ARM Holdings is one of those tech companies that fly under the radar of everyone except everybody in tech.

In 2020, Nvidia (NVDA) offered $40 billion to buy ARM (ARM) from Softbank (SFTBY) , the Japanese tech investment giant, but the deal was blocked by regulators in the United States and Europe.

Instead, the company, which is based in Cambridge, England, was spun off in September 2023 in an initial public public offering, although Softbank still owns 90% of the shares.

Related: Analysts recharge Rivian price target after earnings

If you'd bought ARM shares at anywhere near the $51-a-share IPO price, you've done well.

At Wednesday's close at $106.07, down 1.6% on the day, the stock was still up 108% since the IPO.

The gain may be smaller when the stock opens on Thursday. Shares fell 9% to $96.56 in after-hours trading after the company reported fiscal-fourth-quarter results.

The results were hardly bad. In fact, the company handily beat on revenue and earnings per share. The company reported an adjusted 36 cents a share on sales of $928 million in the quarter ended March 31. Analysts had expected earnings of 30 cents a share on sales of $866 million.

In fiscal 2023, ARM earned an adjusted 2 cents a share on sales of $633 million.

The stock seems to have fallen more than 9% after hours because its revenue guidance for full-year fiscal 2025 was $3.8 billion to $4.1 billion, a little light of the street estimate. (But that is still a gain of 17.5% to 26.8%.)

Why ARM shares are getting sold

One can argue that stock's battering was a function of one of three forces.

- Investors sold because the guidance was light.

- Investors sold (or their computers sold) because the full-year earnings per share were just $3.95, and they wanted $3.98 or more.

- Investors sold because ARM's forward price/earnings ratio is about 70, meaning ARM is much too expensive.

The first two points seem picky. The last point is valid. A p/e ratio that is that big suggests getting the price to move significantly higher requires significant earnings gains.

More on AI Stocks:

- Analyst unveils eye-popping Palantir stock price target after Oracle deal

- Veteran analyst delivers blunt warning about Nvidia's stock

- Analysts revamp Microsoft stock price target amid OpenAI reports

Whatever, ARM is a very healthy company. Its gross profit margin is north of 90%. And the company sees revenue and earnings growing 20% for at least the next three years — with artificial intelligence demands increasingly powering much of its revenue growth.

So, it is possible the selling could create a terrific buying opportunity. The ARM chart suggests the stock has a support level at around $94.

ARM is worth watching

Why ARM matters is this: ARM provides basic designs and technology for the semiconductors produced by its clients.

What the chipmakers and their clients then do is customize and build on those blueprints.

Apple (AAPL) uses ARM-designed chips in its iPhones. So does Samsung and just about everyone who makes cellphones.

Nvidia uses chips built on an ARM architecture. Other customers: Arteris (AIP) and Microsoft (MSFT) .

ARM makes its money by:

- Selling its designs. About 50% of all semiconductors use an ARM-based architecture, according to the Motley Fool.

- Collecting royalties from all the chips that customers ship based on ARM designs.

The designs are also used by chipmakers who make semiconductors used in automotive products. They show up in applications involving the Internet of Things.

And, increasingly, companies, like Nvidia, that are building graphical processing units (GPUs) to expand artificial intelligence use ARM-designed units so their GPUs work better.

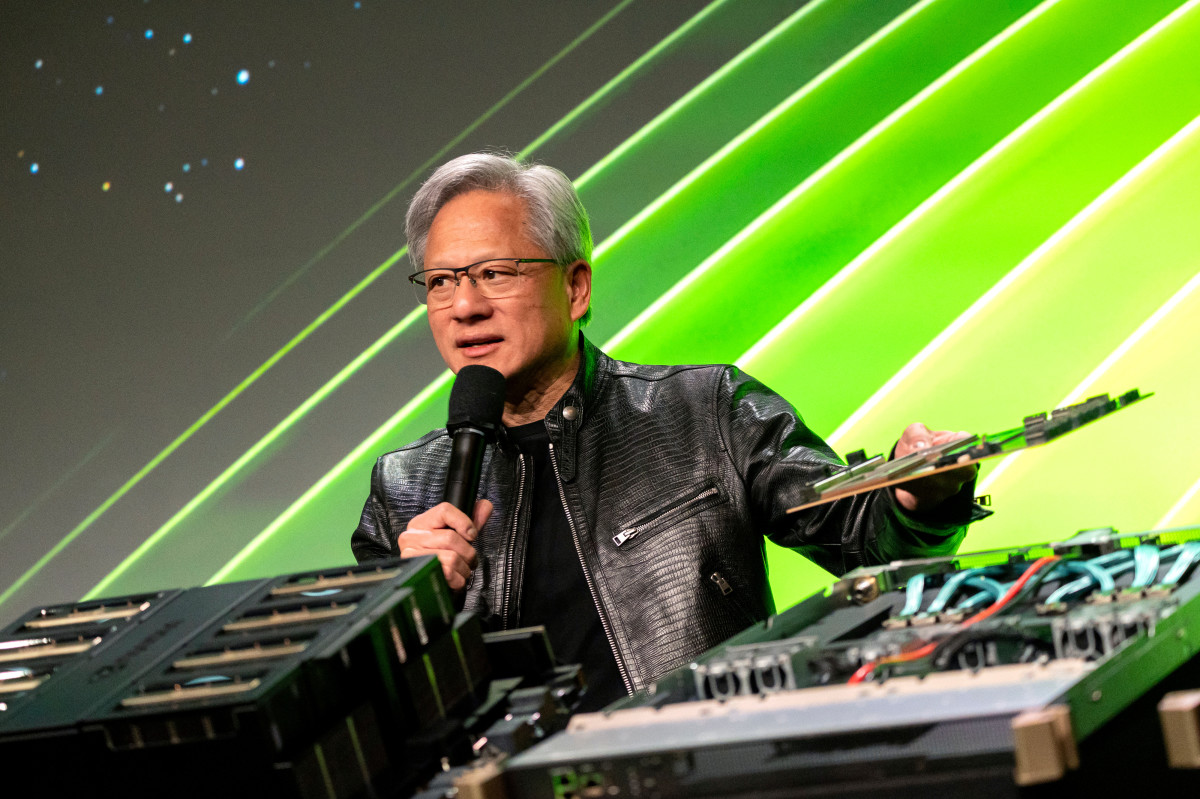

At a Las Vegas conference Wednesday, Nvidia CEO Jensen Huang said he would still like to buy the company. Late in 2023, in fact, Nvidia bought a $147-million stake in the company.

But to buy all of Arm Holdings will cost Nvidia a lot more than the $40 billion price in 2020. ARM's market capitalization on Wednesday was $109 billion.

Related: Veteran fund manager picks favorite stocks for 2024