AT A GLANCE

· Mining output is a significant driver of changes in gold prices

· Economically, gold is connected through the jewelry and investment markets

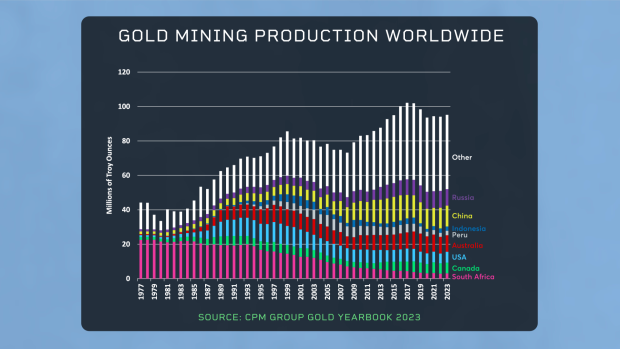

Gold’s supply side is almost entirely overlooked, yet it’s very important in determining gold prices. During periods when gold mining supply falls, gold prices often soar. This was the case in the 1970s, between 1998 and 2009, and again in the period from 2017 to 2020. By contrast, when gold mining production surges, as was the case between 1981 and 1998, and again from 2010 to 2016, gold prices often slump.

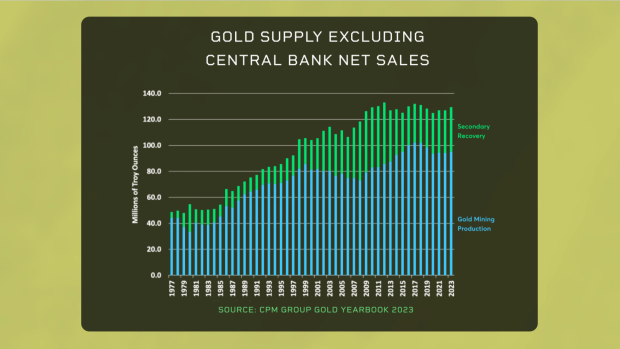

But mining supply is only one kind of supply. There is also secondary recovery — the recycling of gold from used appliances and melted-down coins and jewelry. Secondary recovery, however, does not appear to be a price driver, but rather responds to prices. The higher the price of gold, the more incentive there is to recycle it.

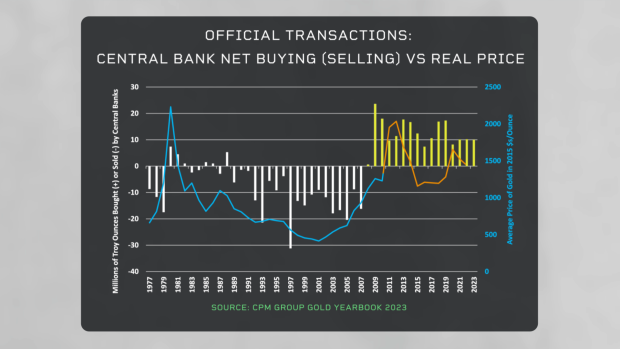

Finally, there is the supply net of "official transitions." Official transactions refer to the buying and selling of gold by central banks. Since the 2010s, central banks have been steadily buying gold; this has reduced the amount of gold available to private sector purchasers and probably driven the price of gold higher.