Bank of England boss Andrew Bailey has warned over mounting signs that inflation pressures may last longer than first thought.

The Bank’s governor told MPs on the Treasury Select Committee that financial markets now do not expect energy prices to start easing back until the the second half of 2023.

Until a few months ago, wholesale gas prices had been expected to start falling next summer.

He said it was a “big shift” and suggested it may impact the Bank’s expectations that higher levels of inflation would be only temporary.

Part of the change in gas price expectations is down to rising tensions between Russia and Ukraine, he added.

He told MPs: “I have to be honest with you, that’s a very great concern.”

Mr Bailey also said oil prices have jumped 12% since the start of January.

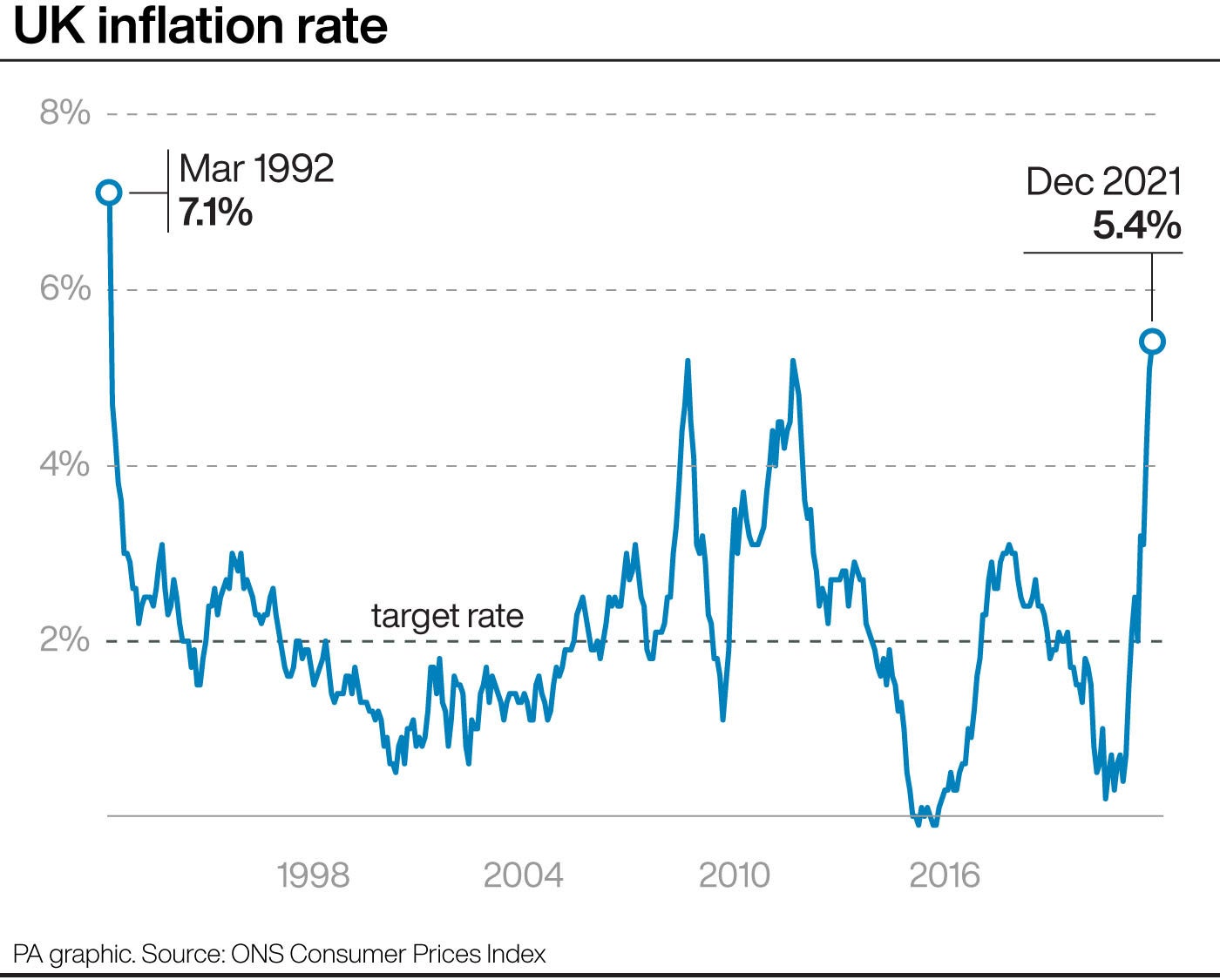

The hearing came as official figures on Wednesday showed inflation jumped to 5.4% in December – the highest level for almost 30 years.

The Bank and its global counterparts have until now stuck to the view that many of the factors pushing inflation – such as global supply chain disruption and wholesale energy price rises – would be “transitory”.

But it now looks like the pressures may not be as short-lived as first hoped.

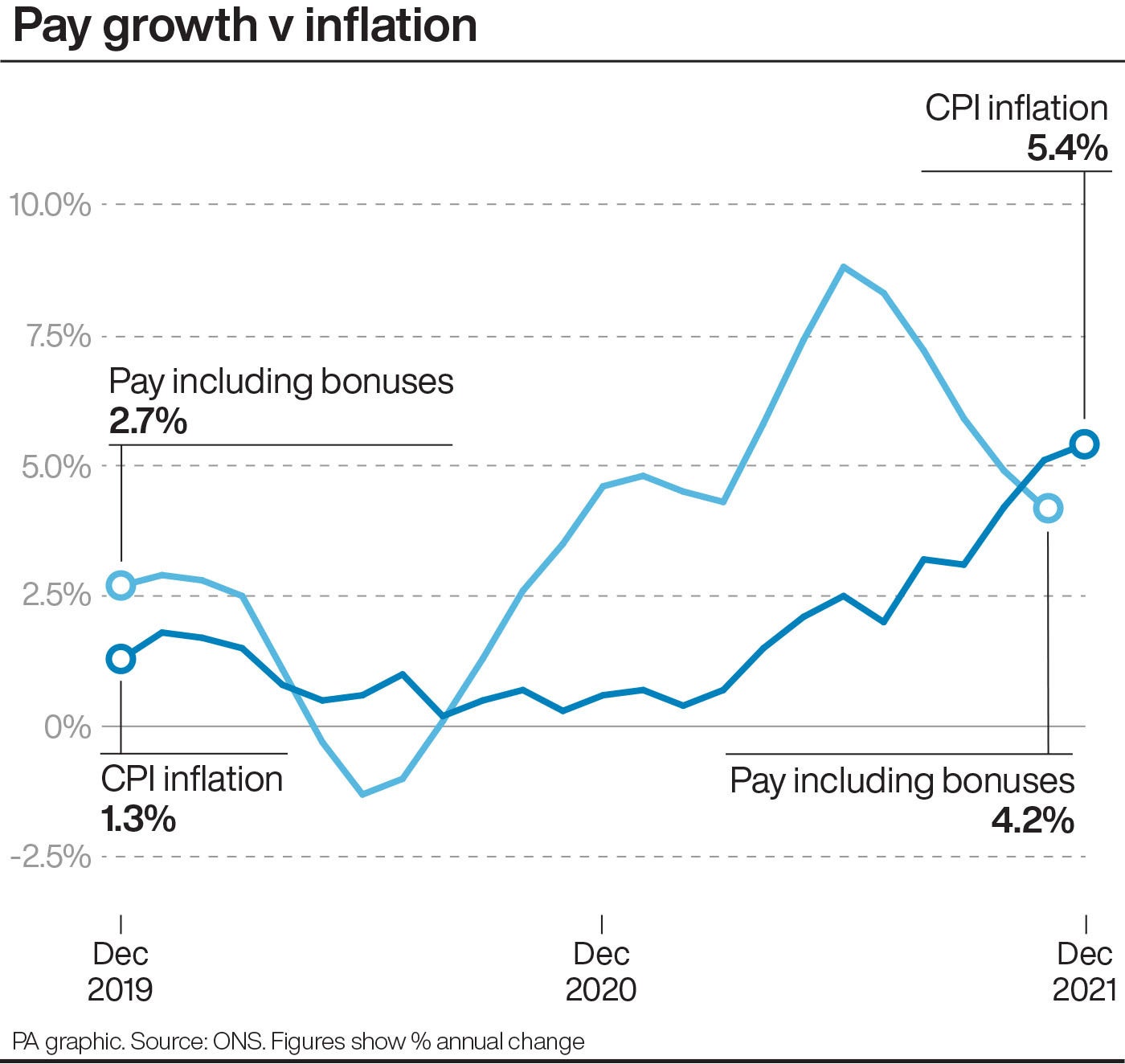

Mr Bailey also told the cross-party Commons committee that there were worrying signs of more broad-based wage rises across the UK economy.

Wages have been rising steeply for certain jobs and in some sectors as recent shortages of workers, such as lorry drivers, have led firms to ramp up pay to attract and retain employees.

But the fear for policymakers is that wage hikes spread economy-wide in response to rising inflation, which can mean that above-target inflation becomes more entrenched.

He said a recent annual survey of regional Bank agents had shown “they’re beginning to see some evidence of this”.

The Bank raised interest rates in December, from 0.1% to 0.25%, to help control rising inflation.

It had held off in November, to the surprise of financial markets, amid uncertainty over what impact the end of furlough would have on the jobs market.

“We have since seen the evidence that the ending of the furlough scheme did not have any impact,” said Mr Bailey.

Committee chairman Mel Stride asked Mr Bailey if it was a “judgment call you got wrong” in fearing that the end of furlough could hit the jobs market.

“That’s a hindsight judgment,” Mr Bailey said in response.

The Bank is under pressure to act to cool inflation, with experts pencilling in another back-to-back rate hike at its next meeting in February.

Mr Bailey stressed the Bank could do little to bring gas prices down or ease global supply chain disruption, but would do “whatever we can”.

He acknowledged that low earners are set to be hit hardest by energy price hikes and said it was an “active debate” what the Government could do to help ease the strain on households.

Sir Jon Conliffe, deputy governor for financial stability for the Bank, told the committee the Bank has witnessed rising debt levels and insolvencies across small and medium-sized UK firms but does not expect this to significantly disrupt the UK’s financial stability.

He said: “The issue is much more around small and medium businesses particularly in the worst-affected sectors like hospitality and personal services.

“The credit that SMEs have taken on, much of it has been covenant-guaranteed and a lot is six-year timeframes with pay-as-you-grow guarantees.

“The chance of that turning into something which is big enough to trigger a financial stability problem is quite small but it doesn’t meant there won’t be insolvencies and in some sectors they might be quite high.

“And there may be some financial institutions that are particularly concentrated on those sectors that could have problems, but that is one of the things we looked at in the stress tests.”