/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

For years, mobile connectivity had one fatal flaw. Dead zones. Now, Tim Cook’s Apple (AAPL) and Elon Musk’s SpaceX are racing to fix it from space. Apple, through investment in satellite operator Globalstar (GSAT), is fortifying its satellite communication prowess, ensuring seamless iPhone connectivity worldwide. Meanwhile, SpaceX, with Starlink’s vast satellite fleet, aims to dominate orbital cellphone coverage.

At the heart of their clash lies spectrum rights, the limited airwaves needed to power these networks. SpaceX has maneuvered to obstruct Apple’s expansion, while Apple has meticulously dictated how Starlink integrates with iPhones. Their feud extends beyond orbit, echoing past disputes over talent poaching and Musk’s veiled threats of launching a rival smartphone.

As these giants clash over the future of satellite connectivity, is Apple’s space push a reason to buy AAPL stock or a sign to stay away?

About Apple Stock

California-based tech titan Apple (AAPL) has engineered a digital empire commanding a market cap of $2.9 trillion.

Apple, part of the elite “Magnificent Seven,” dictates tech’s future, mastering supply chains and redefining innovation. With an iron grip on hardware, software, and services, Apple is setting new trends, ensuring the world stays tethered to its ever-expanding ecosystem.

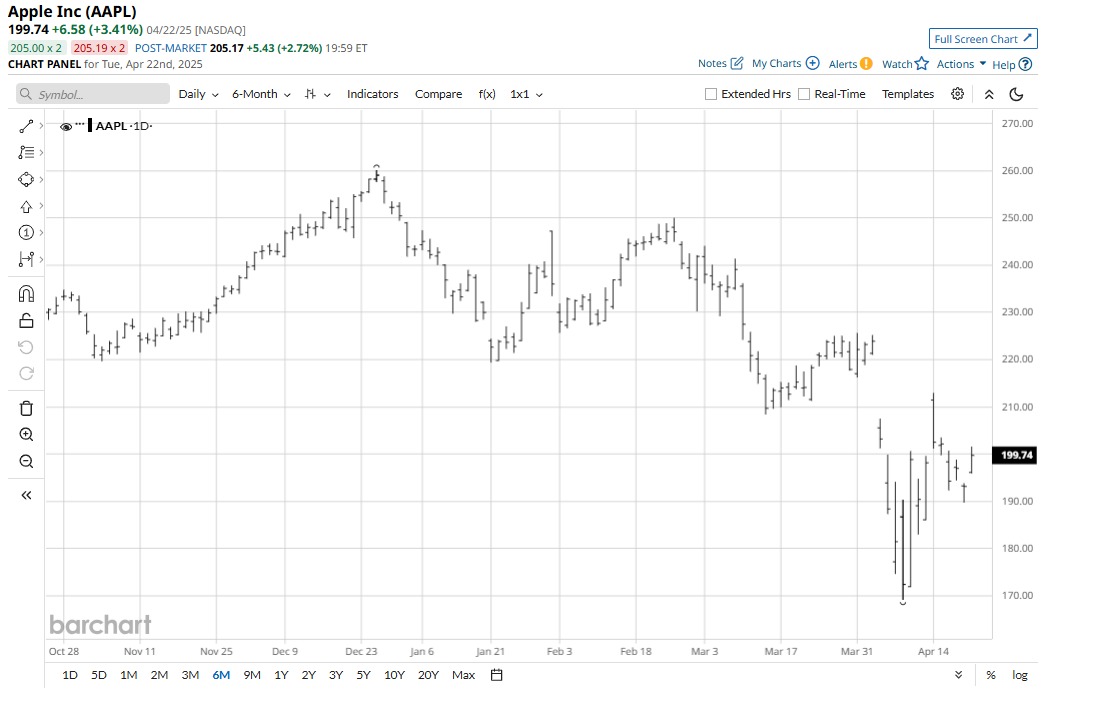

The iPhone maker’s shares have plunged in recent weeks as President Donald Trump threatens new tariffs and escalates a U.S.-China trade war. This risks raising costs for Apple and squeezing its margins. Although Apple remains 23% off its December peak of $260.10, it has rallied 20.4% over the past 52 weeks.

Apple’s Q1 Exceeds Wall Street Estimates

Apple kicked off its fiscal 2025 with a stellar Q1 earnings report on Jan. 30, raking in a record-breaking $124.3 billion in revenue. Hardware roared back to life, pushing product sales to $98 billion, while services, Apple’s silent powerhouse, surged 14% year over year to a record $26.3 billion.

Net income hit a record $36.3 billion, with EPS at $2.40, beating the estimate of $2.36. Precision in product mix drove gross margins to 46.9%, showcasing efficiency.

Apple’s fortress faces new cracks. With 95% of its products assembled in China, U.S. tariffs pose a serious threat. While consumer electronics have been temporarily exempted from most tariffs on China, Apple will face tests to its famed pricing power and supply chain mastery, forcing it to defend margins in an increasingly hostile trade landscape.

Apple is set to unveil its fiscal Q2 earnings early in May. Analysts tracking the company are eyeing a 4.6% year-over-year boost in earnings for Q2, projecting $1.60 per share. Looking ahead to fiscal 2025, they anticipate EPS to rise by 6.4% annually to $7.18, before surging by another 9.1% to $7.83 in fiscal 2026.

Apple’s Satellite Ambitions Meet SpaceX’s Resistance

Apple and Musk’s SpaceX are clashing over satellite dominance. Apple, fresh off its investment in Globalstar, aims to eliminate cellphone dead zones with satellite connectivity for iPhones. Meanwhile, SpaceX’s Starlink, with over 7,000 satellites in orbit, is racing to establish its own mobile network. The fight is over the acquisition of limited spectrum rights essential for transmitting signals. Both companies are vying for these scarce resources, leading to increased tensions and lobbying efforts with federal regulators.

Tensions escalated when SpaceX urged the Federal Communications Commission (FCC) to reject Globalstar’s application for permission to secure spectrum for Apple’s expanding satellite network.

Yet, the two also rely on each other. SpaceX launches Apple-backed satellites, while Apple ensures Starlink compatibility on iPhones. This uneasy partnership mirrors past battles, from Musk calling Apple a “Tesla graveyard” in 2015 to clashes over X’s App Store presence in 2022.

Apple’s satellite push could redefine iPhone connectivity, driving sales and strengthening its empire. A stronger grip on the sky might lift its stock, but with Musk in the way, the road won’t be smooth. The space race is on, and investors are watching closely.

What Do Analysts Expect for Apple Stock?

AAPL stock has a consensus “Moderate Buy” rating overall. Of the 36 analysts covering the stock, 18 recommend a “Strong Buy,” four suggest a “Moderate Buy,” 12 play it safe with a “Hold” rating, and the remaining two analysts advise a “Strong Sell.”

The tech stock’s mean price target of $241.12 suggests that it could rally as much as 21% from the current price levels. The street-high of $300 implies potential upside of 51%.