Medicare provider Clover Health Investments, Corp.’s (CLOV) stock has been under pressure as it works to resolve multiple class action lawsuits. The company recently announced that it had reached a settlement agreement for seven pending derivative lawsuits. With this development, CLOV has now settled all outstanding civil litigation related to its de-SPAC transaction.

However, the settlement remains subject to the completion of definitive documentation and obtaining final court approval. The lawsuits claimed the company failed to disclose that it was under federal investigation before its initial public offering.

On the other hand, CLOV is not yet profitable, and Street analysts do not expect the company to achieve profitability in the near future. In the first quarter of 2023, CLOV reported total revenue of $527.78 million and a net loss of $72.61 million. While the company experienced substantial growth in insurance revenue, total revenue decreased by 39.6% year-over-year.

To address these concerns, CLOV is concentrating on business transformation initiatives to accelerate its path to profitability. Earlier this year, the company entered into an agreement to transition its core plan operations to UST HealthProof’s integrated technology platform and implement other corporate restructuring measures.

“UST HealthProof’s experience working with health plans will accelerate our access to scaled operational efficiencies and strong insurance operations,” commented Jamie Reynoso, Clover’s CEO of Medicare Advantage. Considering the prevailing uncertainties, it may not be the ideal time to invest in CLOV. A closer examination of various metrics provides a better understanding of the situation.

Analyzing CLOV’s Financial Performance: Net Income, Revenue Growth, Gross Margin, and Current Ratio Trends

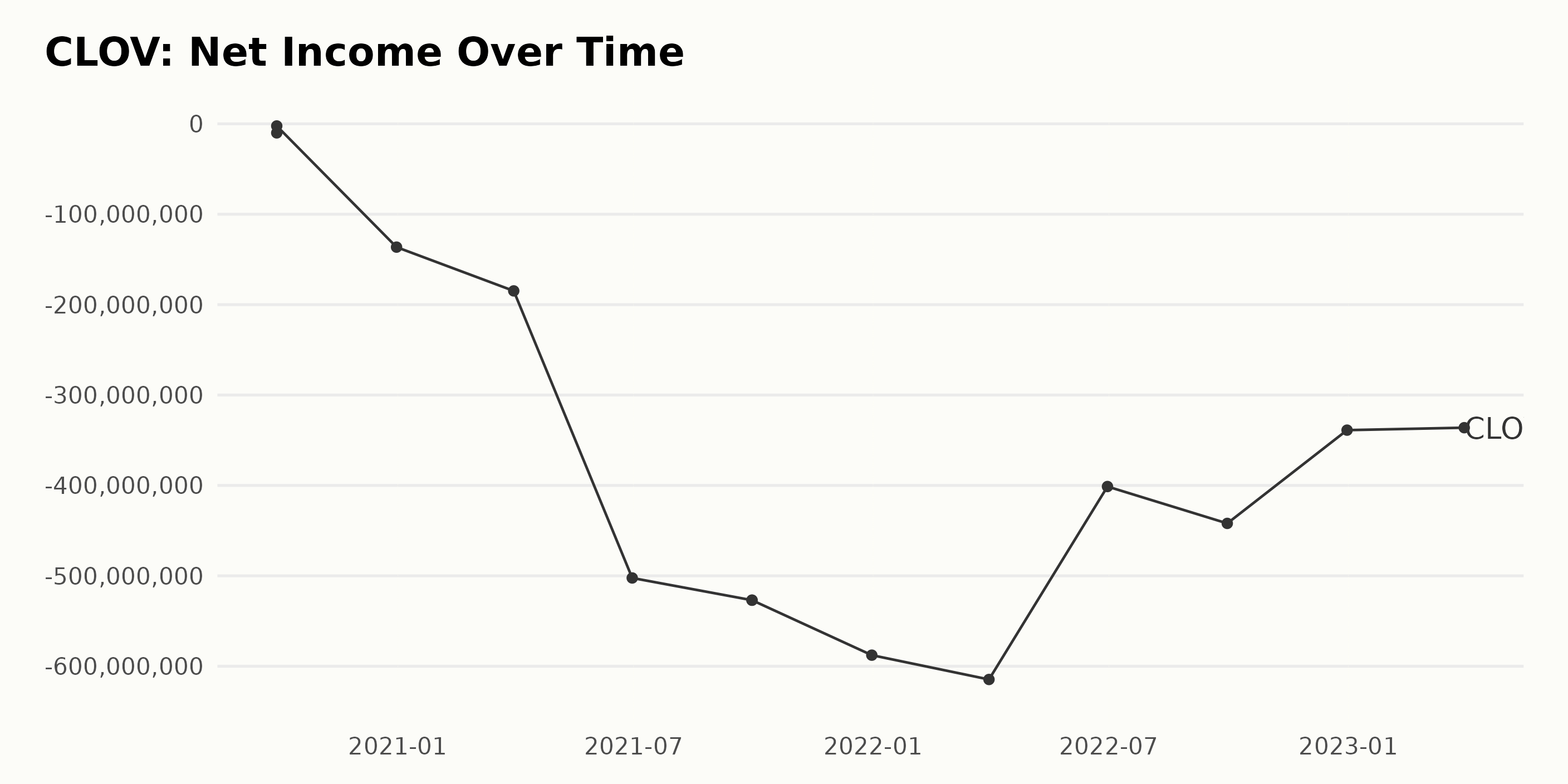

The trailing-12-month net income trends and fluctuations of CLOV are summarized as follows:

- September 30, 2020: Net income improved from -$10.02 million to -$2.37 million

- December 31, 2020: Net income significantly declined to -$136.39 million

- March 31, 2021: Net income decreased to -$184.81 million

- June 30, 2021: Net income further extended its decline to -$502.36 million

- September 30, 2021: Net income remained roughly the same at -$526.95 million

- December 31, 2021: Net income worsened to -$587.76 million

- March 31, 2022: Net income registered another significant decline to -$614.65 million

- June 30, 2022: Net income recovered mildly to -$401.22 million

- September 30, 2022: Net income once again worsened with a figure of -$442 million

- December 31, 2022: Net income improved slightly to -$338.84 million

- March 31, 2023: Net income stood at -$336.14 million

Recently, CLOV has faced increasing losses in net income, reaching -$336.14 million in March 2023. Comparing the latest value with the first value, CLOV has experienced an extremely negative financial situation.

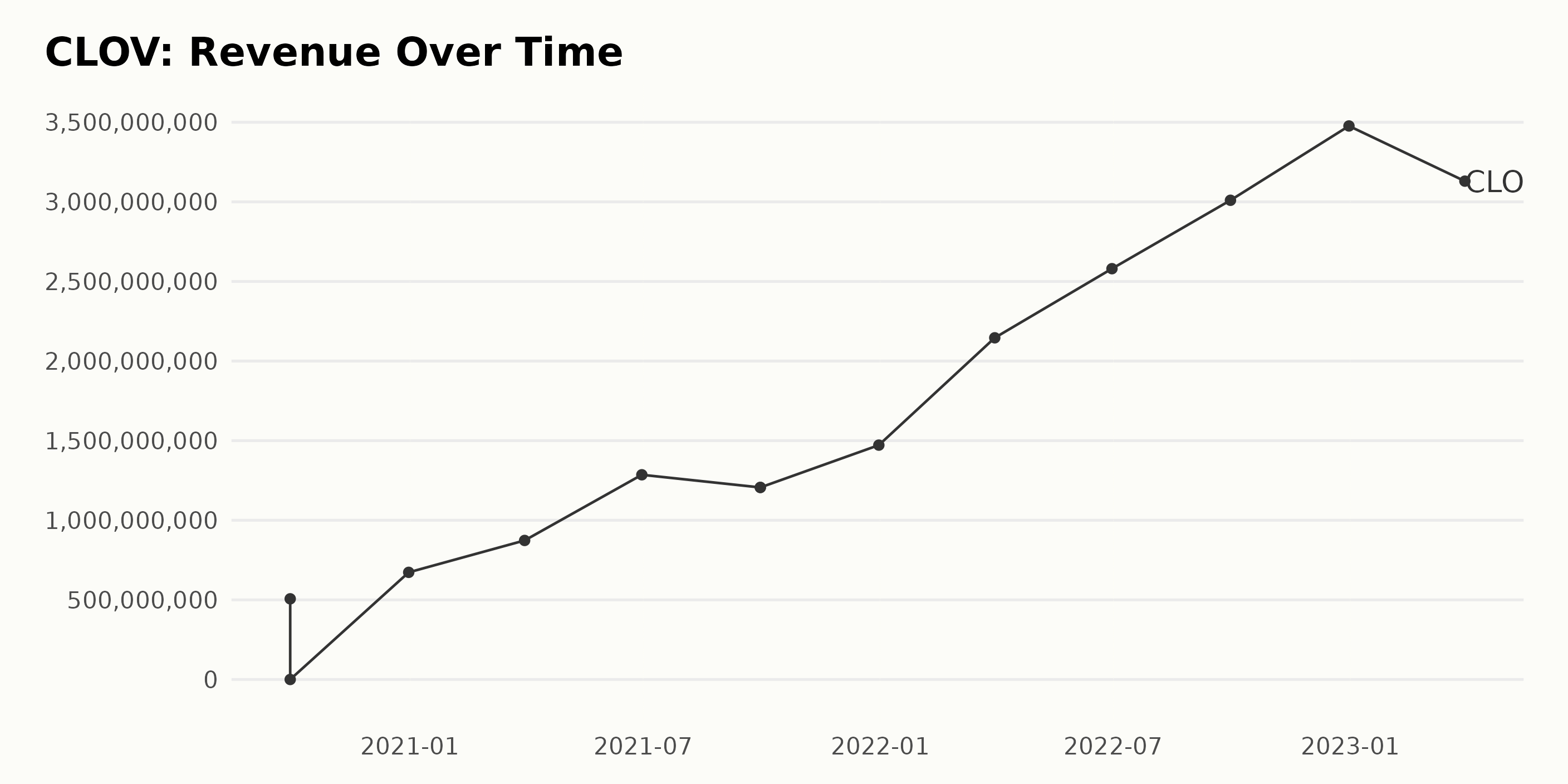

The following is a summary of the trend and fluctuations in the trailing-12-month revenue of CLOV from September 2020 to March 2023:

- September 30, 2020: $506.66 million

- December 31, 2020: $672.89 million

- March 31, 2021: $873.21 million

- June 30, 2021: $1.29 billion

- September 30, 2021: $1.21 billion

- December 31, 2021: $1.47 billion

- March 31, 2022: $2.15 billion

- June 30, 2022: $2.58 billion

- September 30, 2022: $3.01 billion

- December 31, 2022: $3.48 billion

- March 31, 2023: $3.13 billion

Based on the data provided, CLOV experienced significant growth in revenue over the given period. The revenue increased from $506.66 million in September 2020 to $3.13 billion in March 2023. The company’s revenue peaked at $3.48 billion in December 2022 before experiencing a slight decrease to $3.13 billion in March 2023. Regarding growth rate, CLOV’s revenue exhibited an impressive increase from the first value ($506.66 million) to the last value ($3.13 billion), indicating a growth rate of approximately 517.33%.

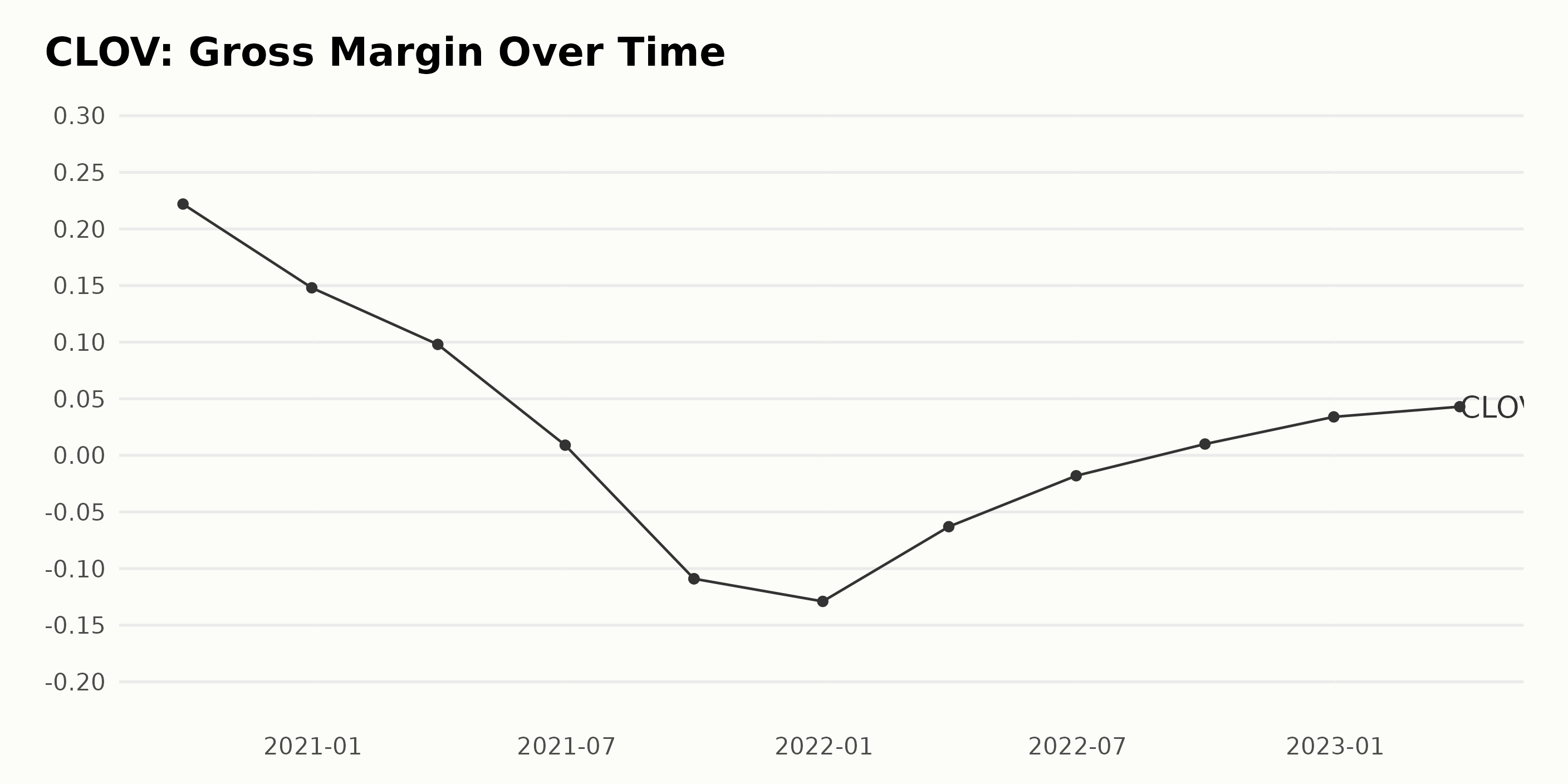

The gross margin of CLOV has experienced significant fluctuations over the years. Here’s a summary of the data points:

- September 2020: 22.20%

- December 2020: 14.80%

- March 2021: 9.80%

- June 2021: 0.90%

- September 2021: -10.90%

- December 2021: -12.90%

- March 2022: -6.30%

- June 2022: -1.80%

- September 2022: 1.00%

- December 2022: 3.40%

- March 2023: 4.30%

Based on the provided data, the gross margin of CLOV has observed a downward trend until December 2021 (-12.90%) from its highest value in September 2020 (22.20%). However, since then, there has been a turnaround as the gross margin has steadily improved, reaching 4.30% by March 2023. Considering the growth rate calculated from the first value (September 2020, 22.20%) to the last value (March 2023, 4.30%), there is a substantial decrease of 17.90 percentage points.

It is important to keep an eye on recent data, and while the gross margin has shown improvement in the last few reported quarters, it is crucial to watch future developments for better insight into the company’s financial health.

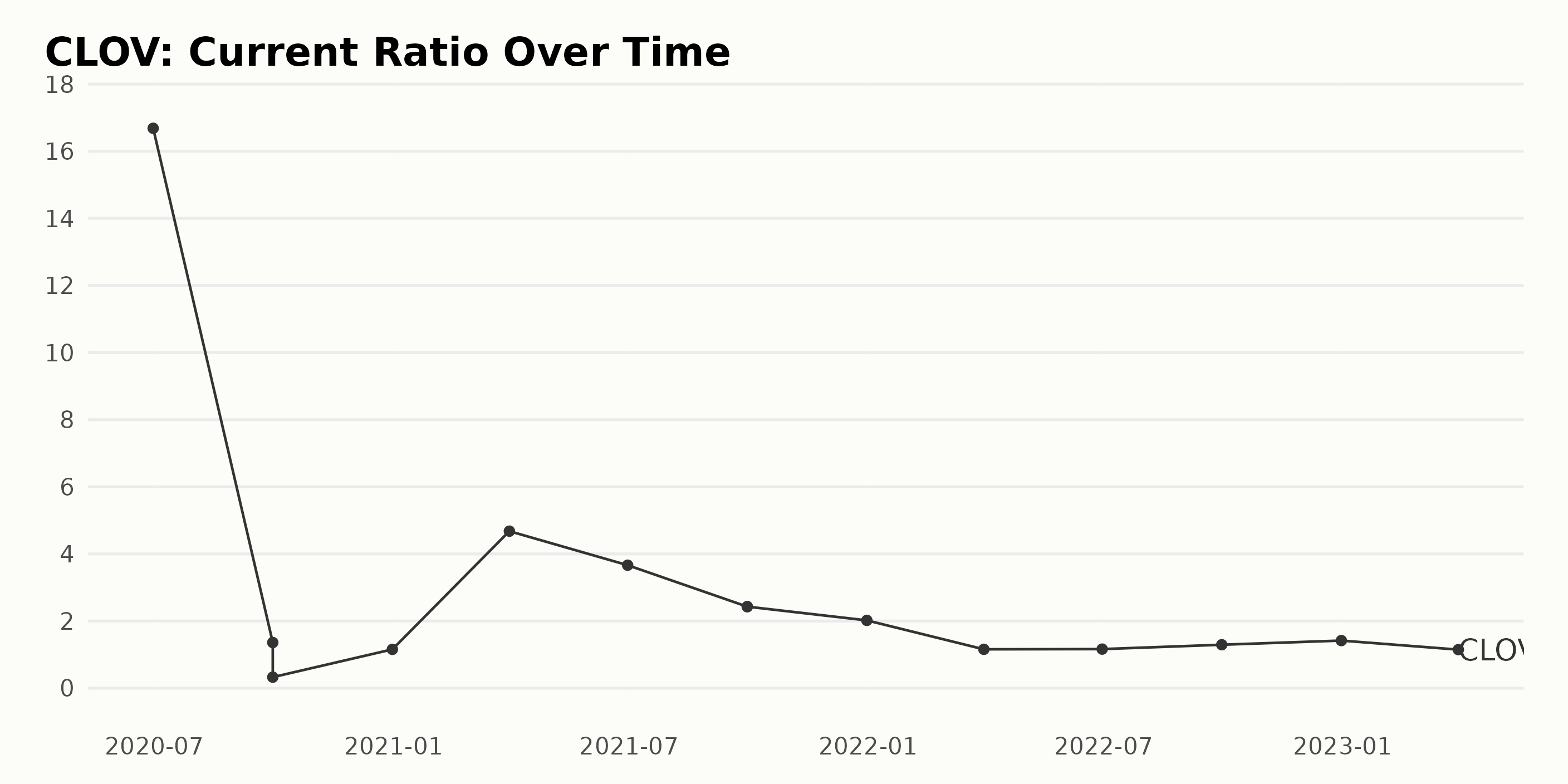

The trend and fluctuations of the current ratio of CLOV are summarized as follows:

- The current ratio significantly decreased from 16.68 in June 2020 to 1.36 in September 2020.

- A minor dip to 0.33 followed in September 2020 before increasing to 1.156 by December 2020.

- Throughout 2021, the current ratio rose to a peak of 4.68 in March and then dropped steadily to 2.43 in September. It remained consistent at this level for the rest of the year.

- In 2022, the current ratio declined to 1.158 in March but gradually increased in subsequent months, reaching 1.418 by December 2022.

- By March 2023, the current ratio had decreased once more to 1.148.

Overall, there is a growth rate of -92.69% from June 2020 to March 2023 in CLOV’s Current Ratio, considering the first value (16.68) and the last value in the series (1.148). The most recent data indicates fluctuations within a smaller range between 1.0 and 3.0 over the past few years.

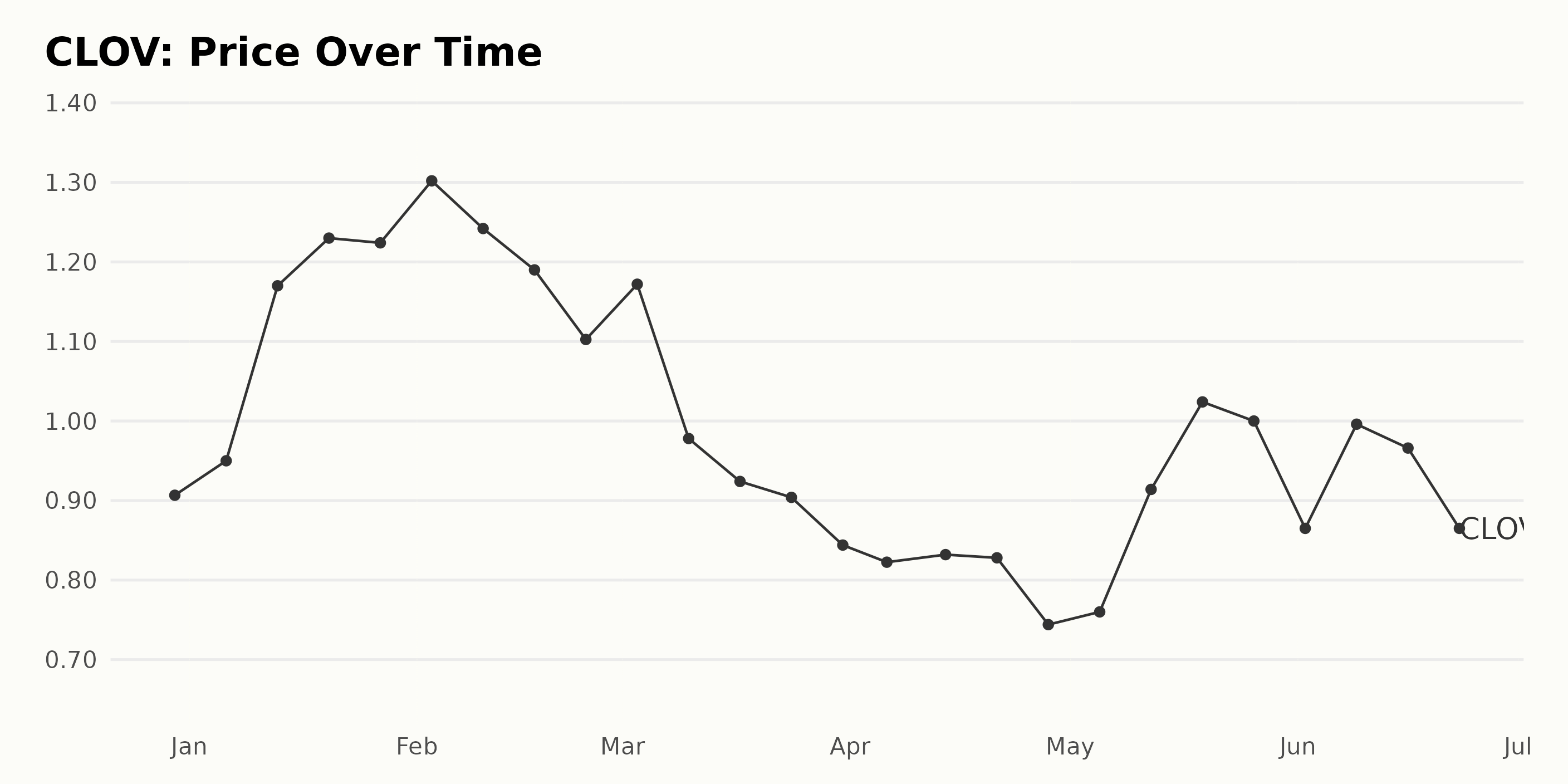

Exploring CLOV’s Share Price Fluctuations: A Six-Month Analysis

The given data shows the price of CLOV over a period from December 30, 2022, to June 23, 2023. It is observed that the prices have fluctuated throughout the entire time frame. The trend and growth rates can be summarized as follows:

- From December 30, 2022 ($0.91) to February 3, 2023 ($1.30), CLOV exhibits a consistent growth trend with minor fluctuations.

- Between February 3, 2023, and March 3, 2023, the share price declined slightly from $1.30 to $1.17 but experienced some fluctuations during this period.

- The share price then shows a downward trend from March 3, 2023 ($1.17) to April 6, 2023 ($0.82).

- Starting April 14, 2023 ($0.83), CLOV’s share price remains relatively stable until April 28, 2023 ($0.74). Afterward, there is an upward trend until May 19, 2023 ($1.02), when the price spikes.

- Finally, between May 19, 2023, and June 23, 2023, the share price fluctuated with no clear direction, ultimately landing at $0.87.

In conclusion, the growth rate of CLOV shows fluctuations without a significant accelerating or decelerating trend. Instead, the share price experiences both growth and decline phases throughout the given time frame. Here is a chart of CLOV’s price over the past 180 days.

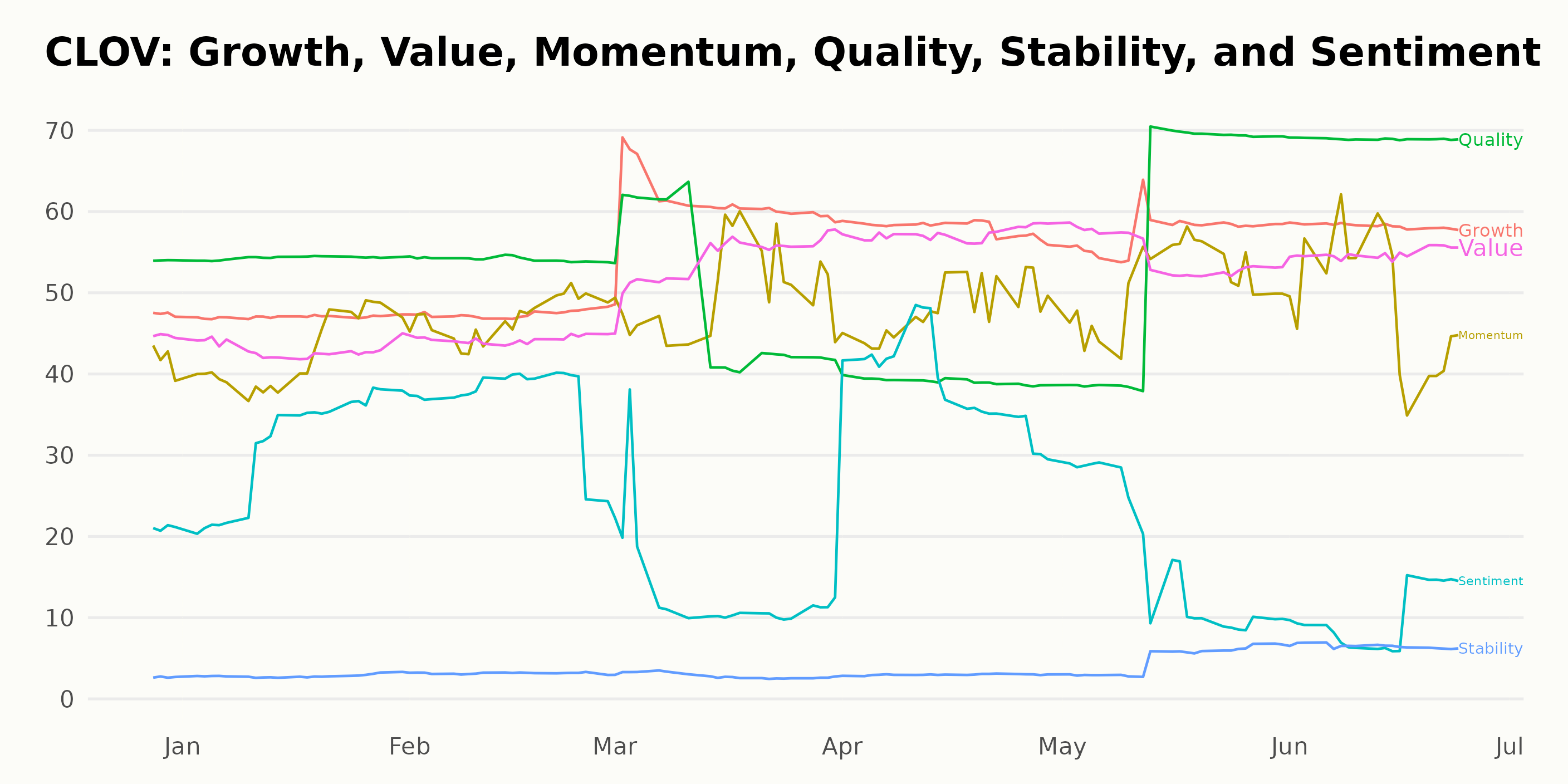

Exploring CLOV’s POWR Ratings

CLOV has an overall C rating, translating to a Neutral in our POWR Ratings system. It also has a C grade for Growth, Value, Momentum, and Quality. CLOV is ranked #10 out of the 12 stocks in the Medical - Health Insurance category.

Here are some key dates and their respective POWR Ratings and ranks in category values for CLOV:

- On December 31, 2022, the overall rating was “D,” with a rank of 11.

- On January 14, 2023, the rating improved to “C,” with a rank of 10.

- From February 4, 2023, to February 25, 2023, CLOV consistently maintained a “C” rating and a rank in the category of 11.

- On March 11, 2023, the rank in the category improved further, with the overall rating remaining at “C” and the rank in the industry moving to 9.

- However, on March 18, 2023, the rating declined again to “D,” with a rank in the category of 10. CLOV’s latest value of “C” is from June 24, 2023, with a rank of 10.

How does Clover Health Investments, Corp. (CLOV) Stack Up Against its Peers?

Other stocks in the Medical - Health Insurance sector that may be worth considering are Humana Inc. (HUM), Elevance Health (ELV), and Centene Corporation (CNC) -- they have better POWR Ratings.

Is the Bear Market Over?

Investment pro Steve Reitmeister sees signs of the bear market’s return. That is why he has constructed a unique portfolio to not just survive that downturn...but even thrive!

Steve Reitmeister’s Trading Plan & Top Picks >

CLOV shares were trading at $0.86 per share on Monday afternoon, down $0.03 (-2.98%). Year-to-date, CLOV has declined -7.48%, versus a 13.89% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Clover Health Investments (CLOV): Buy, Hold or Sell End of June? StockNews.com