U.S. cities and states. On the whole, he says the U.S. is doing pretty well.

“In most of the country, we have plenty of charging infrastructure, at least in the core markets,” he said.

Average utilization has surpassed 25% in several markets, which McDonald says is an encouraging sign for a business that’s historically struggled to make ends meet. It’s part of why he says the EV charging industry has entered a new era: “Charging 2.0.”

“We’re moving from those sort of pimply-faced teenage years into being an adult,” he said. McDonald points to a few signals that things are moving in the right direction.

New, serious players are moving aggressively into the space. Convenience store and gas station chains like Wawa, Sheetz, 7/11, BP and Circle K see dollar signs in the longer duration of EV pit stops. Plus, car companies now realize they need to provide better charging to sell more cars. That’s enticed Mercedes-Benz, Rivian and Ionna—funded by a super-group of automakers—to launch charging networks of their own, like Tesla did back in the day.

“All these major players are coming in with lots of capital and a different reason for building charging stations,” McDonald said.

According to Paren’s report, EV charger reliability among non-Tesla sites—a nagging issue for years—improved in Q1 too. The firm’s reliability index ticked up from 81.2 to 82.6 quarter-over-quarter. It says that's thanks to efforts to replace aging hardware. New stations are getting bigger as well. The average new non-Tesla site built in Q1 had 3.9 ports, up from 2.7 during the same period last year. And the U.S. gained 3,667 chargers and 794 stations in the first three months of 2025.

To be sure, large swathes of rural America are still sorely in need of more charging stations. Not helping matters: the uncertain fate of funds from the $5 billion National Electric Vehicle Infrastructure (NEVI) program. The Trump administration effectively paused that initiative in February, as InsideEVs was first to report. NEVI was designed to subsidize the buildout of fast-charging stations along major travel corridors, and especially in places where charging networks might not see a business case.

With that money in jeopardy, charging firms will focus on the high-demand areas where they know they can make money, McDonald said, potentially widening the charging infrastructure divide and keeping more potential EV buyers on the fence.

“There’s no money to be made in Wyoming and Montana and places like that. And the whole point of NEVI was to solve that problem,” McDonald said. “The good news is fast charging has grown up, and it’s now a business. But it’s not a business everywhere.”

Got a tip about the EV world? Contact the author: Tim.Levin@InsideEVs.com