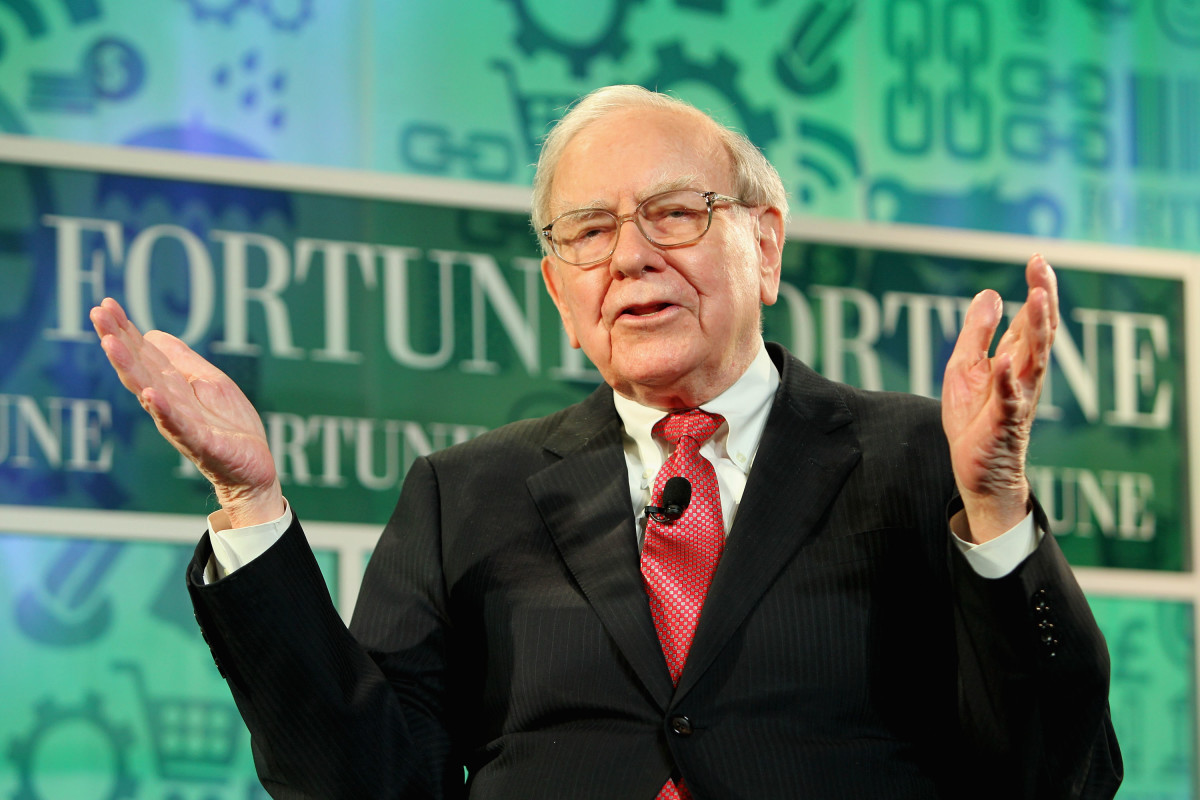

Warren Buffett, with his avuncular manner and otherworldly success as an investor, has become financial adviser to the whole nation.

His Berkshire Hathaway conglomerate registered a compound annual return of 19.8% from its 1965 inception to 2023.

That’s incredible. It’s almost double the 10.2% for the S&P 500 during that period, including dividends.

Perhaps Buffett’s most successful investment is auto insurer Geico. Other famous companies owned by Berkshire include BNSF (Burlington Northern Santa Fe) Railway, See’s Candies and Dairy Queen.

Buffett also is well known for Berkshire’s stock holdings, which totaled about $869 billion as of March 31. That makes it one of the biggest equity managers in the world.

Its biggest holding as of that date was cellphone/computer legend Apple (AAPL) , followed by Bank of America (BAC) , credit-card luminary American Express (AXP) , beverage icon Coca-Cola (KO) , and oil stalwart Chevron (CVX) .

Berkshire Hathaway’s stellar Q1 earnings

On May 4, as Berkshire shareholders met, the company reported strong earnings for the first quarter. Its operating profit soared 39% to $11.2 billion from $8.07 billion a year earlier.

The company’s cash hoard jumped 13% to a massive $189 billion. Buffett said that total would likely hit $200 billion by June 30, as he doesn’t foresee any inviting acquisition targets.

“We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money,” he said at the annual meeting Saturday.

Related: Why Warren Buffett sold Apple stock

Berkshire trimmed its Apple stake for the second quarter in a row. But Buffett still heaped praise on the company for its strong fundamentals, saying the iPhone might be one of the greatest products ever. Apple will likely remain Berkshire’s biggest holding, he said.

Analysts’ take on Warren Buffett’s company

Analysts were impressed with Berkshire’s results. Its operating earnings beat Wall Street forecasts.

The success “reflected higher-than-expected [insurance] underwriting profit, other income, and a lower-than-expected tax rate,” Keefe, Woods & Bruyette analysts wrote in a commentary.

They raised their 2024 and 2025 earnings forecasts based on higher insurance income.

Related: Analysts weigh in on Warren Buffett's Berkshire Hathaway

To be sure, Berkshire has “significant” risks, the analysts said. That includes a management transition, when the 93-year-old Buffett departs the company.

They also see a “gap between the perceptions and reality of Berkshire Hathaway and ongoing macro uncertainty.” As a result, they don't recommend Berkshire’s stock over broader indexes and affirm their market-perform (effectively neutral) rating.

Still, the analysts raised their target price for Berkshire’s A shares (BRK.A) to $660,000 from $645,000. The stock traded at $607,000 Monday.

Stephen Guilfoyle’s view of Berkshire Hathaway

The likely ascension of Berkshire executives Greg Abel and Ajit Jain to take the place of Buffett and Charlie Munger, who died in November, does introduce some risk for the stock, says TheStreet Pro commentator Stephen Guilfoyle.

“One thing we learned over the weekend is that Warren Buffett is still as sharp as a tack,” he said. “Hopefully not for a long time, but that day may come [when Buffett goes]. He even made a half-joke as the meeting closed that he hoped to be there next year.”

More Warren Buffett:

- Analyst revamps Occidental Petroleum stock price target after oil rally

- Why the S&P 500 is getting 2 new members this week

- Morningstar unveils 10 cheap stocks with wide moats

The leaders in waiting have done nothing wrong, Guilfoyle said. But “the two have not yet earned our trust either,” he added.

“I imagine on that day, hopefully well off into the future, the shares will sell off sharply,” Guilfoyle said.

“I am not going to sell the stock today, because the healthy chair [Buffett], who is clearly still with it, is playing in his late innings. I'll worry about that future selloff when it happens.”

For now Guilfoyle has a target price of $472 on the Class B shares (BRK.B) . That's 16.5% above the May 6 closing price near $405.

Related: Veteran fund manager picks favorite stocks for 2024