The big four banks are split on whether the Reserve Bank will pause rate rises on Tuesday, suggesting it will be a tough call for the central bank.

Meanwhile, the Australian share market closed higher on Thursday, boosted by tech, miners and banks.

It followed the tech-heavy Nasdaq leading the gains on Wall Street overnight.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:15pm AEDT

By Rhiana Whitson

-

ASX 200: +1% to 7,112

-

All Ords: +1% to 7,312

-

Australian dollar: Flat at 66.87 US cents

-

Dow Jones: +0.1% to 32,717 points

-

S&P 500: +01.4% to 4,028

-

Nasdaq: +1.8% to 11,926

-

FTSE: +1 % to 7,564 points

-

DAX: +1.2% to 15,328

-

EuroStoxx 600: +1.3% to 450 points

-

Brent crude: -0.3% $US78:04/ barrel

-

Spot gold: -0.3% $US1,977.60/ ounce

-

Iron ore: +1.5% to $US124.40 / tonne (overnight)

-

Bitcoin: +4.1% to $US28,489

Goodbye from me

By Rhiana Whitson

That's it for today's markets blog.

It was a strong day on the ASX, with tech, miners and banks leading the way. Catch up on today's news by clicking through the key events.

We'll see you bright and early tomorrow.

ASX gains 1 per cent

By Rhiana Whitson

It was a strong day on the Australian share market, with tech, banks and miners leading the charge.

The S&P/ASX200 closed up Thursday, gaining 1% to 7,122.

The All Ords closed up, gaining 1% to 7,312.

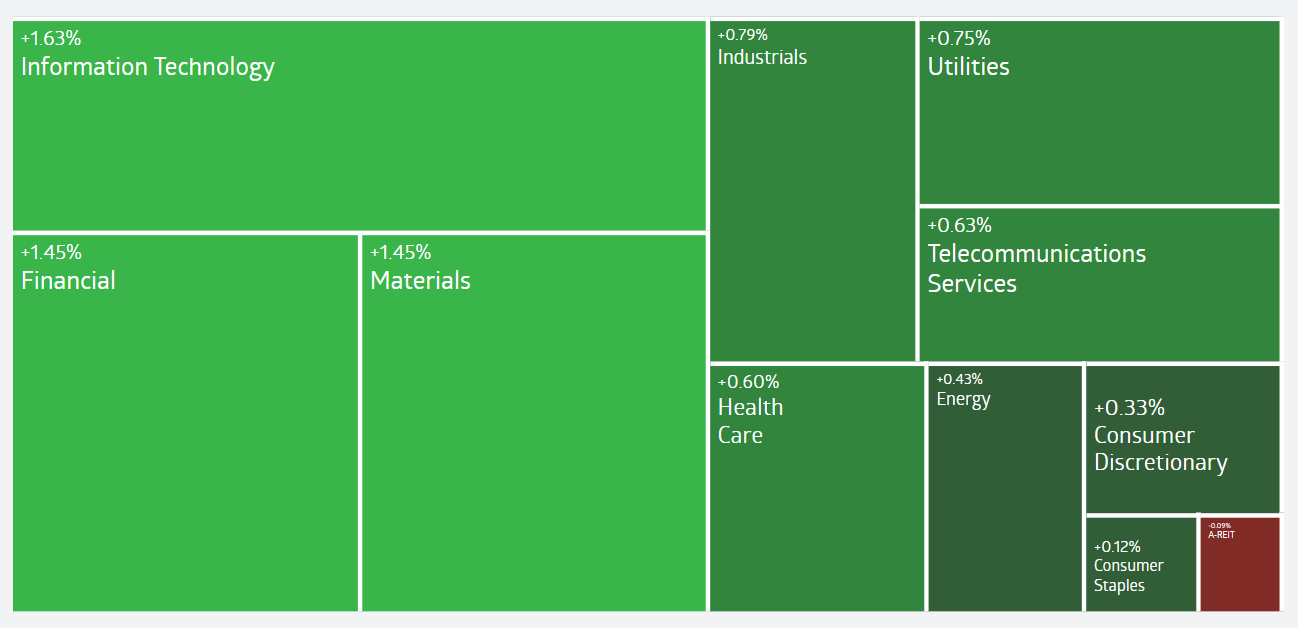

10 of 11 sectors closed in the green. Real estate was the only sector dragging on the benchmark index:

And here is a look at companies with the biggest gains and declines:

Rabobank expects a rate hike next week

By Rhiana Whitson

Predictions about next week's cash rate decision are coming in thick and fast.

As I posted earlier, the major banks are split on whether we'll get an 11th consecutive rate rise.

Rabobank senior strategist Benjamin Picton reckons we will.

"It remains our view that the RBA will hike by a further 25bps in April to take the cash rate to 3.85% ahead of a possible pause in May," Mr Picton says.

Why? He notes the ABS' monthly CPI data doesn't include core inflation, which is the RBA's preferred measure.

"The quarterly inflation data released on April 26th will be decisive for informing the actions of the central bank at the May board meeting," Mr Picton says.

"In the meantime, the softer headline inflation print for the month of February will not be sufficient for the RBA to abandon their tightening bias as labour market indicators, forward indicators and the still comparatively high level of inflation all point to the need for further tightening."

Of course, others will and do have a different view.

All will be revealed on Tuesday at 2.30pm AEDT.

Nickel supplier down 5 per cent, a week after takeover bid from Twiggy Forrest's Wyloo Metals

By Rhiana Whitson

In company news, Mincor Resources has been forced to withdraw its full-year nickel production guidance after a dispute with customer BHP.

Shares of Mincor Resources fell as much as 5% to $1.425 on the news.

It comes after a last week Mincor, received a $760 million offer from Andrew Forrest’s Wyloo Metals.

The disagreement between Mincor and BHP (which is considered a potential rival bidder) stems from product quality problems.

The issue relates to ore feed Mincor supplies to BHP's Nickel West from its restarted Kambalda operations.

The miner withdrew its FY23 production outlook on the back of uncertainty about the future of agreement with BHP.

There is concern the announcement could affect Wyloo Metals' takeover offer.

ABC News/Reuters

Markets snapshot at 2:30pm AEDT

By Rhiana Whitson

-

ASX 200: +0.9% to 7,112

-

All Ords: +0.9% to 7,303

-

Australian dollar: Flat at 66.81 US cents

-

Dow Jones: +0.1% to 32,717 points

-

S&P 500: +01.4% to 4,028

-

Nasdaq: +1.8% to 11,926

-

FTSE: +1 % to 7,564 points

-

DAX: +1.2% to 15,328

-

EuroStoxx 600: +1.3% to 450 points

-

Brent crude: -0.4% $US77.95/ barrel

-

Spot gold: -0.3% $US1,977.60/ ounce

-

Iron ore: +1.5% to $US124.40 / tonne (overnight)

-

Bitcoin: +4.1% to $US28,489

Banks split on rate rise pause

By Rhiana Whitson

Australia's biggest banks are divided on whether we'll cop an 11th consecutive rate hike when the Reserve Bank of Australia meets on Tuesday.

CBA and NAB have both updated their forecasts this morning.

CBA now expects the RBA will hit the pause button on rate hikes next week, but hike again in May.

NAB still thinks the RBA will lift the cash rate on Tuesday, but that it'll be the last hike in the cycle.

RateCity has summarised the cash rate forecasts of the big four banks:

CBA: Pause in April, 0.25%-point hike in May to cash rate peak of 3.85%, four cuts from Nov 2023 – May 2024 back down to 2.85%.

Westpac: Pause in April, 0.25%-point hike in May to cash rate peak of 3.85%, six cuts from Feb 2024 – May 2025 back down to 2.35%.

NAB: 0.25%-point hike in April to cash rate peak of 3.85%. Three cuts in 2024 across Feb – April back down to 3.10%.

ANZ: 0.25%-point hike in April, 0.25%-point hike in May to cash rate peak of 4.1%. One cut in Nov 2024 to 3.85%.

RateCity research director Sally Tindall said the split between the banks suggested it would be a close call for the RBA on Tuesday.

“The RBA is looking for an opportunity to pause and will therefore be looking for one in the data,” Ms Tindall said.

“One reservation the RBA might have is what message a pause will send to Australian households. The last thing the Board wants is for people to think that’s the end of the hikes.

“Inflation is still at 6.8 per cent – there is no way the RBA will rule out any more increases.

“If the Board does decide to pause, it’s likely to come with a caveat that there could still be more hikes ahead,” she said.

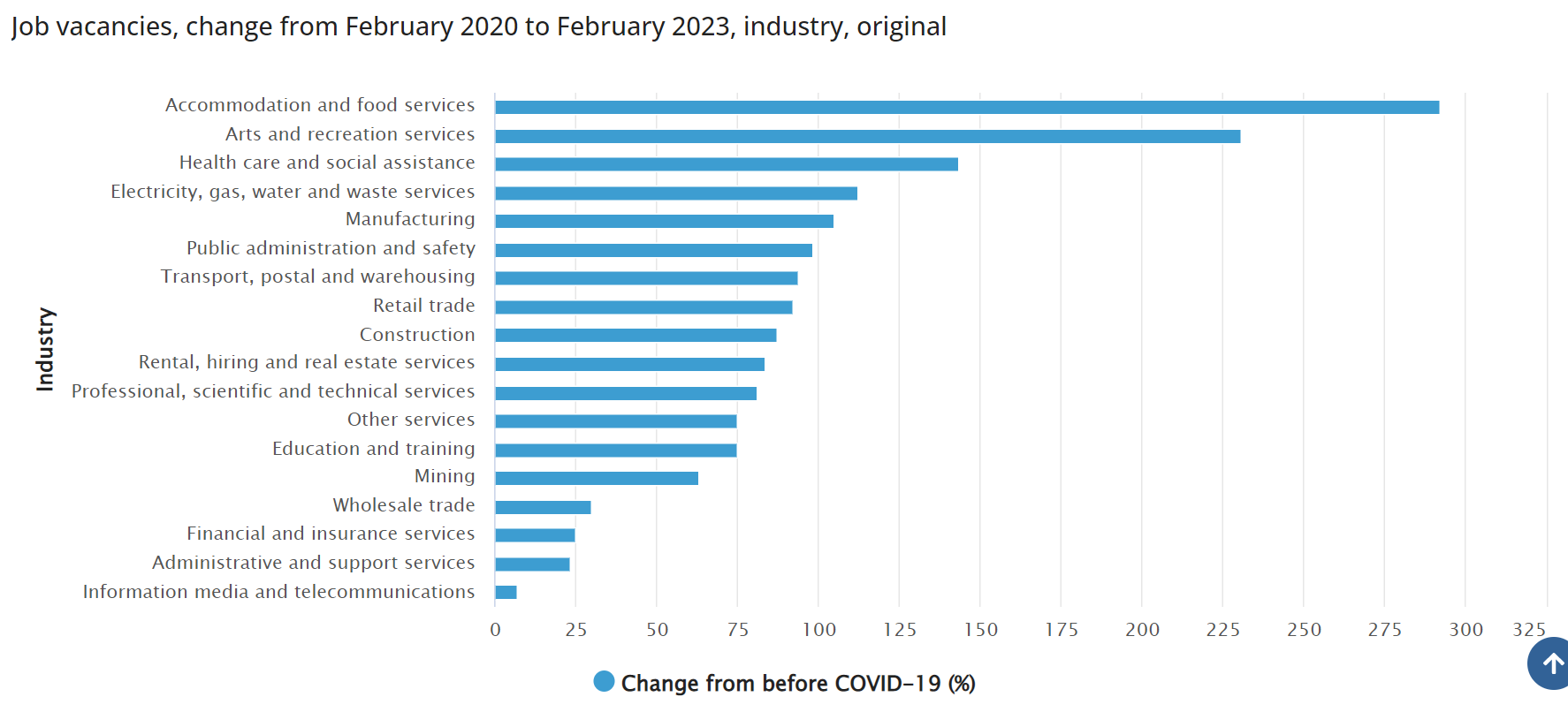

Job vacancies ease in February but remain high

By Rhiana Whitson

There were 439,000 job vacancies in February. That's a fall of 1 per cent (-7,000) from November, according to new figures from the Australian Bureau of Statistics (ABS).

"The number of job vacancies fell by around 1 per cent between November and February, and were down by 9 per cent from the peak in May 2022," Bjorn Jarvis, ABS head of labour statistics, said

This was the third consecutive quarter of declining job vacancies in Australia, but the labour market is still very tight.

“Job vacancies in February 2023 were still nearly double what they were three years ago, just before the start of the pandemic. There is still a very high demand for labour from employers across Australia and across all industries," Mr Jarvis said.

The percentage of businesses reporting at least one vacancy fell for the first time in six quarters, down from 28 per cent in November to 24 per cent in February.

This was still more than double what it had been in February 2020 (11 per cent).

Private and public sectors both saw a quaretrly decline, each falling around 1 per cent from November 2022 to February 2023.

The biggest fall in job vacancies was in Western Australia, down 15 per cent.

New South Wales recorded the largest percentage quarterly growth, up 9 per cent.

“While there have been some recent falls in job vacancies in some states and territories, they continue to be high in all states and territories,” Mr Jarvis said.

He said while job vacancies fell in 11 of the 18 industries, they remained high across most industries when compared with February 2020.

“This continued to be most acute in the Accommodation and food services and Arts and recreation services industries, where vacancies were around three to four times what they were before the pandemic,” Mr Jarvis said.

Markets snapshot at 12:30pm AEDT

By Rhiana Whitson

-

ASX 200: +0.9% to 7,115

-

All Ords: +0.9% to 7,304

-

Australian dollar: -02% 66.66 US cents

-

Dow Jones: +0.1% to 32,717 points

-

S&P 500: +01.4% to 4,028

-

Nasdaq: +1.8% to 11,926

-

FTSE: +1 % to 7,564 points

-

DAX: +1.2% to 15,328

-

EuroStoxx 600: +1.3% to 450 points

-

Brent crude: -0.1% $US78.14/ barrel

-

Spot gold: -0.4% $US1,975.00/ ounce

-

Iron ore: +1.5% to $US124.40 / tonne (overnight)

-

Bitcoin: +4.1% to $US28,379

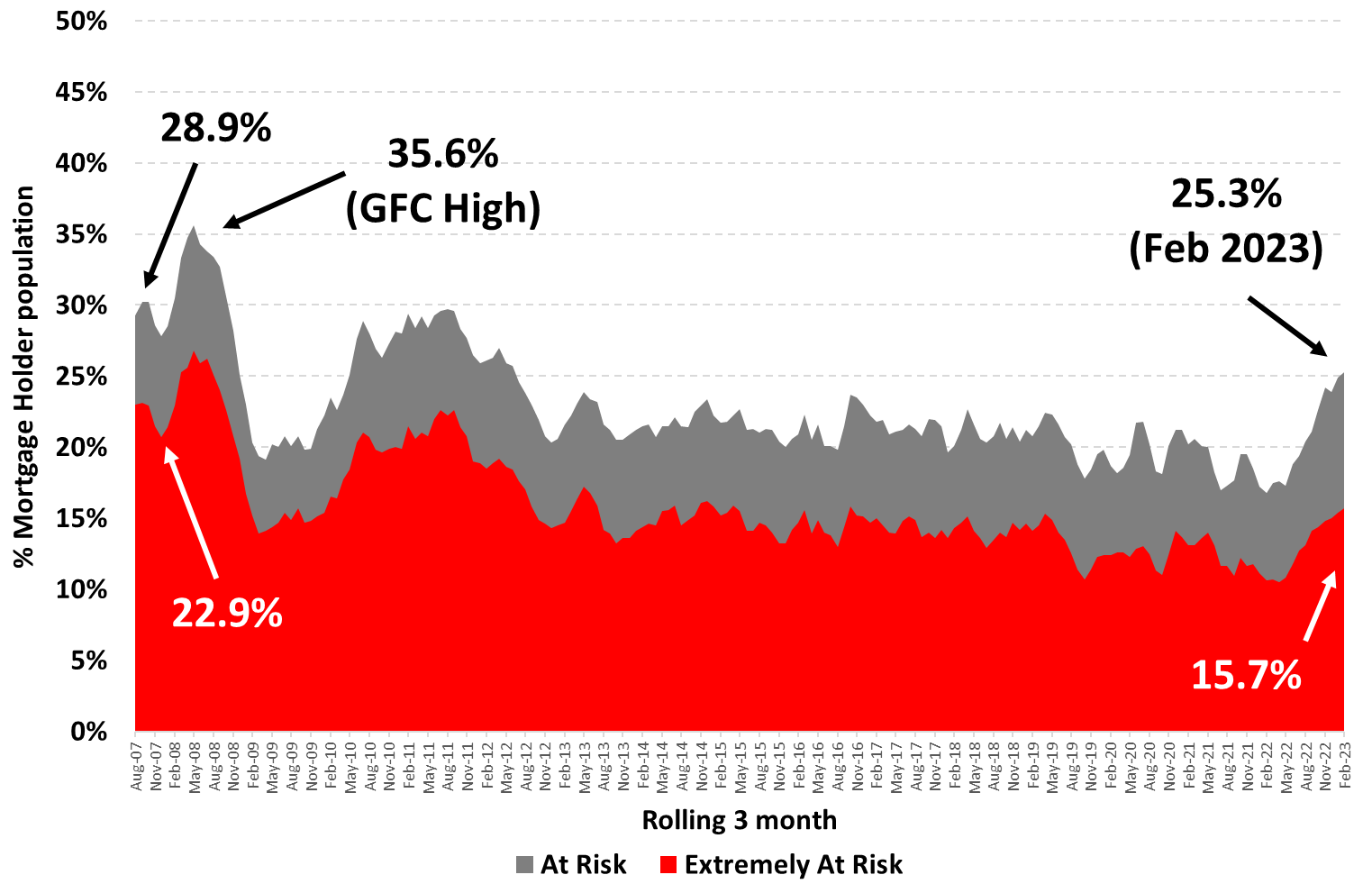

Half a million more Australians at risk of mortgage stress due to rate rises: Roy Morgan

By Michael Janda

While there always considerable debate about what is an "affordable" mortgage — case in point, Justice Perram's famous 'wagyu and shiraz' responsible lending judgement — there's no doubt many more people are struggle as rates have jumped.

Research from Roy Morgan, based on interviews with more than 60,000 Australians each year, reckons around a quarter of mortgage borrowers (1.23 million) are now at risk of "mortgage stress", which it defines based on their income level and the proportion of that income they spend on their loan.

That number has increased by 514,000 over the past year, following 10 consecutive interest rate hikes (in fact, these figures are from February and so don't include the March hike).

While that sounds bad, things have been far worse.

It's the highest level since September 2012, but risk of mortgage stress peaked at 35.6% of households in 2008, when the cash rate spent half a year at 7.25% (remember, it's just half that at 3.6% currently).

As I noted in this analysis, there's a strong argument to be made that the global financial crisis, via the rate cuts it induced, actually saved Australia from its own mortgage default crisis.

Mining, banks, tech lead the gains on the ASX 200

By Rhiana Whitson

We're not far away from midday and Australian shares have jumped to their highest in more than two weeks, boosted by mining stocks, while technology names tracked gains in their peers on Wall Street.

The S&P/ASX 200 index rose 0.9 per cent to 7,114 by 11:37am AEDT after adding 0.2 per cent on Wednesday.

Mining stocks led the gains. The index climbed 1.6 per cent to hit a near three-week high after iron ore prices jumped on optimism around steel demand in China.

Sector behemoths BHP Group, Rio Tinto, and Fortescue Metals added between 1.6 per cent and 2.4 per cent.

Financials rose 1 per cent, with the "Big Four" banks trading 0.7per cent-1.4 per cent higher.

Technology stocks jumped 1.5 per cent, with ASX-listed shares of Block Inc and Xero adding 2.7 per cent and 1.1 per cent, respectively.

Zip Co Ltd soared 12 per cent to hit a more than five-week high. The BNPL firm said it will divest its businesses in Central and Eastern Europe and South Africa, and is on track to shut down its operations in the Middle East.

Shares in healthcare and real estate companies also boosted the ASX200 with gains of 0.3 per cent-0.7 per cent.

Asset manager HMC Capital, whose shares were yet to resume trading, said it will buy 11 private hospitals from U.S.-based Medical Properties Trust for $1.2 billion.

Gold explorers fell 1 per cent, underpinned by weaker bullion prices. Northern Star Resources and Newcrest Mining dropped 0.6 per cent and 1.2 per cent, respectively.

Iress Ltd and Lake Resources were the top gainers on the ASX200.

New Zealand's benchmark S&P/NZX 50 index rose 0.6 per cent to 11,805.

The Reserve Bank doesn't need an overhaul, Australia needs fairer policies, says former governor

By Rhiana Whitson

As rates rise, criticism of the Reserve Bank grows. A review into how the central bank operates is expected to be handed to the federal government tomorrow, but we won't see what's in it for a while yet.

On the eve of the RBA review's close, ABC News business and economics reporter Gareth Hutchens asks former RBA Governor Bernie Fraser what he thinks needs to change:

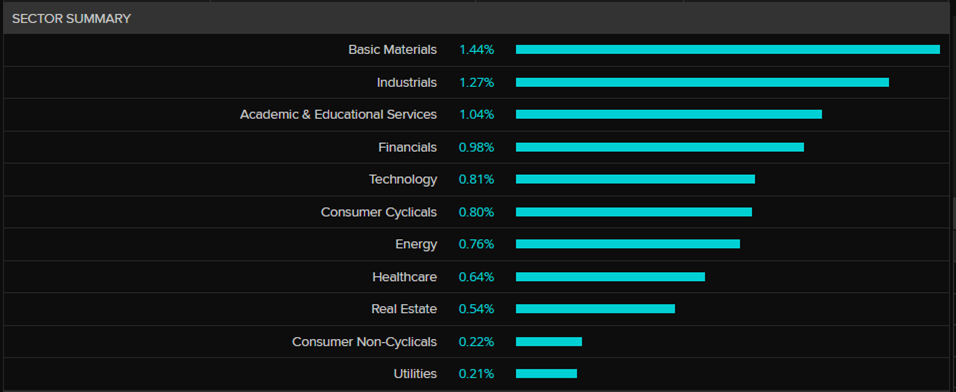

ASX top sectors, gains and declines at 10:40am AEDT

By Rhiana Whitson

Trade is well underway, and here's how things are looking:

Here are the top gains and declines:

Markets snapshot at 10:15am AEDT

By Rhiana Whitson

-

ASX 200: +0.87% to 7,111

-

All Ords: +0.85% to 7,297

-

Australian dollar: Flat at 66.81 US cents

-

Dow Jones: +0.1% to 32,717 points

-

S&P 500: +01.4% to 4,028

-

Nasdaq: +1.8% to 11,926

-

FTSE: +1 % to 7,564 points

-

DAX: +1.2% to 15,328

-

EuroStoxx 600: +1.3% to 450 points

-

Brent crude: Flat $US78.28/ barrel

-

Spot gold: -0.2% $US1,981.20/ ounce

-

Iron ore: +1.5% to $US124.40 / tonne

-

Bitcoin: +4.1% to $US28,379

Sergio Ermotti returns as UBS CEO to steer Credit Suisse takeover

By Rhiana Whitson

UBS Group AG has rehired Sergio Ermotti as CEO to steer its massive takeover of neighbour Credit Suisse - a surprise move to take advantage of the Swiss banker's experience rebuilding the bank after the global financial crisis.

The trader turned corporate problem fixer faces the tough challenge of laying off thousands of staff, cutting back Credit Suisse's investment bank and reassuring the world's wealthy that UBS remains a safe harbour for their cash.

"We felt we had a better horse," UBS chairman Colm Kelleher said, referring to the decision to replace current CEO Ralph Hamers after less than three years in charge.

Mr Kelleher said he brought back Ermotti because he was best equipped to see through the biggest deal in finance since the global banking crash more than a decade ago.

"This is not a Swiss solution," he said, seeking to play down any role of Ermotti's nationality in getting the job, and instead emphasised his focus was on the large risks of making the merger work for UBS.

"Being Swiss helps," Kelleher said. "But the majority of our business is global."

Mr Ermotti, who was chief executive of UBS from 2011 to 2020 and is now chairman of Swiss Re, will take the helm from April 5.

The 62-year old is credited with executing UBS's turnaround after a series of scandals and losses nearly caused the bank's implosion.

He made a plea on Wednesday for "a little bit of patience" over a "couple of months" to allow the bank to forge its strategic plan.

"We cannot rush into decisions which are regrettable," he told journalists.

He said he had returned to UBS after feeling what he termed "a call of duty" and added he had always wanted to be involved in a massive transaction like the takeover of Credit Suisse.

He takes charge weeks after UBS bought its Swiss rival in a shotgun merger engineered by Swiss authorities to stem turmoil after Credit Suisse ran aground.

That deal makes UBS Switzerland's one and only global bank, underpinned by roughly 260 billion francs ($US283 billion) in state loans and guarantees, a risky bet that makes the Swiss economy more dependent on a single lender.

In a reminder of how UBS will be inheriting some of Credit Suisse's troubles, the US Senate Finance Committee found on Wednesday the bank had violated a 2014 tax evasion deal and said its new owners or the Swiss government should assume responsibility for any future fines.

Still, UBS shares rose 3.6 per cent on Wednesday.

- Reuters

Bonds have been volatile, but currencies... Not so much, says analyst

By Rhiana Whitson

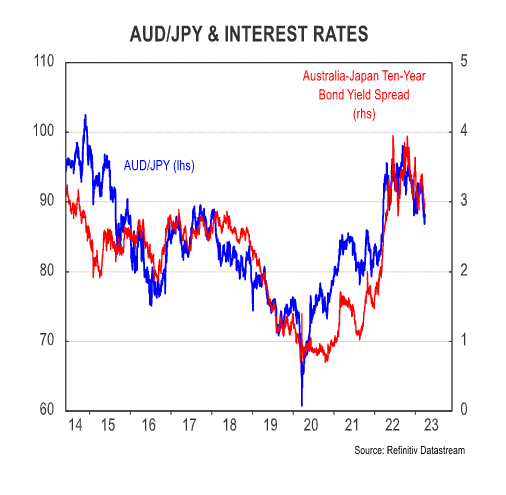

CBA currency analyst Carol Kong's Asia Open note this morning has an interesting chart about the relationship between the Aussie dollar and Japanese yen.

Ms Kong notes that volatility in the global bond market has recently surged to levels last seen during the 2008-09 global financial crisis in the wake of the banking turmoil.

She says by comparison, moves in the currency market have been relatively contained:

"AUD/JPY –one of the most volatile major currency pairs–fell modestly in line with the narrowing of the Australian-Japan 10 year bond yield spread since the collapse of Silicon Valley Bank (see chart). AUD/JPY would have been much weaker if volatility in equities and commodities had also surged, and if safe haven demand underpinned the USD," Ms Kong says.

"That said, we consider AUD/JPY has scope to fall further. We expect the 10 year Japanese government bond yields to recover from its current 0.30% to the Bank of Japan’s upper target of 0.50%.

"Or even higher to around 1% if the BoJ abandons its yield curve control program as we expect. By contrast, the 10 year Australian government bond yields can fall further if we are right about the RBA getting close to the end of its tightening cycle. "

Check out here chart of the day:

Top gains and declines on Wall Street

By Rhiana Whitson

Wondering which stocks had the biggest gains and declined on Wall Street? Here's a snapshot of the S&P500, the Nasdaq andthe Dow Jones Industrial Average.

Will interest rates rise again next week?

By Rhiana Whitson

In case you missed it, the official measure of inflation has fallen for the second month in a row, easing pressure on the Reserve Bank of Australia (RBA) to hike interest rates next week.

ABC News business reporter and presenter Rachel Pupazzoni explains:

No news is good news

By Michael Janda

Good morning, jumping in with a short guest post on the non-drivers of a positive night for the markets.

NAB's Rodrigo Catril says the overnight gains were an extension of "positive vibes" during the Asia-Pacific trading session yesterday.

"The lack of new news has seemingly been a positive for equity investors while gains seen during our APAC session extended into Europe and the US overnight," he wrote.

"Yesterday Asian equities (particularly the tech sector) were boosted following the previous days news that Alibaba plans to split into six units and seek separate listings.

"Its Hong Kong-listed shares were 12% higher, tracking the previous night gains on Wall Street. Gains in Alibaba also sparked a rally in Chinese tech shares with many analysts speculating the Alibaba decision could instigate other big tech companies to follow a similar move."

The only other market driver of note was Fed chair Jerome Powell, but it sounds like he didn't say much we haven't heard before.

"Speaking before lawmakers in Washington, Fed chair Powell was asked when the central bank will stop raising interest rates," Catril observed.

"Powell noted that the Fed forecast shows another quarter percentage-point hike this year. Fed pricing expectations are little changed, with a roughly even chance of a 25bp [basis point] hike priced for the next meeting in May and cuts priced by the end of the year."

Markets snapshot at 815am AEDT

By Rhiana Whitson

- ASX SPI futures: +0.7% to 7,119 points

- Australian dollar: +0.5% to 66.85 US cents

- Dow Jones: +0.1% to 32,717 points

- S&P 500: +01.4% to 4,028

- Nasdaq: +1.8% to 11,926

- FTSE: +1 % to 7,564 points

- DAX: +1.2% to 15,328

- EuroStoxx 600: +1.3% to 450 points

- Brent crude: -0.7% to $US78.12 / barrel

- Spot gold: +0.4% $US1,983.62 / ounce

- Iron ore: +1.5% to $US124.40 / tonne

- Bitcoin: +4.1% to $US28,379