If you think it's hot now, wait till November.

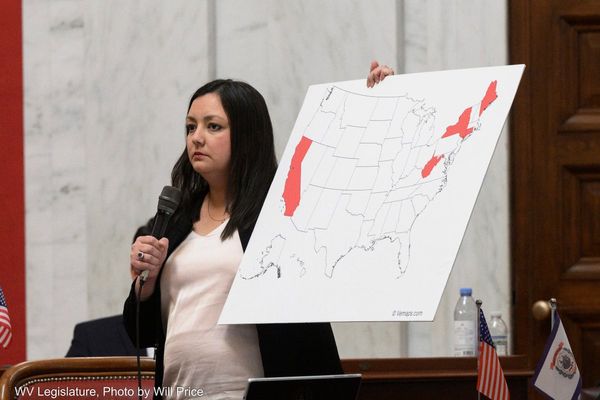

Americans will be voting for their next president in a few months. In just the last week or so, a gunman tried to assassinate former President Donald Trump, and current President Joe Biden announced he was dropping out of the race and endorsing Vice President Kamala Harris.

And we're just getting started.

Related: Analyst reboots Trade Desk stock price target after Netflix deal

TheStreet Pro’s Chris Versace said Biden's decision will "likely rekindle some uncertainty in the market."

"In the last few weeks, when we’ve been asked about the election, our view has been we’ve got a ways to go and what may seem in the moment like a probable outcome may not be the result," he said..

Versace expected a contentious race, "and we think that will be the case even more so now."

"And of course, that will be good for our shares of The Trade Desk (TTD) , as the Harris campaign looks to get its message out, and the Trump one responds," he said. "The same goes for Google's advertising business, including YouTube."

There's a lot of money at stake here.

According to the market research firm Emarketer, U.S. political ad spending will vault past $12 billion in 2024—a new high—to nearly triple the $4.25 billion spent in 2016. As campaigns spend more, they increasingly invest in digital formats like connected TV, which refers to TVs connected to the Internet.

The Trade Desk, a programmatic marketing company, enables buying media inventory across various channels, including display, video, audio, and CTV.

Trade Desk analyst calls guidance conservative

The Ventura, Calif.-based company, which was founded in 2009, said in a recent report that "anyone paying attention to the headlines this year recognizes that TV is at a tipping point."

"The decline of the cable bundle, powered by mass consumer shifts and a surge in ad-supported streaming, has transformed how advertisers plan and transact on TV-based media," the report said. "Underscoring this shift, 43% of Americans say they’re spending more time on streaming platforms because more of their favorite content is on CTV."

Related: Alphabet earnings up next with Google parent's AI costs in focus

Programmatic TV advertising is the automated buying and selling of ads on TV based on specific audience data, and Jeff Green, the company's founder, and co-CEO, told analysts in May that the rapid rise of CTV "as the driving force of programmatic would not have happened so quickly were it not for the Covid pandemic."

"With stay-at-home directives around the world, consumers shifted in mass for the convenience of streaming, and the media world hasn't been the same since," he said during the company's first-quarter earnings call. "TV has always been the central element of major brand advertising campaigns, so the shift from linear to CTV was always going to be disruptive."

The Trade Desk is scheduled to post second-quarter results on Aug. 8, and analysts have been adjusting their price targets for the company's shares ahead of the earnings report.

Wedbush analyst Scott Devitt said in a research note that he viewed management's second-quarter guidance as conservative and thought the company is well-positioned heading into 2Q results, given positive feedback from advertisers in the firm's 2Q survey and healthy demand trends with outsized strength in connected TV.

Devitt reiterated his outperform rating and $110 price target and said that, ahead of the earnings report, he is focused on ongoing CTV adoption and demand, tailwinds from political spending in the second half, continued expansion of partnerships with CTV publishers and retail media platforms, and the pace of international growth.

"Shares continue to trade at a premium relative to peers, though we view valuation as justified given the company's sustainable long-term growth prospects, attractive margin profile, and execution of key initiatives by management," he said.

Firm expresses caution on Trade Desk earnings

Morgan Stanley's Matthew Cost raised the firm's price target on Trade Desk to $110 from $100 while keeping an overweight rating on the shares.

The firm previewed its second-quarter EPS for the North American Internet group, stating that Amazon (AMZN) remains its top mega-cap pick.

More Tech Stocks:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Cathie Wood unloads shares of rebounding tech titan

- Big tech company files Chapter 7 bankruptcy, closes abruptly

BTIG analyst Clark Lampen raised the firm's price target on Trade Desk to $110 from $98 and kept a buy rating on the shares.

The firm's second-quarter checks were constructive, the analyst said. Feedback continues to suggest that digital trends will improve over the balance of the year as political and Olympics spending support mid-to-high single-digit underlying growth ex-inflation.

Despite that, comparing feedback from the latest checks with prior commentary from the same experts suggests that second-quarter performance did slightly lag early quarter expectations, making BTIG slightly cautious on the setup into earnings given the healthy investor sentiment, Lampen added.

Earlier this month, Wolfe Research analyst Shweta Khajuria initiated coverage of Trade Desk with an outperform rating and $115 price target as part of a broader sector note launching coverage of global internet names.

The analyst said the company has an attractive, scalable business model that has shown healthy topline growth and high margins while maintaining a leadership position in the breadth and depth of product suite, product innovation, and execution.

Khajuria said that Trade Desk continues to gain share with very robust topline growth and margin profile, driven by new product catalysts, secular tailwinds in connected TV and retail media, geographic expansion, and industry evolution around privacy and security.

Related: Veteran fund manager sees world of pain coming for stocks