Icarus had a legendary moment flying high toward the sun with wings crafted by brilliance, until the heat melted the wax, sending him crashing into the sea.

Like Icarus, Intel (INTC) once soared in the tech world, propelled by groundbreaking innovations like the x86 series of microprocessors. But overconfidence and missed steps in a rapidly evolving industry have caused its wings to falter.

💸💰 Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💸

Intel's decline can be traced back to several costly missteps over the years. In the mid-2000s, the company famously passed on the chance to develop the chip for Apple’s iPhone, paving the way for rivals like Qualcomm to dominate the mobile market.

Related: Analysts revamp Apple stock forecast on iPhone trend

In the following years, Intel also fell behind TSMC in manufacturing, struggling with delays in advancing its chip technologies. By the 2010s, TSMC had overtaken Intel in producing faster, smaller chips.

More recently, Intel has lagged behind in the AI wave, where companies like Nvidia have taken the lead.

These missed opportunities have left the once-dominant tech giant playing catch-up in a fast-moving industry. Now, the once-mighty giant is having the hardest time in more than 50 years.

Getty/TS

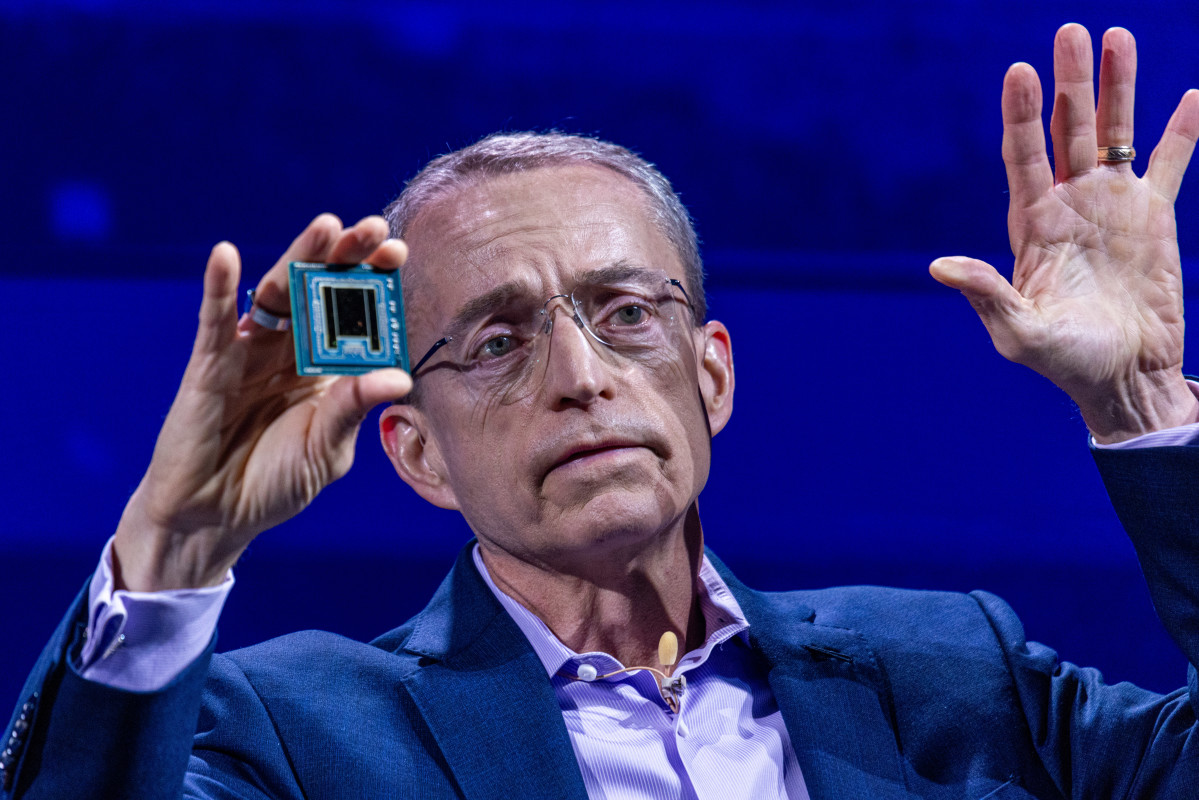

Who can save Intel?

Intel’s most recent financial results for the June quarter were brutal. The company’s earnings per share for Q2 missed analysts' expectations by 80%, coming in at just 2 cents adjusted, compared to the projected 10 cents. Revenue of $12.83 billion also fell short of the $12.94 billion expected.

CEO Pat Gelsinger attributed the loss to the accelerated production of Core Ultra PC chips designed for AI workloads during a call with analysts.

Related: Intel's future suddenly may be in doubt

“We previously signaled that our investments to be fine and drive the AI PC category would pressure margins in the near-term,” Gelsinger said. “We believe the trade-offs are worth it. The AI PC will grow from less than 10% of the market today to greater than 50% in 2026.”

Intel is trying to self-rescue. In August, Intel unveiled a cost-cutting plan targeting $10 billion in savings by 2025, which includes reducing its workforce by about 15,000 roles, or 15%.

The company is spinning off its foundry business to attract fabless chipmakers, who currently rely on TSMC for manufacturing their designs.

"This is the biggest restructuring of Intel, I'd say, since the memory microprocessor decision four decades ago," Gelsinger said during a Yahoo Finance interview.

Intel stock is down more than 50% year to date. Bloomberg recently reported that Intel's rival Qualcomm is considering a takeover of the company.

But Intel needs clients way more than buyers.

Analyst lower Intel stock price target ahead of earnings

Goldman Sachs lowered its price target on Intel last week from $22 to $21 and maintained a sell rating on the shares, thefly.com reported. This move came ahead of Intel’s Q3 earnings, scheduled for release on Oct.31.

The firm reduced its 2025/26 non-GAAP earnings per share estimates by 7%, reflecting a slower recovery in Intel’s PC CPU and FPGA segments. However, a more favorable outlook for server CPUs partially offsets the reduction.

While Goldman acknowledges that Intel’s management is "taking necessary steps to right-size the organization," the firm remains cautious, as there are no clear signs that Intel will regain its process technology leadership.

"If anything, Intel may continue to outsource a significant fraction of its client CPU tiles to TSMC beyond 2025," the analyst added.

Earlier this month, Deutsche Bank also lowered its price target on Intel from $27 to $25, maintaining a hold rating.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

Deutsche Bank remains cautious on Intel, citing near-term challenges like margin pressures, increased competition, and difficulties in transitioning to new technology nodes. These issues are expected to affect Intel’s performance in the short term.

While Deutsche Bank sees potential for earnings improvement after 2024, it believes the "path to realizing this requires strong execution across a wide array of actions with little room for co-specific missteps or macro headwinds."

Intel stock closed at $22.40 on Oct. 22.

Related: Veteran fund manager sees world of pain coming for stocks