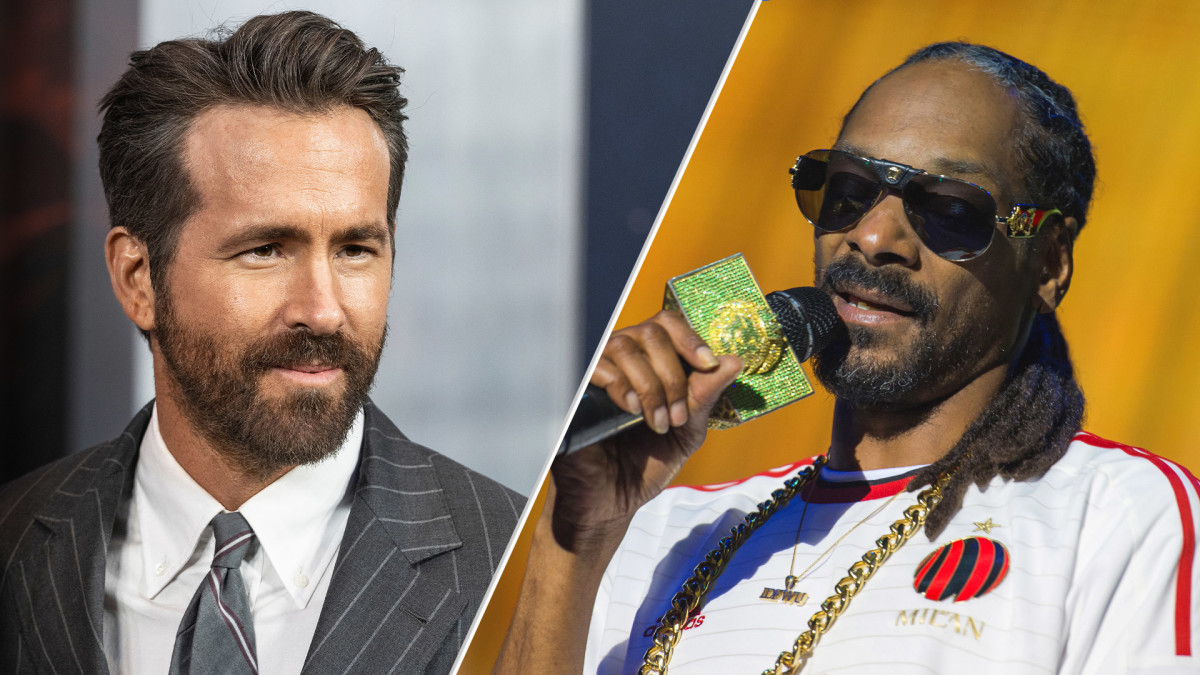

Ryan Reynolds and Snoop Dogg were both eyeing the same billion-dollar investment back in May. A few months later, both A-list celebrities missed out on the same prize.

The investment was to become team owners of the National Hockey League's (NHL) Ottawa Senators. In June, the Senators were sold for $950 million, a 19% increase in value to Forbes' 2022 valuation of the franchise.

That impressive valuation growth is actually significantly lower than the 29% year-on-year increase of the average NHL team, according to Forbes' 2023 NHL valuation list released on Friday.

Related: Ryan Reynolds' net worth: How much money the actor really makes

The Senators' near $1 billion valuation is even on the lower side for the top professional hockey league, ranking just 24 out of 32 teams, and below the $1.33 billion average among the franchises. The highest valuation belonged to the Toronto Maple Leafs, who were valued at $2.8 billion, a 40% increase versus last year.

The Leafs took the top spot from the New York Rangers, whose value still jumped up 20% to sit at $2.65 billion. The Montreal Canadiens were in third at $2.3 billion, while the Los Angeles Kings sat at exactly $2 billion, the only other franchise to break that barrier.

NHL franchise values below other pro sports leagues

The value of the average NHL franchise still rank well below other major professional sports teams in the National Football League ($5.1 billion), National Basketball Association ($3.85 billion), and Major League Baseball ($2.32 billion), but the average growth versus 2022 of an NHL franchise is still much higher than that of the NFL (14%) and MLB (12%).

But double-digit growth across the board for the four major sports leagues solidifies steep growth of investments in sports teams.

Reynolds, Snoop Dogg could try again

While Reynolds and Snoop Dogg weren't successful in reeling in an NHL franchise, they could easily bid should another one enter the market. There are also growing ways now for celebrities or other athletes to gain team ownership as private equity has already entered the NBA, MLB, and NHL.

This has allowed big names to invest in these firms who then put that money into sports franchises.

Reynolds has already had success since acquiring Wrexham F.C. alongside fellow actor and friend Rob McElhenney, and the two have continued their sports investments by acquiring a stake in the Formula One team Alpine. Other athletes and celebrities like Patrick Mahomes, Travis Kelce, and Michael B. Jordan are also part of ownership group.

Related: Snoop Dogg's net worth: The rapper's businesses, investments, & more

It makes sense why a lot of these big names choose to park their money in sports franchises when looking at year-on-year growth, but long term examples make the case even more compelling.

Mark Cuban sold a majority stake in the Dallas Mavericks for a valuation worth $3.5 billion last month. He bought the franchise for $285 million in 2000, a 1,300% increase in his investment when not taking into account inflation.

For any potential owners, whether majority or minority, that type of growth seems like a hard proposition to pass up on.

Get exclusive access to portfolio managers’ stock picks and proven investing strategies with Real Money Pro. Get started now.