AMD bulls are hoping share gains and cloud momentum will more than offset any headwinds from softening consumer tech spending as the company reports on Tuesday afternoon.

Among analysts polled by FactSet, the consensus is for AMD to report Q2 revenue of $6.53 billion (up 70% annually due to both organic growth and the Xilinx acquisition) and non-GAAP EPS of $1.03.

AMD typically provides quarterly and full-year sales guidance in its reports. The company’s Q3 revenue consensus stands at $6.84 billion, and its full-year revenue consensus stands at $26.21 billion (roughly matching the company’s May 3 guidance for approximately 60% full-year sales growth, or mid-30s growth on an organic basis).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging AMD’s Q2 report, which is expected after Tuesday’s close, along with an earnings call scheduled for 5 P.M. Eastern Time.

Please refresh your browser for updates.

6:01 PM ET: That's a wrap for AMD's Q2 call. Shares are down 5.3% after-hours to $94.05 after AMD slightly beat Q2 estimates, issued below-consensus Q3 sales guidance and reiterates its full-year sales guidance.

On the Q2 call, CEO Lisa Su noted gaming GPU demand has softened and that AMD now expects the PC market to decline by a mid-teens percentage in 2022. At the same time, she said AMD expects to continue seeing strong server CPU growth in 2H22, and that demand also remains good for game console SoCs and Xilinx's products.

Thanks for joining us.

5:57 PM ET: A question about the full-year guide being reiterated. Is improved Xilinx supply responsible?

Su says that when AMD establishes a full-year guide early in the year, not everything will go according to plan. Reiterates Data Center, Embedded and console growth will help offset PC softness, and that a number of 5nm products will ramp in Q4.

5:54 PM ET: A question about the upcoming Genoa ramp. Will it start with high-volume SKUs for cloud clients.

Su says AMD's focus is on both high-volume cloud and enterprise SKUs. Notes each has long qualification cycles. Notes Genoa's production ramp will start in Q4 and continue into early 2023.

5:53 PM ET: Su reiterates AMD's 2023 Data Center visibility remains very good. Says what's happened in recent years has made clients more cognizant of the need for long-term planning.

5:51 PM ET: A question about data center share gains. Analyst notes the Q2 numbers suggest AMD gained more than 6 points of share Y/Y and that this puts its server CPU share in the mid-20s. Was there a large contribution from Xilinx or Pensando (for Data Center segment sales) that might make those estimates off the mark?

Su suggests those estimates are close to the mark, and that there wasn't any outsized contribution from Xilinx/Pensando.

5:48 PM ET: A question about price competition.

Su says pricing isn't the first thing customers are paying attention to in the data center, but total cost of ownership (TCO). Adds that AMD has focused on "premium" segments of the PC CPU market, where customers are willing to pay for quality.

5:47 PM ET: A question about Xilinx sales.

Su says Xilinx sales were up ~20% Q/Q, with strong demand across markets. Mentions AMD helped improve Xilinx's supply chain situation, while adding Xilinx is still a little supply-constrained. 2H growth is expected as AMD works to address those constraints.

5:45 PM ET: A question about server GPU sales.

Su says they're not a big contributor to 2022 sales, but that growth is expected in 2023 as current customer engagements pay off.

5:44 PM ET: A question about server CPU ASP trends.

Su notes the upcoming Genoa and Bergamo platforms have higher max core counts than Milan, and suggests this should help drive ASP growth.

5:42 PM ET: A question about why free cash flow was only up modestly Y/Y in Q2.

Kumar notes working capital needs impacted FCF, and that higher tax payments and the timing of product shipments also weighed. Adds that AMD's pre-payments for wafer capacity also depressed FCF.

5:40 PM ET: A question about how much future server CPU growth could be driven by enterprise and telco sales vs. cloud.

Su notes enterprise adoption "takes a bit longer" than cloud adoption due to longer sales cycles. Reiterates AMD is seeing good enterprise momentum. Notes AMD will be broadening its server CPU lineup with platforms such as Genoa-X and Sienna, and that adding Xilinx and Pensando's offerings to AMD's lineup will strengthen the server CPU business.

5:38 PM ET: A question about cost inflation and its impact on gross margin.

Su says margin growth going forward will be driven by mix changes (i.e. Data Center and Embedded becoming a larger % of sales). Says AMD is working to deal with cost inflation.

5:36 PM ET: A question about the Gaming segment. Analyst notes it appears there are very different dynamics for game console SoCs (semi-custom) and gaming GPUs.

Su says the console SoC business has been very strong, and that it was previously very supply-constrained. SoC sales are expected to peak in Q3, in line with normal seasonality.

Regarding gaming GPUs, she says there was a slowdown in Q2, and that this is due to both supply catching up with demand and macro issues. Adds that there should be some growth in Q4 as new GPUs launch.

5:33 PM ET: A question about AMD's implied Q4 sales guide. ~7% Q/Q growth is implied. Is this driven by Data Center?

Su says "the bulk" of the expected growth is expected to come from Data Center and Embedded. Notes both new product launches and additional supply will help. Also mentions that Q4 will contain 14 weeks.

5:32 PM ET: A question about the recent delay of Intel's next-gen server CPU platform (Sapphire Rapids), and whether that could drive additional growth for AMD.

Su says Genoa "looks very good," and that AMD has gotten a lot of positive feedback from clients. Adds that AMD has spent the last 12 month building up its server CPU capacity, and that it'll see "a large step-up" over the next 4 to 5 quarters.

5:30 PM ET: A question about cloud demand going forward.

Su says AMD spends a lot of time talking with cloud clients about what they're seeing. Notes there's "a bit of a slowdown" among Chinese cloud clients, while adding North American demand remains strong. Reiterates AMD is taking share, that Milan is "very strong" and Genoa is also well-positioned. Says AMD still has "a strong opportunity" to grow the Data Center business into 2023.

5:28 PM ET: A question about customer inventory levels (Intel has indicated this is is an issue for them).

Su says AMD's guidance reflects strong Data Center, Embedded and game console demand, along with a more conservative outlook for the PC market. Adds there was a bit of a buildup in PC inventory and that this is taken into account, while stating "the AMD portion" of this is modest.

Also says AMD's server CPU and embedded offerings remained supply-constrained in Q2, and that more supply will be coming online in 2H.

5:25 PM ET: A question about Data Center growth.

Su says cloud demand remained very strong in Q2, and that this is expected to continue in 2H. Enterprise server CPU trends "are a bit more mixed," partly due to macro issues, with component "match set" issues also a factor. Reiterates AMD is gaining server CPU share and remains underrepresented in the market. Also reiterates the business has good visibility into 2023.

5:23 PM ET: First question is about the Q3 guide and AMD's implied Q4 guide. What are the puts and takes?

Su says the Q3 guide implies Q/Q growth will be led by Data Center, with some growth also seen in semi-custom. Also says the guide assumes the PC market will now be down mid-teens this year, compared with a prior forecast for a high-single-digit decline.

Q4 growth will be driven by Data Center and Embedded, with Su also noting the launch of various 5nm products (PC CPUs, server CPUs, server GPUs) will provide a boost.

5:20 PM ET: The Q&A session is starting. AMD is now down 5% AH (the gaming GPU commentary might be weighing a bit).

5:19 PM ET: Regarding the Q3 guide, Kumar says growth will primarily be led by Data Center and Embedded.

Likewise, full-year growth is expected to be led by Data Center and Embedded.

5:17 PM ET: Kumar notes AMD still has $7.4B remaining under its buyback authorization, and that inventory rose ~$200M Q/Q to $2.6B.

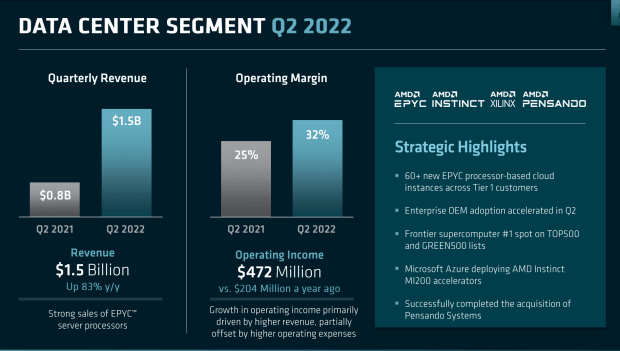

5:16 PM ET: Kumar notes Data Center growth (83% Y/Y) was driven by strong growth for 3rd-gen Epyc CPUs (Milan). Client growth (25%) was driven by a "richer mix" of Ryzen PC CPU sales.

5:13 PM ET: Kumar is recapping AMD's Q2 financial performance. Notes Data Center and Embedded drove AMD's Y/Y gross margin growth.

5:12 PM ET: Devinder Kumar is now talking.

5:12 PM ET: Su: Despite the continued macroeconomic environment, we see strong growth in the second half of the year, aided by our 5nm products.

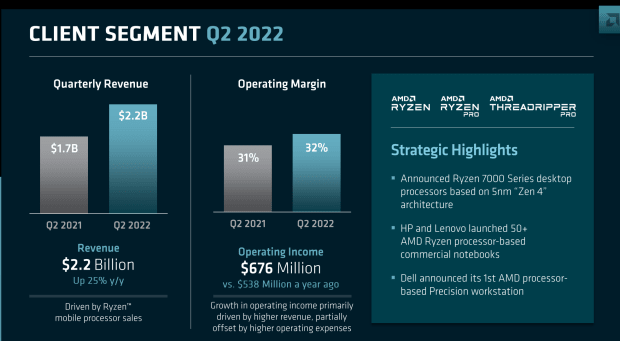

5:10 PM ET: Client growth was driven by notebook CPUs. Su says AMD believed it gained PC CPU share for the 9th straight quarter. Commercial PC CPU revenue is said to have grown "significantly" Y/Y. Ryzen 7000 desktop CPUs are set to launch later in Q3.

Su admits there has been "additional softness" in the PC market in recent months, while stating AMD is well-positioned to navigate the environment.

Gaming segment growth was driven by semi-custom. Gaming GPU sales declined due to "macro conditions" impacting discretionary spending. Gaming GPU sales are also expected to be down in Q3.

The Embedded segment saw "robust demand" across end-markets. Su says Xilinx sales benefited in Q2 from AMD's manufacturing resources, and that AMD's embedded CPU sales also grew during the quarter.

5:07 PM ET: Su adds AMD saw strong demand for its data center FPGA and networking offerings, and that "customer pull" for AMD's next-gen Epyc server CPU platform (Genoa) is very strong.

5:05 PM ET: Su says Epyc sales saw significant Y/Y growth across both cloud and enterprise.

5:04 PM ET: Su notes each AMD segment grew significantly Y/Y in Q2, led by Data Center and Embedded.

5:03 PM ET: Lisa Su is talking.

5:02 PM ET: AMD is going over its safe-harbor statement. The Q1 call featured prepared remarks from CEO Lisa Su and CFO Devinder Kumar, followed by a Q&A session with analysts that featured Su, Kumar and Xilinx chief Victor Peng.

5:01 PM ET: The call is starting. AMD is down 4.2% AH going into it.

4:56 PM ET: The call should start in a few minutes. Here's the webcast link, for those looking to tune in.

4:54 PM ET: AMD's slides for its Data Center and Client segments. The company mentions 60+ new Epyc-powered cloud computing instances launched in Q2 across tier-1 cloud clients.

4:50 PM ET: Thanks to the Xilinx deal, AMD recorded $1.02B worth of amortization expenses related to acquired intangible assets during Q2. That was one reason GAAP EPS came in at just $0.27 (non-GAAP EPS was $1.05).

4:42 PM ET: R&D spend accounted for more than 2/3 of AMD's Q2 operating expenses: Due to both organic spending growth and Xilinx/Pensando, it totaled $1.3B on a GAAP basis in Q2, up from $659M a year earlier.

GAAP marketing and G&A spend totaled $592M, up from $341M a year ago.

4:38 PM ET: As a reminder, AMD's earnings call is set to start at 5PM ET. I'll be covering.

4:36 PM ET: Due to both organic spending growth and Xilinx/Pensando, AMD's non-GAAP operating expenses rose 72% Y/Y to $1.56B, matching its guidance.

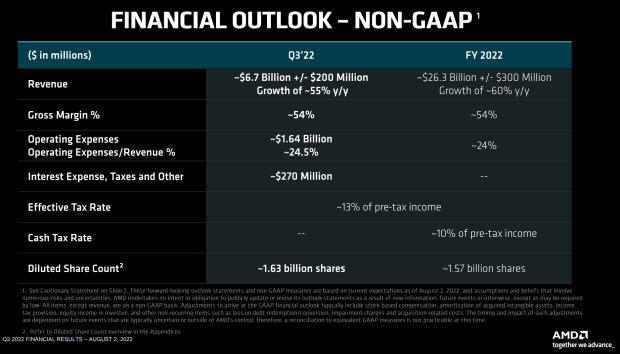

For Q3, AMD is guiding for non-GAAP opex of $1.64B.

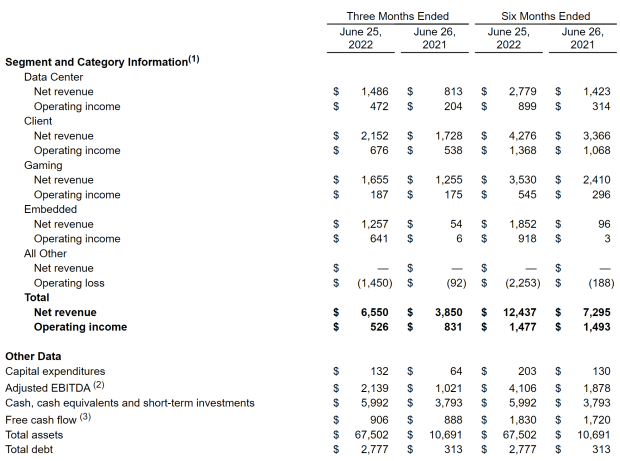

4:34 PM ET: AMD's Q2 segment numbers. All four segments were solidly profitable in Q2. Embedded (mostly Xilinx) has the highest op. margin, followed by Data Center (driven by Epyc CPU sales). Gaming has the lowest op. margin.

4:30 PM ET: Nvidia's shares are down 1.4% AH following AMD's report. Intel, which has hammered post-earnings last week due to disappointing results/guidance, is up 0.3%.

4:28 PM ET: AMD spent $920M on buybacks in Q2. That compares with $1.9B worth of buybacks in Q1.

The buyback spend nearly matched Q2 free cash flow of $906M. AMD ended Q2 with $6B in cash and $2.8B in debt.

4:24 PM ET: AMD's Q2 slide deck is up. Here's the company's formal guidance.

4:20 PM ET: Shares are now down 3% AH. The Q3 guide seems to be weighing on shares, but many investors are likely pleased to see the full-year guidance reiteration. Earnings call commentary about the puts and takes behind AMD's sales guidance (presumably, softer PC demand is a headwind) will be closely watched.

4:17 PM ET: Overall, revenue rose 70% Y/Y due to both organic growth and Xilinx. The Q3 ($6.7B, +/- $200M) guide implies ~55% revenue growth.

Separately, AMD previously indicated its guidance for ~60% full-year growth (just reiterated) implies mid-30s organic revenue growth.

4:15 PM ET: Q2 revenue by segment:

Data Center +83% Y/Y to $1.5B

Client +25% to $2.2B

Gaming +32% to $1.7B

Embedded +2228% (due to the Xilinx deal) to $1.3B

Data Center revenue includes some contributions from Xilinx and Pensando. But the lion's share of the revenue comes from AMD's server CPUs and GPUs.

4:10 PM ET: Q2 non-GAAP gross margin was 54%, up 640bps Y/Y and in-line with guidance. AMD also expects a ~54% GM in Q3 and reiterates guidance for a ~54% full-year GM.

4:08 PM ET: AMD guides for Q3 revenue of $6.7B, below a $6.84B consensus. However, it reiterates full-year revenue growth guidance of ~60% .

Shares are down 4.8% after-hours.

4:06 PM ET: Results are out. Q2 revenue of $6.55B is slightly above a $6.53B consensus. Likewise, non-GAAP EPS of $1.05 is slightly above a $1.03 consensus.

4:05 PM ET: With markets on edge about PC and graphics card demand, any commentary shares about demand trends for its PC CPU and gaming GPU businesses will get close attention.

On the flip side, all signs indicate server CPU demand from cloud giants (the proverbial hyperscalers) remains healthy. And AMD has indicated it expects game console SoC orders to remain strong into 2023.

4:00 PM ET: AMD closed up 2.6%. The Q2 report should be out soon.

3:57 PM ET: The Q2 report will be the first one to feature AMD's new (post-Xilinx-acquisition) reporting structure. Sales will now be broken out into 4 segments: Data Center, Client, Gaming and Embedded.

3:55 PM ET: AMD shares are going into earnings down 31% YTD, amid broader tech-stock selling pressure. But they have rallied a bit in recent weeks, and are up 2.8% today to $99.47 ahead of earnings.

3:51 PM ET: AMD tends to report a little after the market's close. The Q1 report was posted at 4:10 PM ET.

3:49 PM ET: The FactSet consensus is for AMD to report Q2 revenue of $6.53B and non-GAAP EPS of $1.03.

AMD's Q3 and full-year sales guidance will get close attention. The Q3 revenue consensus is $6.84B, and the company guided in May for ~60% full-year sales growth. This outlook was reiterated at AMD's June analyst day event.

3:46 PM ET: Hi, this is Eric Jhonsa. I’ll be live-blogging AMD’s earnings report and call.