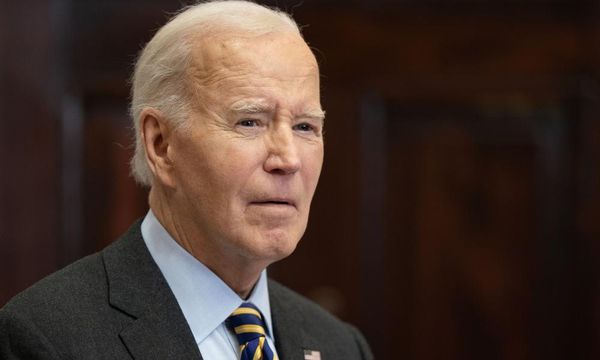

US President Joe Biden has proposed new taxes on the rich to help fund Medicare, saying the plan would help to extend the insurance programme’s solvency by 25 years and provide a degree of middle-class stability to millions of older adults.

In his plan, Biden is overtly declaring that the wealthy ought to shoulder a heavier tax burden. His budget would draw a direct line between those new taxes and the popular health insurance programme for people older than 65, essentially asking those who have fared best in the economy to subsidise the rest of the population.

Biden wants to increase the Medicare tax rate from 3.8 percent to 5 percent on income exceeding $400,000 per year, including salaries and capital gains. That would likely increase tax revenues by more than $117bn across 10 years, according to prior estimates by the Tax Policy Center.

MAGA Republicans on the Hill say the only way to be serious about preserving Medicare is to cut it.

Well, I think they’re wrong.

I’m releasing my budget this week. In it, I’ll propose a plan to extend the life of Medicare for a generation, without cutting benefits.

Here’s how: https://t.co/ySkIlQ6C8K

— President Biden (@POTUS) March 7, 2023

“This modest increase in Medicare contributions from those with the highest incomes will help keep the Medicare program strong for decades to come,” Biden wrote in a Tuesday essay in The New York Times. He called Medicare a “rock-solid guarantee that Americans have counted on to be there for them when they retire”.

The proposed Medicare changes were part of a fuller budget proposal that Biden planned to release on Thursday in Philadelphia. Pushing the proposal through Congress will likely be difficult, with Republicans in control of the House and Democrats holding only a slim majority in the Senate.

The proposal is a direct challenge to GOP lawmakers, who have argued that economic growth comes from tax cuts like those pushed through by President Donald Trump in 2017. Those cuts disproportionately favoured wealthier households and companies. They contributed to higher budget deficits when growth failed to boom as Trump had promised and the economy was then derailed in 2020 by the coronavirus pandemic.

The conflicting worldviews on how taxes would affect the economy is part of a broader showdown. Biden and Congress need to reach a deal to raise the government’s borrowing authority at some point towards the middle of the year, or else the government could default and plunge the US into a debilitating recession.

In advance of the 2024 campaign season, Democrats have ramped up talk around Medicare, promising to fend off any Republican attempts to cut the programme, although so far the GOP has pledged to avoid any cuts. Still, Republican legislators have reached little consensus on how to fulfil their promise to put the government on a path towards balancing the federal budget in the next 10 years.

Last year, members of the House Republican Study Committee proposed raising the eligibility age for Medicare to 67, which would match the Social Security programme, the US public pension scheme. But that idea has not moved forward in a split Congress.

Republicans have denied that they planned to cut Medicare. A proposal from Republican Senator Rick Scott of Florida, which would require Congress to reconsider all federal laws every five years, including Medicare, has gained little traction.

Biden’s plan was also intended to close what the White House describes as loopholes that allow people to avoid Medicare taxes on some income. Besides the taxes, Biden wanted to expand Medicare’s ability to negotiate the cost of prescription drugs, a strategy that began with the Inflation Reduction Act. He signed the sweeping legislation last year.

Taken together, Biden’s new proposals would help shore up a key trust fund that pays for Medicare, which provides healthcare for older adults. According to the White House, the changes would keep the fund solvent until the 2050s, about 25 years longer than currently expected.

Changes would also be made to Medicare benefits. Biden wants to limit cost sharing for some generic drugs to only $2. The idea would lower out-of-pocket costs for treating hypertension, high cholesterol and other ailments.

In addition, the budget would end cost-sharing for up to three mental health or behavioural health visits per year.