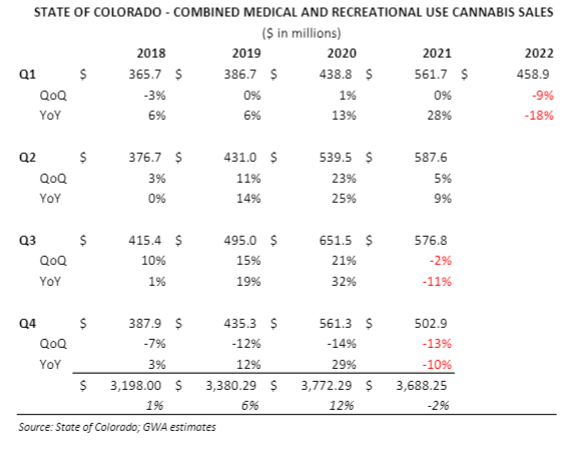

For the third consecutive quarter, The Colorado Department of Revenue posted neg comps for cannabis both YoY and QoQ. Q1:22 results -41% med / -13% rec YoY and -23% med / -11% rec QoQ. The deceleration in revenue growth is consistent with what we have observed for the past 3 quarters from many of the MSOs and other states but was compounded by new regulations that went into effect Jan 1 limiting daily medical marijuana purchases.

In March 2020, and on a few other occasions, we expressed concern that disposable income levels could fall as the COVID pandemic began its assault on the U.S. economy and, to that end, legal cannabis revenues could be pressured as the illicit market offers a less expensive alternative.

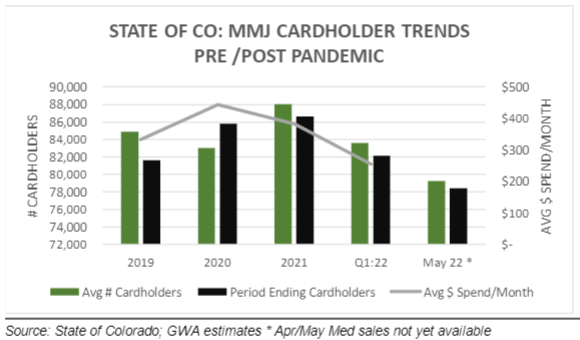

2019 ended with ~81.6K cardholders (right before the pandemic), increasing to ~85.8K by the end of 2020 and topped off at ~90K in Sept 2021. Since the beginning of this year, there has been a steady drop-off in the number of cardholders with ~78.4K at the end of May. To put this in perspective, the count peaked in 2011 at ~127K.

The average patient spend per month has dropped from $444 in 2020 to ~$250 in Q1:22 which is likely higher given that not all cardholders make purchases in any given month (denominator in our calculation is likely lower). We have been tracking these metrics since 2012 and Colorado has always been an outlier and it is entirely possible that much has been sold into the grey market prior to the purchase limitations that went into effect Jan 1.

As we have written about in a prior GreenWave Buzz, during the pandemic, the growth in

the medical market outpaced recreational use sales by a wide margin reversing a steady

trend since 2014 when the rec use market was implemented. Post pandemic trends support this thesis.