Super Micro Computer finally filed its annual report, which was supposed to be due last August, avoiding the risk of being delisted by the Nasdaq.

On Feb. 25, the server producer filed its annual report for fiscal 2024 ended June 30 and the financial results for the first two quarters of fiscal 2025.

💰 Stay ahead of the markets: Subscribe to TheStreet's free daily newsletter💸

Super Micro (SMCI) said in a news release that it had regained compliance with the Nasdaq’s filing requirements.

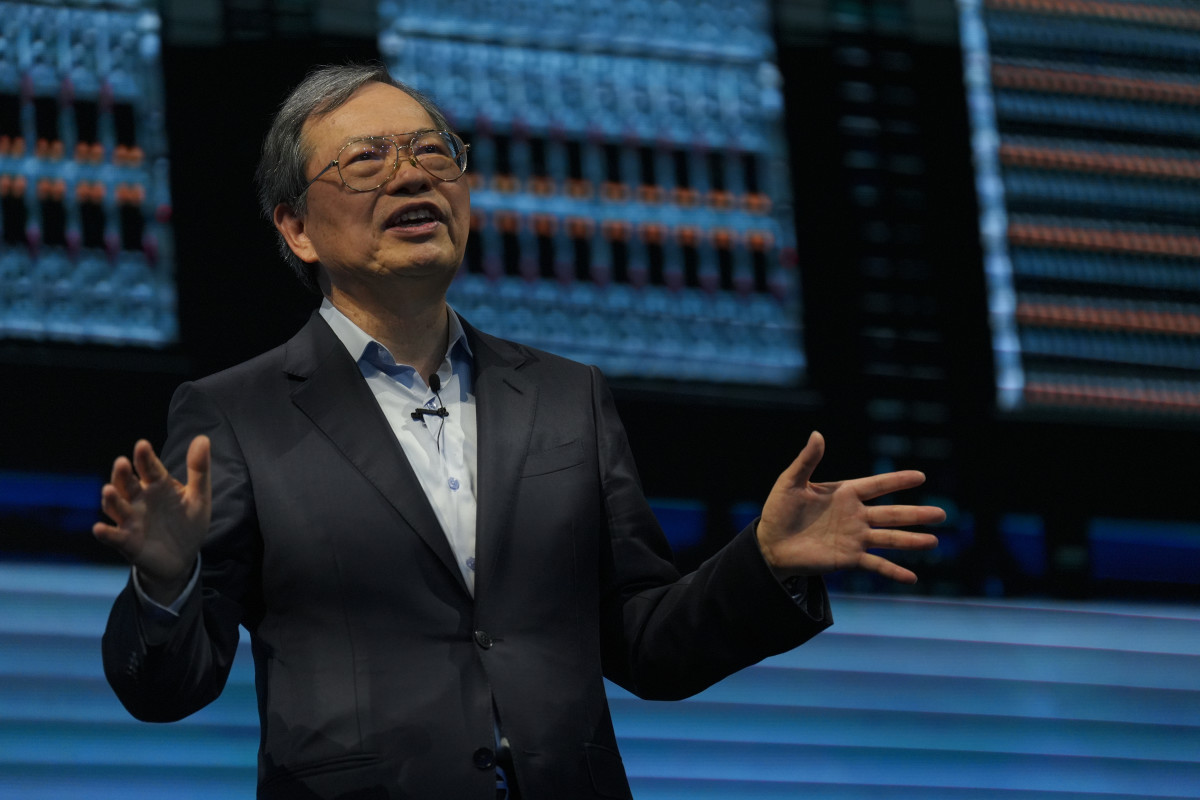

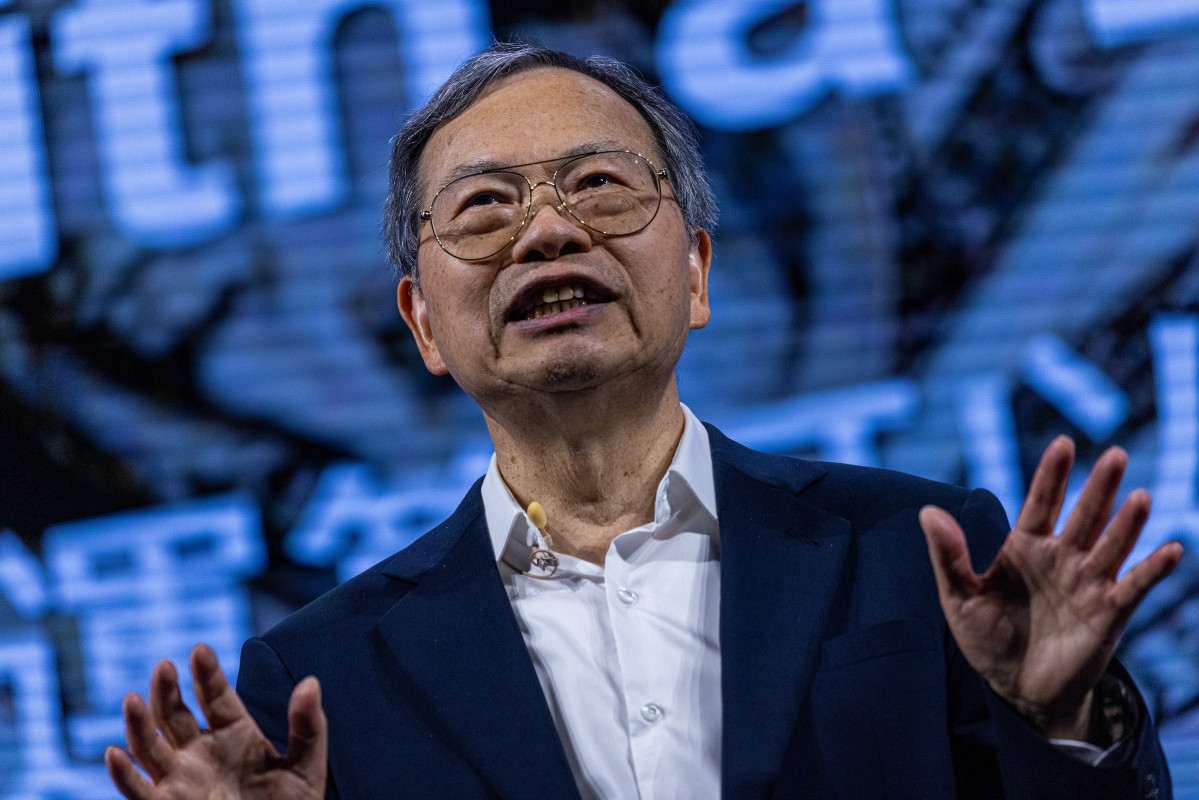

“Today’s filings represent an important milestone,” said Charles Liang, chief executive of Super Micro.

"With our financial reporting now current, we can now fully focus on executing our proven winning growth strategy through technology, product and solution innovations, time-to-market advantage, global footprint, and green computing," said Liang.

Related: Veteran fund manager sounds alarm on Palantir’s stock

Liang also said the company was ramping up investments across engineering, sales, finance, accounting, compliance, and operations "to achieve our great mission in DLC, Data Center Building Block Solution (Supermicro 4.0) as well as our revenue target."

The stock rallied 12.2% in the session on Feb. 26 but then lost nearly 16% on Feb. 27.

Super Micro's trouble and ambition

Super Micro specializes in server hardware. It integrates Nvidia's GPUs into its servers, which are then supplied to clients like cloud-service providers.

Almost a year ago Super Micro was riding high. The company's stock peaked in March 2024 as a darling in the AI and data-center boom. But it has tumbled 64% since that peak.

Its trouble began last summer.

On Aug. 27, short-seller Hindenburg Research released a report accusing Super Micro of what it called "glaring accounting red flags, evidence of undisclosed related-party transactions, sanctions violations, and customer troubles."

A day later, Super Micro said it would delay filing its Securities and Exchange Commission Form 10-K for the fiscal year ended June 30.

In October, Super Micro's then-auditor, Ernst & Young, resigned, citing governance and transparency concerns. Super Micro's special committee of the board later said it found “no evidence of misconduct” after an investigation.

In December, Super Micro was dropped from the Nasdaq 100 Index.

For the fiscal second quarter ended Dec. 31, the company reported earnings per share of 51 cents, missing the Wall Street analyst consensus estimate of 58 cents. Revenue of $5.68 billion for the quarter beat the consensus of $5.65 billion.

On Feb. 11, Super Micro set a $40 billion revenue projection for fiscal 2026. The stock saw a strong boost in the following week.

“With our leading direct-liquid cooling technology and over 30% of new data centers expected to adopt it in the next 12 months, Super Micro is well positioned to grow AI infrastructure designs wins based on Nvidia Blackwell and more,” Liang said.

Related: Surprising news hits Nvidia stock price

He expects this technology to drive fiscal 2025 revenue to $23.5 billion to $25 billion and then to $40 billion in fiscal 2026.

For fiscal 2024, the company's revenue more than doubled to $14.99 billion from $7.12 billion.

Analysts cautious on Super Micro stock

Barclays reinstated Super Micro coverage with an equal weight rating and $59 price target after the filing, thefly.com reported.

After removing the overhang of the potential delisting, the analyst says the stock should now trade on fundamentals.

Barclays recognizes Super Micro's leadership position in artificial intelligence server and direct liquid cooling, but adds that its "competitive moat is shrinking and its checkered past" could limit the multiple investors are willing to pay for the stock.

Mizuho Securities also reinstated coverage of the stock with a neutral rating and a $50 price target.

More Wall Street Analysts:

- Analyst revisits Palantir stock forecast after annual report filing

- Veteran analyst sounds the alarm on Google and Mag 7

- Veteran stock analyst delivers blunt 3-word message on tariffs

“We believe overall Supermicro remains well positioned,” the analyst said, adding that the company has priority component allocations for servers for the enterprise and government markets.

However, the analyst said the San Jose, Calif., company faces a “more competitive landscape" with peers like Dell Technologies (DELL) .

Super Micro stock is up more than 40% year-to-date. The stock traded in a range on Feb. 28, from less than $39 to near $43.50, Wall Street Journal data show.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast