The pandemic led millions of Americans to lose their jobs, deal with income loss or dip into their emergency funds–causing plenty of financial stress and making it difficult for consumers to understand how to best manage their money.

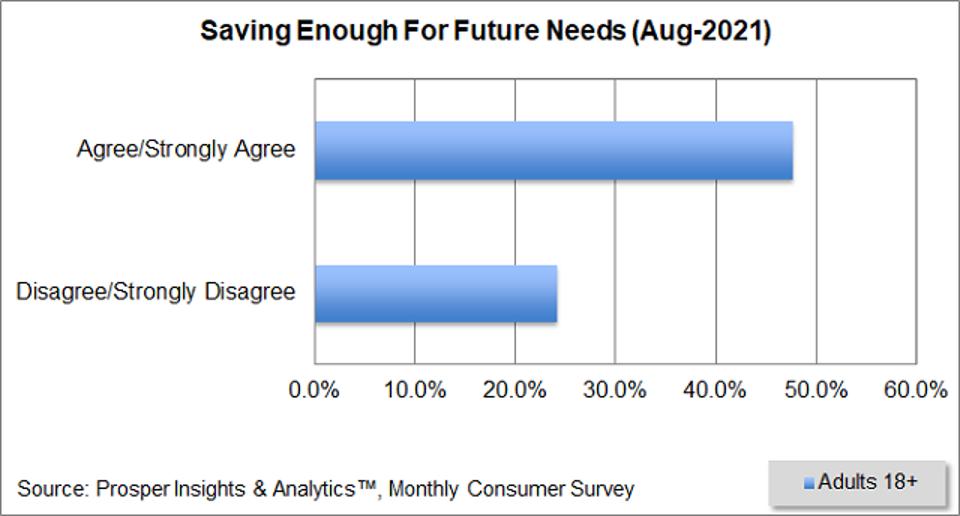

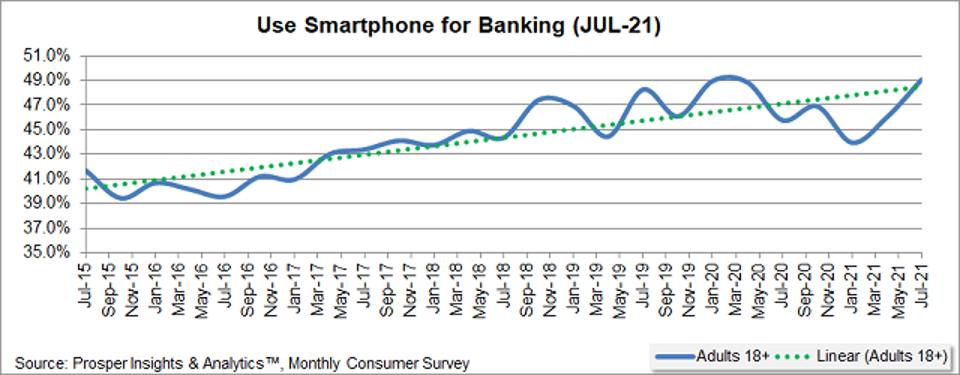

According to a recent Prosper Insights & Analytics Survey, less than half of adults ages 18+ agree that they are saving enough for future needs. Simultaneously, the percentage of adults using their smartphone for banking has steadily increased since 2015, rising to 49.1% as of July 2021. With so many both relying on their phones for money management and seeking a way to increase their savings, shouldn’t there be a tool that brings these needs together?

I recently discovered that this tool does exist it’s an app called Truebill, and it’s already helped Americans save $100 million. In addition to helping, you save; its automated tools can also help you do everything from canceling unwanted subscriptions to even offering pay advances of up to $125.

I had the chance to sit down with cofounder and Chief Revenue Officer Yahya Mokhtarzada to get an inside look at the rise of personal finance tech and learn more about how Truebill is making a positive impact on the financial health of millions of Americans every day.

Gary Drenik: Tell me about Truebill - what is it and how does it work?

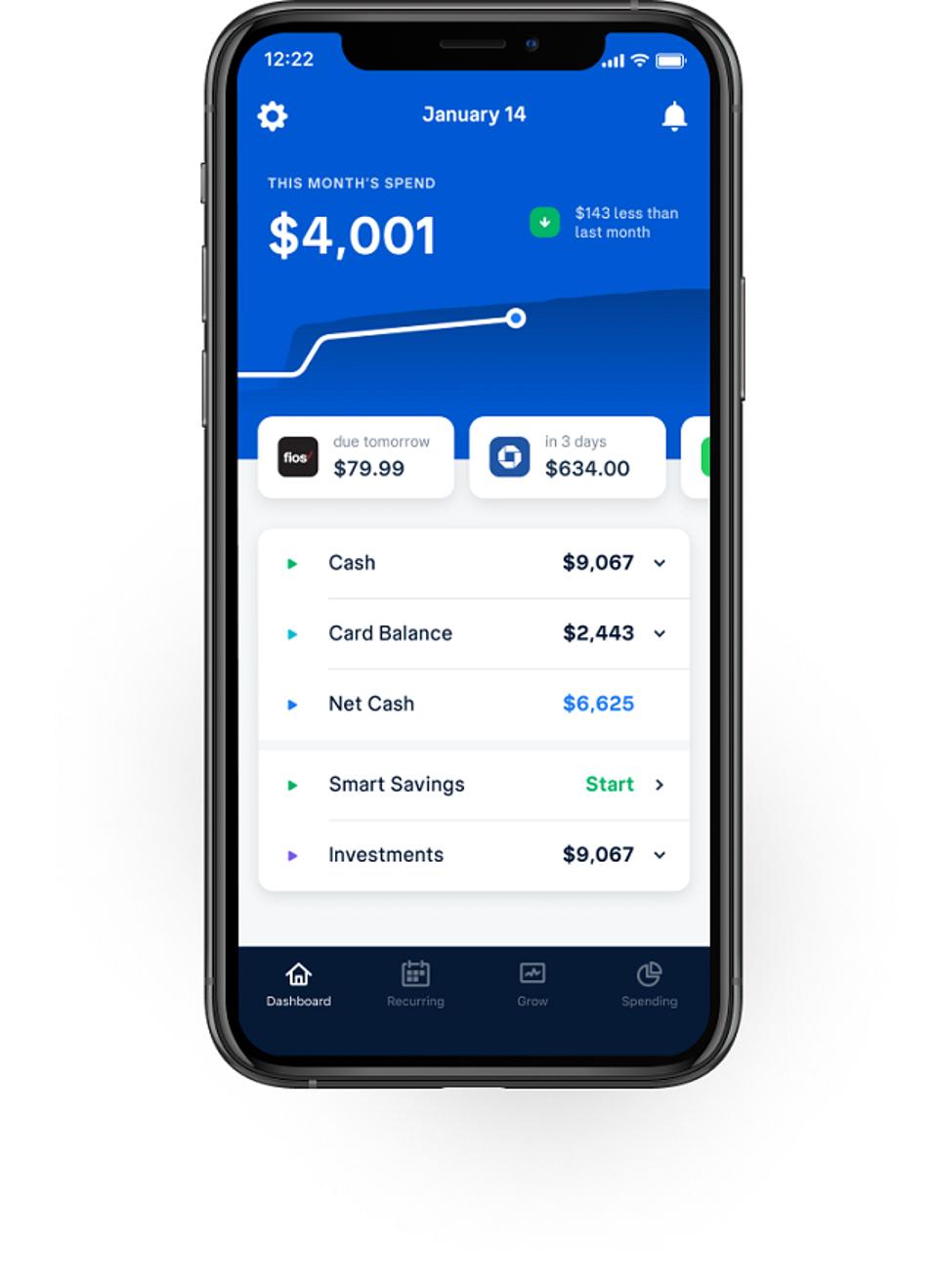

Yahya Mokhtarzada: Truebill is the easiest way to get a clean, holistic view of all your finances in one place. It’s an app that analyzes spending habits, identifies inefficiencies, and offers immediate methods for members to improve their financial health.

To use Truebill, you simply download the app, connect your financial accounts, and Truebill instantly gives you a complete overview of your money - that means, where it is, where it’s going, and even where you can save. From there Truebill can automatically take action on your behalf by performing tasks like cancelling unwanted subscriptions, negotiating better rates on bills, and even moving money to help you save for goals.

Every month over a million people use Truebill, and we’ve saved users over $100 million dollars.

Drenik: What makes Truebill different from other personal finance apps on the market?

Mokhtarzada: There are a few key differences. Firstly, Truebill goes beyond simply telling you where your money is and actively takes steps to help you improve your financial health. This means developing a whole suite of tools to help people at every stage of their financial journey.

As such, I think we have the most comprehensive features set out, including a dashboard that gives you complete financial visibility, bill negotiation to lower bills, subscription cancellation to help get rid of unwanted charges, credit reports to understand how you’re progressing, and even interest-free no-fee pay advances to help you avoid overdraft fees when needed.

I don’t think any other app offers as much as we do, in such a clean and intuitive way.

Drenik: You recently raised a $45 million Series D round of funding led by Accel. How are you using this new capital?

Mokhtarzada: We’re super excited about the product possibilities that are opening up with the new funding. Firstly, we’re making significant investments in growing our data science team with an eye towards predictive modeling. From a data science standpoint, it’s very easy to tell someone “you just overdrafted.” It’s a lot more difficult to analyze a person’s income and spending patterns and identify they’re likely to overdraft before they do, then take action to help it be avoided.

We’re also taking on larger development challenges as we roll out more traditional financial products. We think there’s an opportunity to simply do better on traditional products (i.e., credit cards, debit cards, investing, credit building) than what’s generally available, and we hope that by reimagining how these products work we’ll be able to make a positive impact.

Lastly, the funding gives us the opportunity to invest in the Truebill brand. This means ramping up marketing across non-digital channels in a way that positions Truebill with a clear, unified message.

Drenik: Covid-19 led to extreme financial stress for the majority of Americans. How has personal finance tech responded to this and where is the industry headed?

Mokhtarzada: It's no secret that the pandemic caused a lot of financial strain for Americans. Many are currently at the crossroads where they are picking up the pieces, and I think traditional banks have unfortunately dropped the ball in being responsive to the changing needs of Americans. Fintech companies are quickly stepping in to fill this void, with products that are affordable and address the needs of people in real time.

I’ve seen some really fantastic products launch in the credit building space, which a lot of people are going to need after falling behind on their payments in the last year. Additionally, there are some really interesting new products in the debt consolidation space that will help people grappling with debt and interest charges.

Beyond that, I think we’re seeing a trend of financial unbundling that has been dramatically accelerated by Covid-19. For my parents' generation they banked with the closest bank to our home, knew the tellers at the branch, and did all their business with that bank - meaning their credit card, debit card, savings account, mortgage, and even car loan all came from one place. As the relationship with the physical branch began to matter less, we saw the emergence of point solutions in fintech. This means there are more companies doing just auto loans, or just credit cards, or just investment accounts, and consumers are now more open to shopping around to find the best deal.

Drenik: Thanks, Yahya. Your insights on how personal finance apps like Truebill can positively impact consumers’ financial health will be immensely helpful for Americans looking for easier ways to manage their money.