A major Chinese-funded and built hydropower dam taking shape in the southeast of the Democratic Republic of Congo may find itself affected by the Congolese president’s desire to renegotiate deals signed with foreign mining companies.

Work on the US$660 million Busanga Hydropower Station began in 2017 and once completed the project will provide power to a major mining project, Sicomines, in the mineral-rich region.

The hydropower project is part of a minerals-for-infrastructure deal signed in 2007 by former president Joseph Kabila, under which Chinese firms agreed to construct US$3 billion in infrastructure in return for a 68 per cent stake in the mine.

The DRC agreed to pay back the funding with copper and cobalt produced by the mine under a device known as resource-backed loans.

China cancels Democratic Republic of Congo loans as it joins belt and road

However, such deals have been criticised by non-governmental organisations, including Global Witness, for their lack of transparency and allegations that Congolese politicians benefit from them more than the public.

The DRC is Africa’s largest copper and cobalt miner and has attracted growing interest from Chinese companies that have invested heavily in the country.

But it has found itself caught up in China’s geopolitical rivalry with the West, which is also eying its cobalt supplies – a key element in electric car batteries.

Christian-Geraud Neema, an analyst of Sino-Congolese relations, noted that “without Busanga, Sicomines’ operation will not be sustainable” adding that “we have to observe how far President Felix Tshisekedi will be going to renegotiate different partnerships signed with the Chinese”.

Last month Tshisekedi threatened to renegotiate deals with foreign mining companies signed by his predecessor – a move that could have an impact on China’s ambitions to become the world’s leading manufacturer of electric cars.

Tshisekedi believes his predecessors in Kinshasa signed lopsided contracts that denied the Congolese people – many of whom live in poverty – their fair share of benefits from the sale of their nation’s minerals.

But others have pointed to the benefits from the agreement.

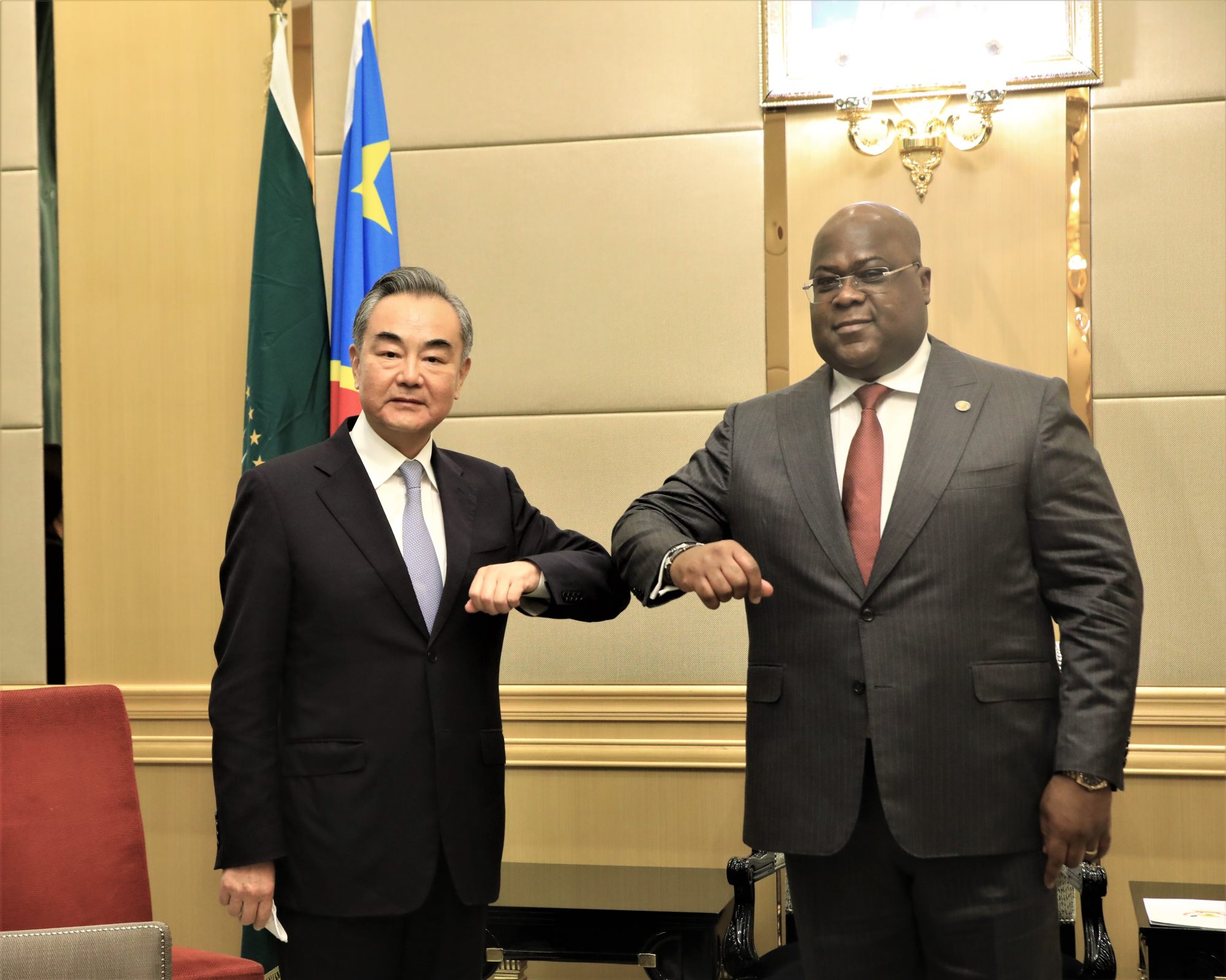

Wu Peng, director general of the Chinese foreign ministry’s department of African affairs, recently said the dam was the largest infrastructure project under construction in the DRC and would generate 1.3 billion kilowatt hours of electricity annually, around 10 per cent of the DRC’s total electricity generation.

Mark Bohlund, a senior credit research analyst at REDD Intelligence, said “Busanga hydropower plant is part of what I view as a restart of Chinese lending to the DRC”.

Three Chinese nationals killed in Democratic Republic of Congo mine attack

He said this was very closely connected to the mining sector, which would take around two-thirds of the power output.

“Very much a win-win deal as energy costs are substantial in the DRC mining sector. I expect it to be followed by other similar projects,” Bohlund said.

ChinaPower, one of the contractors, confirmed in May that it was installing turbines and equipment that will help to power Sicomines –a copper and cobalt mining joint venture between two Chinese companies, Sinohydro and the China Railway Engineering Corporation, and Congolese state miner Gécamines, which has one of Africa’s largest reserves of copper and cobalt at around 6.8 million tonnes.

About 170MW from the dam’s 240MW electricity production capacity will power the Sicomines project, with the remainder fed into the national grid. When complete the dam will be the third-largest in the country, behind two dams on the Inga Falls along the Congo River.

The dam was partly financed by a US$165 million loan from Exim Bank of China and built by a joint venture known as Sicohydro, 75 per cent of which is owned by Sinohydro and the China Railway Engineering Corporation and the rest by the Congolese Société Nationale d’Électricité and Gécamines.

The project has prompted protests after the residents of four villages were displaced last year to allow Sicohydro to dig basins. Neema said the compensation issues remained at the centre of NGO and civil society concerns about the Busanga dam.

Since 2012, Chinese companies have pumped more than US$10 billion into the DRC. Besides the Busanga dam, Chinese companies have also bid to build a third Inga dam.

REDD Intelligence said in a recent note that the Democratic Republic of Congo was likely to see increasing economic engagement from China with lending to road and hydropower projects supporting the now largely Chinese-owned mining sector.

The Inga III hydropower project, for which a Chinese consortium has been one of the two bidders, is an outlier that could see larger Chinese funds disbursed to the DRC, REDD Intelligence noted.

Neema said Chinese companies were among the favourites to win the bid for the 11,050MW Inga Dam III, but Spanish firms might also play a role.

“The Congolese government decided that all three bidders come with one proposal. That was under former president Joseph Kabila. With Felix Tshisekedi in power, the situation is different,” Neema said. “He’s looking forward to renegotiating mining contracts signed which may have an impact on the overall investment approach that China has in the DRC.”

Six Chinese companies led by the China Three Gorges Corp have formed a consortium with a Spanish company AEE Power Holdings to build Inga III. The US$14bn project would involve the construction of two dams and transmission lines within the DRC and its borders.

Chinese businesses are driven abroad by profits, not political agendas, whether it’s TikTok or a grocery store in the Congo

Neema said the renegotiation that may take place about the mining projects might also affect how the Chinese government would be approaching Inga Dam, as Tshisekedi was leaning towards seeking financing from the African Development Bank.

Tshisekedi’s approach was supported by American diplomats worried about the Chinese presence in the DRC, Neema said.

“For now, it’s maybe too early to tell but I do believe that Chinese companies are still more likely to get it for one main reason – they have the financial and technical abilities to launch the project themselves,” Neema said.

But to raise the necessary financing from China Eximbank, they would need to take into account their whole strategy and approach in the DRC, he said.