The cost of living crisis was laid bare on Thursday as the Chancellor was forced to step in to offset a nearly £700 spike in energy bills, while the Bank of England warned inflation would hit its highest point in more than three decades.

Energy bills are set to soar by 54% for 22 million households from the beginning of April, adding £693 to the annual bills of a typical household.

Meanwhile, inflation is set to hit an eye-watering 7.25% in April, according to new Bank of England forecasts released on Thursday.

The prediction would mean that disposable incomes fall by around 2%, according to Bank estimates, the worst impact since records began in 1990.

Increased energy bills, even with the new support from the Government will push four million households into fuel poverty – double the current amount, according to the Resolution Foundation think-tank.

The squeeze comes as oil giant Shell revealed a 14-fold increase in profits as the company benefited from the spike in global prices.

Bank of England rate setters hiked the base interest rate from 0.25% to 0.5%, a move it hopes will take some pressure off households.

As the Bank announced the rates change, Chancellor Rishi Sunak was promising to help households through the energy price rises.

He announced a £200 rebate on energy bills, which will have to be paid back.

The Chancellor also revealed a £150 reduction in council tax for millions in England, which will not have to be paid back, and £144 million to councils to support vulnerable households.

He hopes it can offset some of the £693 per year that energy regulator Ofgem has added to the bills of millions from April 1.

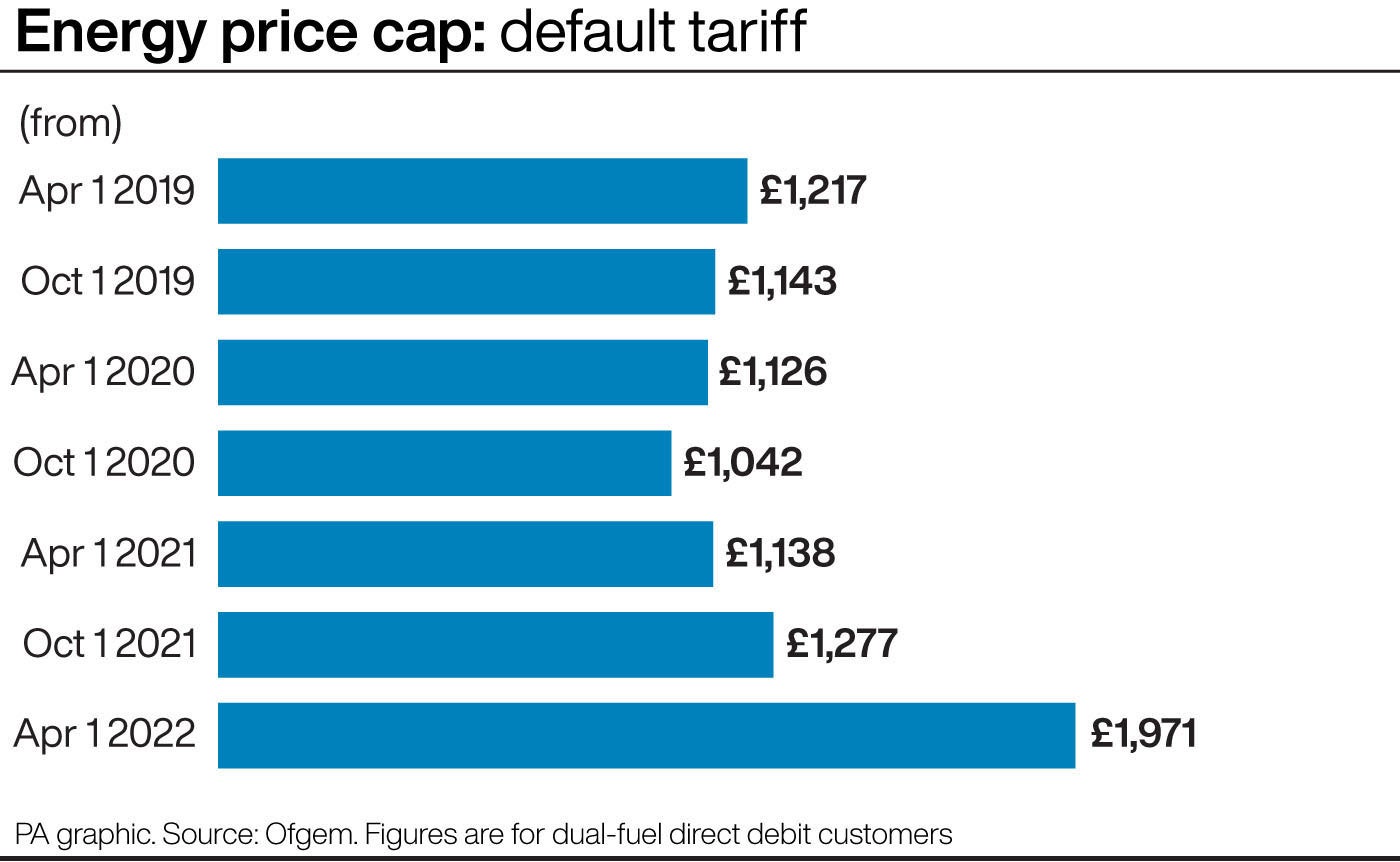

The regulator was forced to hike the energy price cap to a record £1,971 for a typical household on a standard tariff as gas prices soared to unprecedented highs.

For customers with prepayment meters the price cap will go up by £708 to £2,017, the regulator added.

The price cap is set per unit of energy used with the increase calculated based on a household that uses a “typical” amount of energy. Households that use more will pay more.

Details of the Chancellor’s £200 rebate will be worked through following a consultation, but households will have to repay the cash with bill hikes of £40 per year over the next five years from 2023.

Ministers are hopeful that wholesale energy prices will drop so households can pay back what they owe without a major rise in bills.

Some energy company insiders worry that while good in principle, the policy is too reliant on falls in global gas prices, as investment bank Goldman Sachs previously warned prices are likely to remain at twice their usual levels until 2025.

Mr Sunak’s £150 council tax rebate will cover homes in bands A to D, impacting 80% of households in England, he said.

“The price cap has meant that the impact of soaring gas prices has so far fallen predominantly on energy companies,” he told MPs on Thursday.

“So much so that some suppliers who couldn’t afford to meet those extra costs have gone out of business as a result.

“It is not sustainable to keep holding the price of energy artificially low.

“For me to stand here and pretend we don’t have to adjust to paying higher prices would be wrong and dishonest.

“But what we can do is take the sting out of a significant price shock for millions of families by making sure that the increase in prices is smaller initially and spread over a longer period.”

In the Commons, some MPs questioned whether oil companies like Shell should be hit with a windfall tax, after the company revealed huge profits.

Labour’s Nick Smith said: “Does he (the Chancellor) really think that the super profits of 20 billion dollars made by Shell are untouchable? His hands-off approach won’t persuade many people across our country.”

Shadow chancellor Rachel Reeves said millions of people are cutting back spending to pay bills, adding: “What do the Government offer? A buy now, pay later scheme that loads up costs for tomorrow.

“The best way of targeting support to those who need it most would be an increase to £400 and an extension to 9 million households of the warm homes discount, as Labour has proposed today. Their scheme today is a pale imitation of Labour’s, especially for the households and pensioners on the most modest incomes,” she added.

The price cap increase includes a £68 charge per household to cover the costs of protecting millions of customers whose energy suppliers collapsed in recent months.

Ofgem had developed a way of spreading this charge over a longer period but scrapped the plan when it learnt of the Government’s action.

“It didn’t make value for money sense to be running a private financing scheme over and above that,” Ofgem chief executive Jonathan Brearley said.

The Government has for weeks been assessing what it can do to help customers. Potential solutions have included loans to energy companies and cuts in VAT or levies on energy bills.

Ofgem also plans on Friday to set out new rules which will allow it to change the energy price cap in between its regular six-month reviews.

The regulator pledged the power will only be used in exceptional circumstances, and five tests will have to be passed before it can step in.

The price cap had already been set at a record high in October before the worst of the gas price spike had been seen in the market.

There are also worries about next winter, when experts predict bills could spike to as much as £2,329.

Prime Minister Boris Johnson insisted the £9 billion package unveiled by the Chancellor was necessary.

“This is a mega package of £9 billion on top (of existing measures) which is necessary but it’s huge,” he told reporters.

“That is there to help people with this particular spike that we are seeing right now.

“What I hope and believe is that eventually, as the world economy gets its momentum back, the inflationary pressures will start to subside.”