Caleres (NYSE:CAL) will release its quarterly earnings report on Thursday, 2024-12-05. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Caleres to report an earnings per share (EPS) of $1.36.

The market awaits Caleres's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

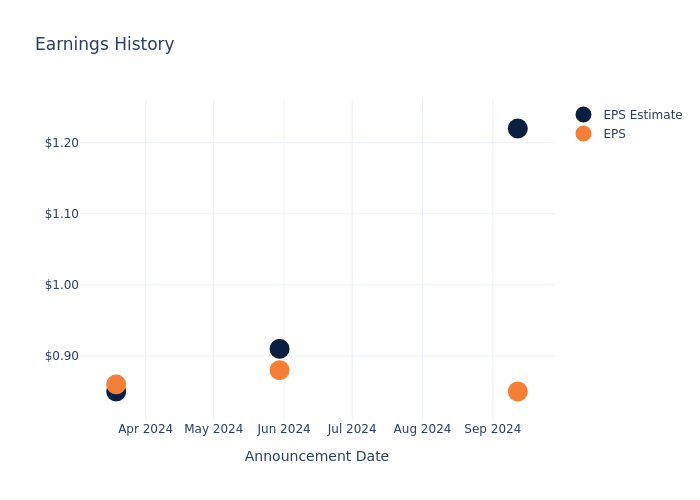

Earnings Track Record

Last quarter the company missed EPS by $0.37, which was followed by a 5.44% increase in the share price the next day.

Here's a look at Caleres's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.22 | 0.91 | 0.85 | 1.29 |

| EPS Actual | 0.85 | 0.88 | 0.86 | 1.37 |

| Price Change % | 5.0% | -4.0% | 1.0% | -4.0% |

Stock Performance

Shares of Caleres were trading at $32.47 as of December 03. Over the last 52-week period, shares are up 12.34%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analysts' Take on Caleres

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Caleres.

The consensus rating for Caleres is Neutral, based on 1 analyst ratings. With an average one-year price target of $30.0, there's a potential 7.61% downside.

Comparing Ratings with Competitors

In this analysis, we delve into the analyst ratings and average 1-year price targets of Guess and Stitch Fix, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Guess, with an average 1-year price target of $26.0, suggesting a potential 19.93% downside.

- The prevailing sentiment among analysts is an Neutral trajectory for Stitch Fix, with an average 1-year price target of $4.04, implying a potential 87.56% downside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Guess and Stitch Fix are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Caleres | Neutral | -1.76% | $310.88M | 4.91% |

| Guess | Buy | 0.81% | $319.94M | -4.97% |

| Stitch Fix | Neutral | -12.39% | $142.48M | -18.44% |

Key Takeaway:

Caleres ranks in the middle among its peers for revenue growth, with a slight decrease. It is at the top for gross profit, indicating strong operational efficiency. However, its return on equity is lower compared to its peers, positioning it towards the bottom in terms of profitability.

About Caleres

Caleres Inc is a footwear retailer in the United States. The Company's business are organized into two reportable segments are famous Footwear and Brand Portfolio. The famous Footwear segment is comprised of famous Footwear retail stores, famousfootwear.com and famousfootwear.ca. The Brand Portfolio segment offers retailers and consumers a carefully cultivated portfolio of top brands. This segment is comprised of wholesale operations that designs, develops, sources, manufactures, markets and distributes branded, licensed and private-label footwear to online retailers, national chains, department stores, mass merchandisers and independent retailers, as well as Company owned famous Footwear, Sam Edelman, Naturalizer and Allen Edmonds stores and e-commerce businesses.

A Deep Dive into Caleres's Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Caleres's revenue growth over a period of 3 months has faced challenges. As of 31 July, 2024, the company experienced a revenue decline of approximately -1.76%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 4.23%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Caleres's ROE excels beyond industry benchmarks, reaching 4.91%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Caleres's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.49%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.27.

To track all earnings releases for Caleres visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.