/CME%20Group%20Inc%20Phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at $90.9 billion by market cap, CME Group Inc. (CME) operates as the world’s leading derivatives marketplace. The Chicago-based derivatives exchange offers the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate.

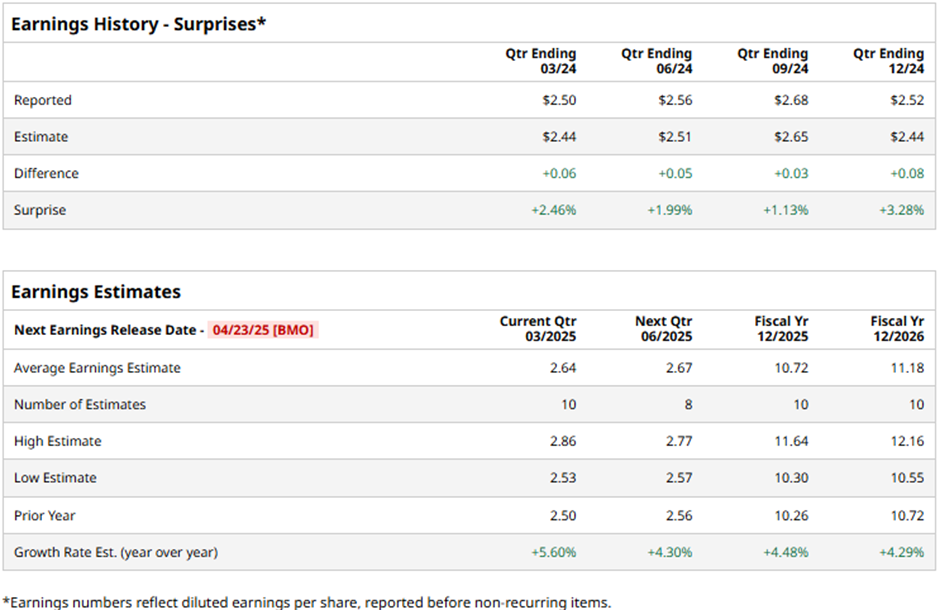

The financial sector giant is set to announce its first-quarter results before the markets open on Wednesday, Apr. 23. Ahead of the event, analysts expect CME to report a non-GAAP profit of $2.64 per share, up a notable 5.6% from $2.50 per share reported in the year-ago quarter. Furthermore, the company has surpassed Wall Street’s bottom-line projections in each of the past four quarters.

For the full fiscal 2025, CME is expected to deliver an adjusted EPS of $10.72, representing a 4.5% increase from $10.26 in fiscal 2024. While in fiscal 2026, its earnings are expected to grow 4.3% year-over-year to $11.18 per share.

CME stock has soared nearly 19.9% over the past 52-week period, significantly outperforming the Financial Select Sector SPDR Fund’s (XLF) 5.2% returns and the S&P 500 Index’s ($SPX) 4.2% decline during the same time frame.

CME Group’s stock prices soared nearly 3% after the release of its fiscal 2024 results on Feb. 12. The company observed solid daily volumes throughout the year and delivered a 9.9% year-over-year surge in total revenues to a record $6.1 billion. Furthermore, its Q4 revenues of $1.5 billion surpassed the Street’s expectations by 1.3%. Meanwhile, the company reported a robust 9.3% year-over-year growth in annual earnings to shareholders, reaching $3.5 billion and representing an impressive net margin of 56.8%. Moreover, its adjusted EPS of $2.52 for Q4 surpassed the consensus estimates by 3.3%, which boosted investor confidence.

The consensus view on CME stock is cautiously bullish, with a “Moderate Buy” rating overall. Out of the 19 analysts covering the stock, seven recommend “Strong Buy,” one advises “Moderate Buy,” eight suggest “Hold,” one advocate “Moderate Sell,” and two have a “Strong Sell” rating. As of writing, the stock is trading slightly below its mean price target of $260.89.