Nice going, Rufus.

Amazon (AMZN) recently wrapped up its Prime Day sale extravaganza and the internet retail and entertainment giant said it was a humdinger.

Related: Alphabet earnings up next with Google parent's AI costs in focus

In fact, Amazon said this was biggest Prime Day shopping event ever, with record sales and more items sold during the two-day event than any previous Prime Day.

"Prime Day 2024 was a huge success thanks to the millions of Prime members globally who turned to Amazon for fantastic deals, and our much-appreciated employees, delivery partners, and sellers around the world who helped bring the event to life for customers," Doug Herrington, CEO of Worldwide Amazon Stores, said in a statement.

It was also a good day for Rufus, Amazon's AI-powered conversational shopping assistant, which the company said "helped millions of customers shop Amazon’s wide selection quickly and easily."

Amazon introduced Rufus in February, saying that "we believe generative AI is going to change virtually all customer experiences that we know."

"With Rufus, customers are now able to shop alongside a generative AI-powered expert that knows Amazon’s selection inside and out, and can bring it all together with information from across the web to help them make more informed purchase decisions," the company said.

Amazon's annual summer savings event has been an ongoing promotion for about a decade.

Analyst cites strong 'Back to School' spending

TheStreet Pro’s Chris Versace noted that, according to Adobe Analytics, U.S. consumers spent $14.2 billion during Prime Day 2024, up almost 12% compared with $12.7 billion a year ago and surpassing Adobe’s expectation of $14 billion.

“As we suspected, one area of spending strength was Back to School, which soared 216% compared to last year, Versace said. “Meanwhile, Electronics was up 61%, with Adobe calling out Apple (AAPL) , as a beneficiary with overall phone sales rising 18% year over year. Apparel and Furniture were also named as well-performing categories.”

Related: Analysts reboot CrowdStrike stock price target following global outage

However, he added that Prime Day accounts for only about 1% of Amazon’s sales in the current quarter, and “as such, we should not read too much into the findings, and also be mindful that the event will goose the July Retail Sales report.”

“It should also pull forward Back-to-School spending that we tend to see in August, resulting in a sequentially softer headline retail figure in the August Retail Sales report,” Versace said.

JMP Securities said that Amazon's annual Prime Day saw another year of record Gross Merchandise Value, despite persisting consumer headwinds.

GMV, which represents the total value of goods or services sold within a given period, grew 11% year-over-year to 12.7%, according to Adobe, and the firm said that it was impressed with the positive trends given the current macro backdrop.

JMP made no change to its outperform rating and $225 price target and expects Amazon to hold another Early Access Sale event later this year, though no details have been released.

Amazon, which is scheduled to report second-quarter results on August 1, posted better-than-expected earnings and revenue for the first quarter.

Advertising revenue grew 24% in the first quarter, surpassing retail and cloud computing.

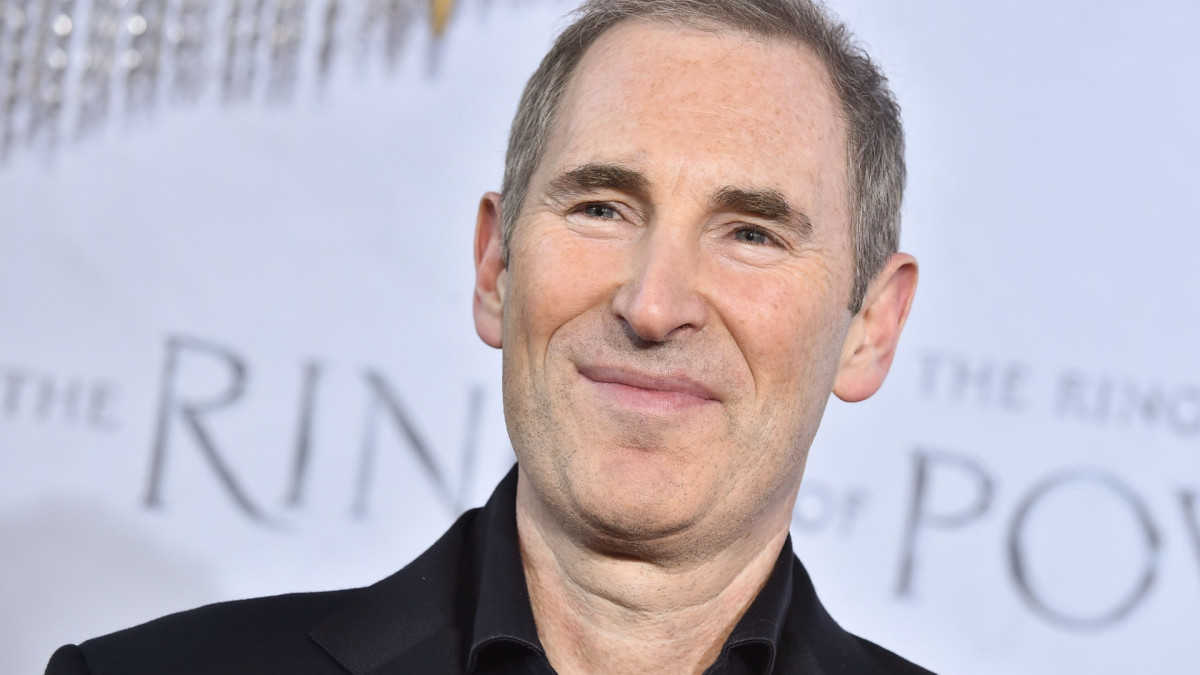

"The strength in advertising was primarily driven by sponsored products, supported by continued improvements in relevancy and measurement capabilities for advertisers," CEO Andy Jassy told analysts during the company's earnings call. "We still see significant opportunity ahead in our sponsored products, as well as areas where we're just getting started like Prime Video ads."

Analyst bullish on advertising growth

Prime Video ads, he added, "offers brands value as we can better link the impact of streaming TV advertising to business outcomes like product sales or subscription sign-ups, whether the brands sell on Amazon or not."

"It's very early for streaming TV ads but we're encouraged by the early response," Jassy said.

More tech stock news:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Cathie Wood unloads shares of rebounding tech titan

- Big tech company files Chapter 7 bankruptcy, closes abruptly

Analysts have been adjusting their price targets for Amazon ahead of the earnings report.

Loop Capital kept a buy rating and $225 price target on Amazon, but noted that the firm is increasingly bullish on the growth runway for Amazon's advertising business that it sees extending well beyond sponsored listings into CTV, audio ads and across the open internet.

The company offers fundamental advantages, especially with unparalleled shopper data, while changes in the ad ecosystem are amplifying its differentiation, and Amazon Ads could achieve $150 billion in revenue before the end of the decade from $47 billion last year, the firm said.

Truist raised the firm's price target on Amazon to $230 from $220 and kept a buy rating on the shares.

The firm anticipates an earnings beat, citing its Truist Card Data that tracks North America sales, positive checks into the ads business, and expectations for further growth acceleration at Amazon Web Services, the company’s cloud-computing subsidiary.

Despite the backdrop of a "weakening consumer" Amazon continues to gain share of global e-commerce and improve its value proposition to both merchants and consumers, Truist said.

Morgan Stanley raised the firm's price target on Amazon to $240 from $220 and kept an overweight rating on the shares.

The firm previewed second-quarter earnings per share for the North American Internet group, stating that Amazon remains its top mega cap pick.

Related: Veteran fund manager sees world of pain coming for stocks