Home buyers enjoyed historically low mortgage rates beginning in January 2010 when average 30-year mortgage rates fell below below 5%. Rates became even more competitive in 2020 and 2021, when they averaged below 3%.

While the COVID-19 housing era was a buyer’s market, the giddy times ended when mortgage rates started climbing in 2022. Consumers became hesitant about buying while waiting for mortgage rates to return to more manageable levels.

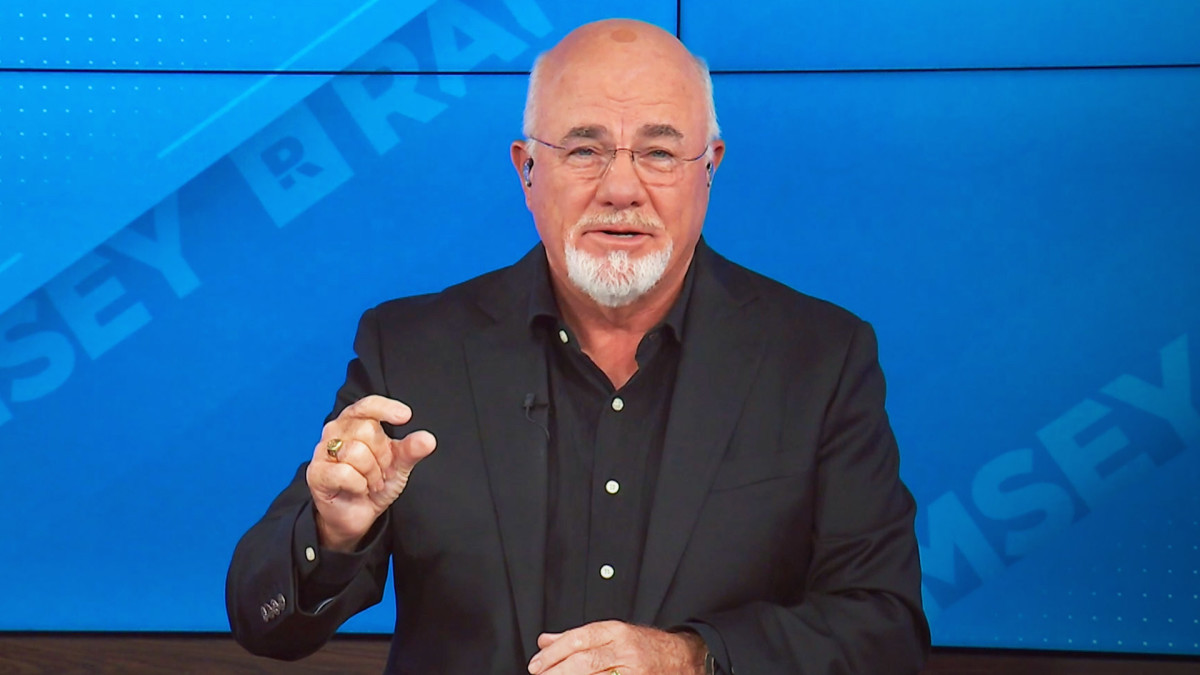

However, personal finance expert Dave Ramsey believes 2025 will present new opportunities for homeowners and potential buyers.

🎁 Buy 1 Year and Get 1 Year FREE on TheStreet Pro. Act now before it's gone ⏰

Though mortgage rates have increased over the past few months, they are expected to drop next year.

Refinancing a mortgage could save homeowners several thousands of dollars per year, but a few different factors determine whether the payoff will be enough to make the process worthwhile.

Ramsey shares a few guidelines and tips on what to look out for in 2025.

Shutterstock

Refinancing your mortgage in 2025 could be 'waste of time' if you make this common mistake

Experts anticipate that 30-year mortgage rates will inch down toward 6% in 2025 from nearly 7% in late 2024. That will offer an opportunity for buyers who purchased a home in the last two or three years.

For buyers who purchased a home when rates were at 7% or above, this could provide an opportunity to refinance their mortgages. Refinancing a loan replaces your current mortgage with a new term with a different lender to get a more competitive interest rate.

Ramsey notes that shaving off one percentage point can save homeowners thousands of dollars each year.

However, he also warns that the annual savings would need to take effect over a specific timeframe to offset refinancing costs.

More on homebuying:

- Housing expert reveals surprising ways to reduce your mortgage rate

- Americans buying homes may see major housing cost changes in 2025

- Dave Ramsey has a warning for Americans buying a home now

“A refinance can be a big blessing, but it can also wind up as nothing more than a time-wasting hassle if you don’t think things through on the front end,” he wrote.

“Before you start getting in touch with lenders and get too deep into the process of refinancing your mortgage, you’ll want to make sure it’s actually the right move for your money,” Ramsey continued. “So, sit down and do the math. How much will your interest rate go down? How much will you save per year by refinancing?”

For a loan balance of $250,000, saving 1% by refinancing would save the homeowners $2,500 per year. However, mortgage closing costs are usually between 2% and 6% of the loan term, meaning borrowers can expect to pay 4% on average.

Refinancing the $250,000 mortgage at a 1% lower rate would cost $10,000. To break even and make refinancing worthwhile financially, the homeowners would need more than five years left on their mortgage terms.

Compare lenders to get the best interest rates on a home loan refinance

Most lenders note that refinancing won't make much sense if a homeowner is at least halfway through their loan term, as there will not be enough time to reap the savings benefit. Refinancing also won't be beneficial if the homeowner plans to sell the home within a few years.

Related: Dave Ramsey has a warning for Americans buying a home now

However, If the numbers will save you enough long-term, there are a few key steps of the mortgage refinancing process that homeowners should research thoroughly:

- Shop around for lenders and interest rates: Inquiring with multiple lenders allows you to find the best rate on the market and maximize your monthly savings. Asking lenders about closing costs can give you a more accurate estimate and even offer the possibility of a discount.

- Consider a mortgage rate lock: Locking in a mortgage rate allows it to stay at a set level for a certain period, typically anywhere from 30 to 120 days. Some lenders offer rate locks for free, while others charge a fee, but the payoff is usually worth it.

- Understand the underwriting process: Lenders underwrite your finances to assess your risk level and ensure you can pay your loan back. Your credit history, bank account statements, and recent pay stubs from your job may be audited. It is a lengthy process, but it is usually the last barrier to getting approved for a new loan.

Related: Veteran fund manager sees world of pain coming for stocks