People planning and saving for retirement encounter a large number of ways to approach the challenge.

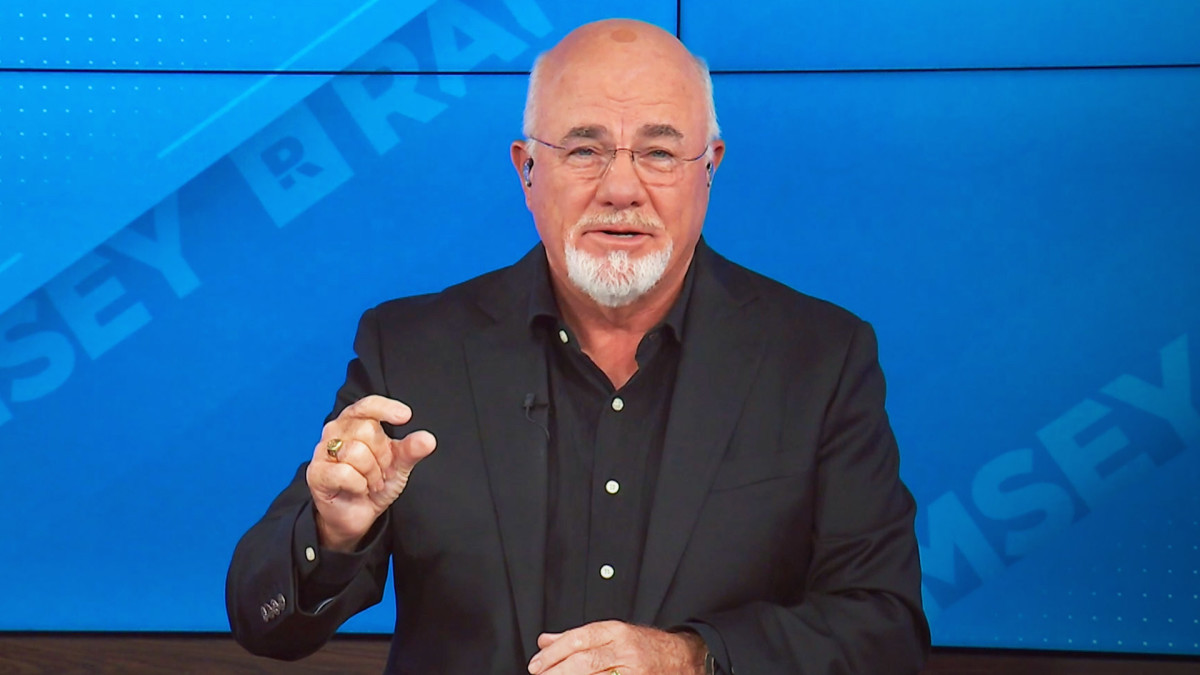

But personal finance author and radio host Dave Ramsey has a warning about a major mistake many make.

Related: Dave Ramsey has blunt words on car payments and retirement savings

Among the strategies people should use while building their retirement savings is to maximize the amount of money they put into 401(k)s and IRAs. Often, workers have the opportunity to take advantage of employer matches that make these investments even more attractive.

Ramsey suggests that having a written budget can help people allocate their income and stick to their plans. Also important is to live on less money than you make, as building wealth involves avoiding overspending.

Ramsey also emphasizes the need to build an emergency fund equivalent to three to six months of living expenses.

But many people think of credit cards as good tools for dealing with unexpected expenses.

Not so, Ramsey says. In fact, credit cards are precisely related to the one big mistake he urges people to avoid.

Dave Ramsey says debt keeps people from building wealth

Having some debt, including credit card debt, has become normalized. But Ramsey says that the fact it seems normal is irrelevant — it causes problems.

Ramsey explained a number of excuses people make for going into debt, calling them lies that attempt to justify toxic financial behavior.

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

One is that people tell themselves it's important to have a good credit score. Ramsey disputes that notion, encouraging an approach that involves saving money and paying cash, even for big purchases such as buying a car.

Another is that many people believe they still have plenty of time to plan for their financial futures. And they use this belief to justify accumulating debt.

The Ramsey Show host warns that it's impossible for people to invest in their financial security while they are paying for their past. He suggests a debt-reduction strategy where people pay off their debt in the order of their smallest balance to their largest balance.

Another lie people tell themselves, he wrote on Ramsey Solutions, is that they don't have a high enough income to live without debt.

To counter that argument, he says there are plenty of ways to get a side hustle these days, including driving for Uber or Lyft and delivering food through DoorDash or GrubHub.

You can always begin searching and applying for a higher paying primary job as well.

Shutterstock

Ramsey explains other debt myths people tell themselves

Another common money myth is that having a budget limits your freedom.

"The truth is, a budget gives you freedom," Ramsey wrote. "People say budgeting makes them feel like they got a raise, because they 'find' money they were wasting."

Some people believe that not using debt would be a frightening change of lifestyle. Someone who is used to using a credit card and making car payments can grow comfortable with those habits.

Ramsey likens accumulating debt to cooking yourself in a pot of boiling water.

"It's warm and cozy at first, but before you know it, you've been boiled alive," he wrote.

Related: The average American faces one major 401(k) retirement dilemma

Ramsey acknowledges that taking the necessary steps to get out of debt requires some discipline and hard work.

But he also says that regular people frequently call in to The Ramsey Show celebrating being debt free using his smallest-debt-first strategy that he calls the debt snowball method.

"Remember this," he wrote. "Millions of people who were in your shoes are now living and giving like no one else. You're next."

"It's your turn to throw off the weight of debt and start building the life you've dreamed of. It's so very possible. And you're so very worth it."

Related: Veteran fund manager picks favorite stocks for 2024