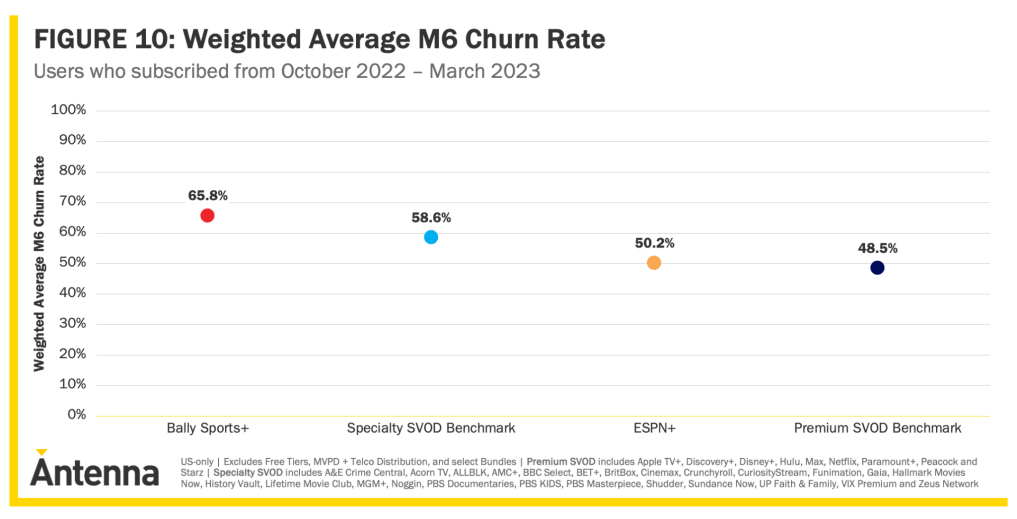

Nearly 66% of users who sign up for Bally Sports Plus cancel their subscription within six months, according to new research published by Antenna.

And at its peak, the research company said, the regional sports network's $20-a-month direct-to-consumer streaming service had only around 97,000 customers nationally.

As Bally Sports’s parent company, Diamond Sports Group, fights for survival in a Texas bankruptcy court, the numbers explain why its DTC service, launched in September 2022, hasn't come close to offsetting rapid decay of Diamond's linear platforms.

A platform built around seasonal sports can probably expect higher churn. But for Bally Sports Plus, the metric is particularly daunting, especially considering this context: the current churn rate across all premium SVODs is 49%, which is considered pretty in its own right.

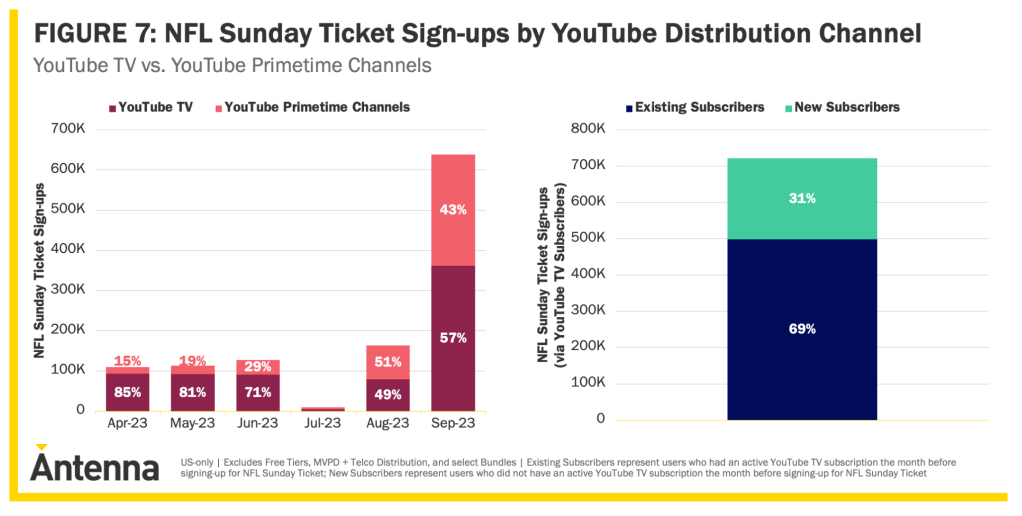

Antenna's latest report, “State of Subscriptions: Sports,” published Tuesday, had a few other nuggets in it — we particularly like this one that shows that more than 31% of “NFL Sunday Ticket” customers arriving via YouTube TV are first-time subscribers to the out-of-market games package.

Also, 57% of all Sunday Ticket subscribers arrive via Google's virtual MVPD, Antenna said. This data conflicts with Morgan Stanley Research numbers published last month that suggested only around 20% of subscribers come from YouTube TV vs. the YouTube Primetime Channels marketplace.