Nvidia (NVDA) is back above $130 a share.

On Oct. 8, the Financial Times reported that in Guadalajara, Mexico, Foxconn would construct the largest factory focused on producing Nvidia's most advanced artificial-intelligence servers.

Foxconn is one of the world’s largest contract electronics manufacturers and is also a supplier for Apple’s iPhones.

💸 Don't miss the move: Subscribe to TheStreet's FREE daily newsletter 💸

Foxconn will assemble Nvidia’s GB200, a superchip built on its Blackwell architecture, combining two Blackwell graphics-processing units with a Grace central processing unit.

This design enables the GB200 to handle intense AI workloads, like real-time processing of trillion-parameter models.

"We're building the largest GB200 production facility on the planet," said Benjamin Ting, Foxconn senior vice president for the cloud enterprise solutions business group, Reuters reported.

Related: Analyst who forecast Palantir's rally makes another bold call

This move indicates a shift in Nvidia's supply chain away from Asia. With the majority of Nvidia's chip production based in the area, investors are worried about geopolitical risks that could hinder Nvidia’s deliveries and revenue.

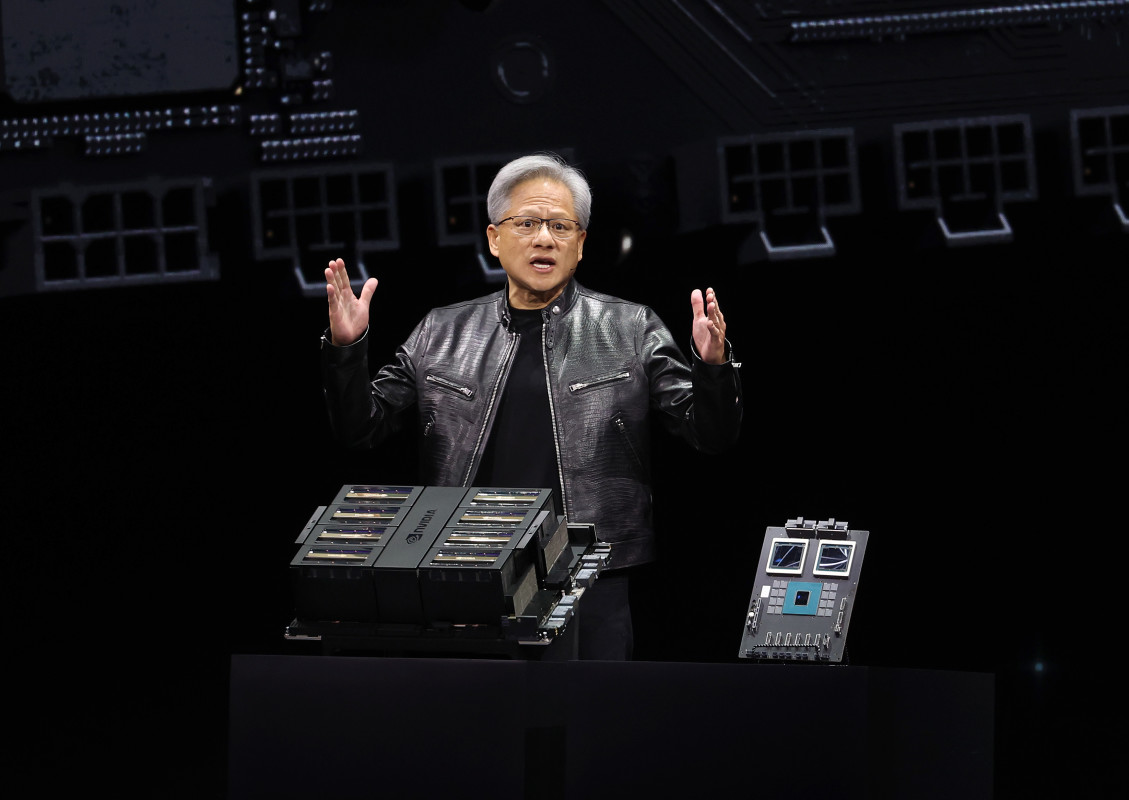

Nvidia’s chief executive, Jensen Huang, said in September that Nvidia can switch to alternative suppliers as it has enough intellectual property. Taiwan Semiconductor (TSM) is now Nvidia’s biggest supplier.

“Maybe the process technology is not as great, maybe we won't be able to get the same level of performance or cost, but we will be able to provide the supply," Huang said at Goldman Sachs’s Communacopia + Technology Conference.

"And so I think ... in the event anything were to happen, we should be able to pick up and fab it somewhere else,”

Blackwell demand is 'crazy': Foxconn

On Aug. 28, Nvidia released another solid earnings report.

For the quarter ended July 28, the company posted adjusted earnings of 68 cents a share, more than double the figure from the year-earlier figure and beating the analyst consensus of 64 cents. Revenue reached $30 billion, marking a 122% year-over-year increase and surpassing the expected $28.7 billion.

Nvidia is set to ship its Blackwell GPUs to clients in Q4 of this year, with a consumer release anticipated for 2025.

Related: Nvidia CEO Jensen Huang just told investors what’s next for the AI chipmaker

“In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue,” Nvidia Chief Financial Officer Colette Kress said during the August earnings call.

Foxconn Chairman Young Liu called demand for the Blackwell platform “crazy.” On Oct. 5 Foxconn posted its highest-ever Q3 revenue, T$1.85 trillion ($57.3 billion), driven by demand for AI servers.

Blackwell, a platform Nvidia introduced in March, enables organizations to run real-time generative AI on models containing trillions of parameters. These large language models are trained on vast datasets to comprehend and generate human-like language responses.

“Blackwell is in full production,” Huang said in an interview with CNBC in early October. “The demand for Blackwell is insane. Everybody wants to have the most, and everybody wants to be first.”

Analyst resets Nvidia stock price target

Goldman Sachs analyst Toshiya Hari raised the firm's price target on Nvidia to $150 from $135 and affirmed a buy rating on the shares. Nvidia is also on the firm's Americas Conviction List, thefly.com reported.

Related: Cathie Wood buys $15 million of soaring mega-cap tech stocks

Following a group investor meeting with Huang, Kress and other management members, Goldman Sachs raised its fiscal 2026-2027 revenue and adjusted-earnings estimates for Nvidia by an average of 7% and 8%, respectively.

The move reflects recent industry developments, including increased capital spending on cloud technology and strong order trends from major AI-server original-equipment manufacturers, the analyst said.

Morgan Stanley affirmed an overweight rating and $150 price target on Nvidia shares after investor meetings, indicating strong market conditions ahead.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

The analyst says that Nvidia's NVL36/72 Blackwell systems remain the top choice for high-computation inference tasks. Nvidia's ramp of Blackwell is progressing on schedule, with that product sold out for the next 12 months.

"Every indication from management is that we are still early in a long-term AI-investment cycle," the analyst said.

At last check Nvidia shares were trading above $135. The stock has more than doubled (up 173%) this year.

Related: The 10 best investing books, according to our stock market pros